DISCLAIMER: While an investment in managed futures can help enhance returns and reduce risk, it can also do the opposite and result in further losses in a portfolio. In addition, studies conducted on managed futures as a whole may not be indicative of the performance of any individual CTA. The results of studies conducted in the past may not be indicative of current time periods. Managed futures indices such as the Barclay CTA Index do not represent the entire universe of all CTAs. Individuals cannot invest in the index itself. Actual rates of return may be significantly different and more volatile than the index’s.

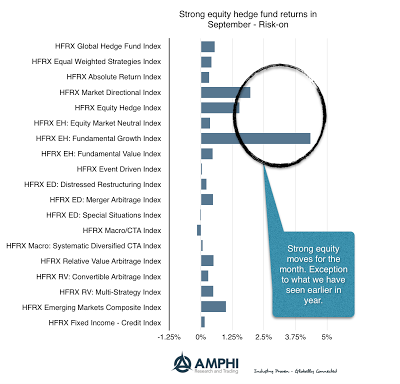

There have been many articles on hedge fund outflows and poor performance. This should not be surprising given the year-to-date performance of many hedge fund strategies; nevertheless, September was a good month for equity hedge fund strategies. Given the good September performance for small-cap, growth, and value indices, this should not be a complete surprise. A simple comparison shows the HFR indices outpacing the major equity-style indices for the month. There were good alpha opportunities for hedge funds. The biggest losers were global macro and managed futures managers who could not take advantage of central bank actions or macro themes. The focus on central bank announcements has negatively affected macro traders over the last quarter.

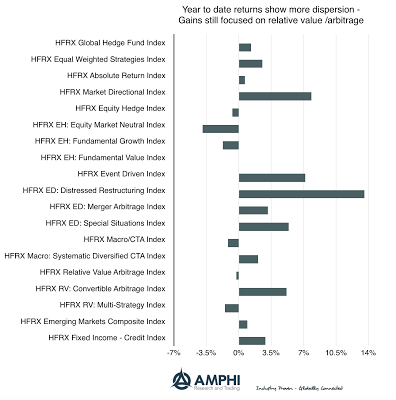

The year-to-date HFR index returns show event and distressed strategies continuing to do well, but the market directional index now also generates good gains. However, the market directional index still lags behind the major style beta indices. At the same time, the equity market neutral and fundamental growth strategies have posted the worst returns. As we enter the fourth quarter, hedge funds need to show significant improvement to meet investor expectations.