The TED spread has been used as financial market warning signal for decades although it has moved in and out of favor over time. Market participants have turned to other measure of financial risk, but when this old measure jumps, it is worth taking a closer peek.

There is an interesting signal here but it may not be higher risk. The Financial stress indicators from the Kansas City and St Louis Fed have both been moving lower not higher. Bank stocks in the US have been flat for the year albeit European financials have declined 15 percent in 2016.

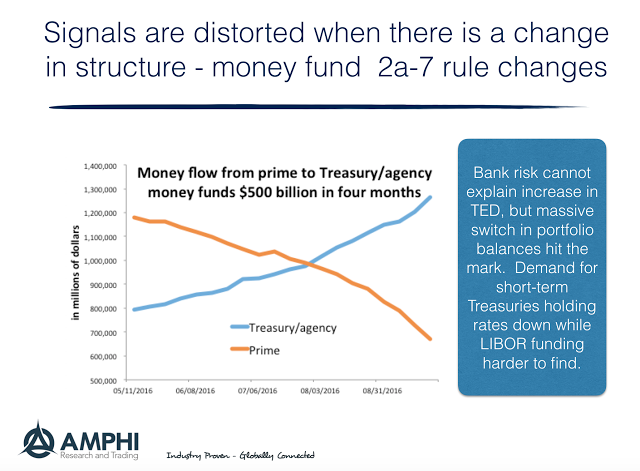

The TED spread is signaling higher funding costs from a significant change in regulation. The reforms of 2a-7 money funds is coming on October 14 and the market has been adjusting by pulling out of investments in non-Treasury short-term money sources. There has been a $500 billion money fund switch from prime funds to Treasury/agency funds. This is a large change in market share of about 15 percent. We think the money flows are the driven not risk. While we often state that prices are primal, the explanation for price moves is not always obvious.