DISCLAIMER:

While an investment in managed futures can help enhance returns and reduce risk, it can also do just the opposite and in fact result in further losses in a portfolio. In addition, studies conducted of managed futures as a whole may not be indicative of the performance of any individual CTA. The results of studies conducted in the past may not be indicative of current time periods. Managed futures indices such as the Barclay CTA Index do not represent the entire universe of all CTAs. Individuals cannot invest in the index itself. Actual rates of return may be significantly different and more volatile than those of the index.

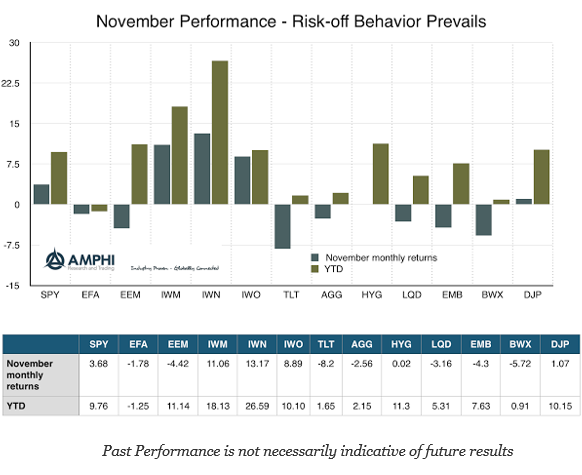

For those who had a “safe” portfolio skewed to bonds before the election, it was a disaster month. For those who were stock-pickers in value and small cap, it was a dream market. The return differential between bonds (TLT) and value (IWN) was more than 20% in one month. Call it a “Trump Rally / Trump Bond Sell-off”, but the financial world changed beyond politics. This sound bite story may be getting old, but there is a lot going on in markets beyond being long stocks and short bonds.

What is noticeable is that the equity gains in the US were not a global phenomenon. Some of the global underperformance was clearly dollar related, but the US election rally was not shared by the rest of the world or by the large cap firms that are more active in global trade and have more earnings from overseas operations. The large cap/small cap return differential as well as the value and growth differentials were all especially strong. Respectively, small caps, value, and growth indices beat the SPY monthly return by approximately 7.5%, 9.5% and 5%. This is consistent with an economic growth rally and a reduction in regulation rally.

Bond duration hurt all investors with TLT underperforming the Barclay Aggregate (AGG) by over 5.5%. High yield demand increased and higher spreads cushioned the duration risk for this sector; however, higher quality corporate bonds saw a strong decline. This is consistent with the small cap return skew in equity returns. International and emerging markets bonds both lost money from the global rate rise and a strong dollar.

The year to date performance does not do justice to the wild swings we have since the first two months of the year. After impending disaster with a strong equity sell-off, stocks have done well and have clearly outperformed bonds.