“I made my fortune by selling too early”, a quote from Baron Rothschild used for an investment game by John Hussman. John Hussman has invented a game called “Baron Rothschild” as a teaching tool which is based on a simple process of drawing returns from a set of cards The sequence of cards can generate a performance record. Think of this as a form of Monet Carlo simulation from a return distribution. The player can call stop after any number of picks or he can continue to pull return cards to compound his performance.

Hussman finds that a limited number of picks will do better than drawing more cards in order to run up the returns. There is some interesting math here on optimal stopping times and whether all or a portion of money is invested, but we will leave that for another discussion. See Spencer Jakab’s Heads I Win, Tails I Win for the reference and further description of the game. This game and the Hussman conclusion lead to one of the age old issues with trend-following and investing in general. Should you get out early from winning trades?

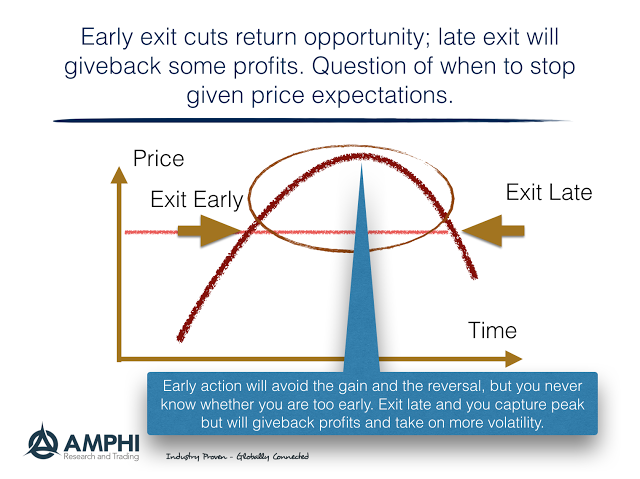

In trend-following, the idea is that you hold your long positions in any trend as long as the market is going up. You may have a trailing stop, but you should be willing to give up returns on a short-term reversal in order to stay in a position. Because you don’t know when the top or the bottom of the market will occur, just hold onto positions even if it means giving back some profits. The more general investment advice is simple, hang onto your winners and sell your losers. Hussman is willing to say that walking away early before tops or bottoms is always better that waiting for the peak or trough and then giving back some profits.

This question is fundamental to all investment strategies, yet there has been limited work and providing a clear answer. Clearly, the momentum risk premium factor research suggests that following past behavior with holding positions until momentum reverses has been a successful strategy. Nevertheless, there is also work that shows that momentum strategy are subject to crash risk or a large reversal. Some have argued that the risk premium is received because there is crash risk with momentum strategies. Higher returns come with higher risk.

Our simple graph tries to address the key problem. Should you continue to play the game and hold a position when you don’t know when there will be a reversal? I can argue that this issue of profit-taking or exit management and risk management is more critical than the question of how do you identify a trend.