All systematic traders are not alike. Investors know that, but the differences become highlighted at the end of the year when returns are reviewed. There are potential diversification gains within a strategy space by choosing a set of managers who behave differently.

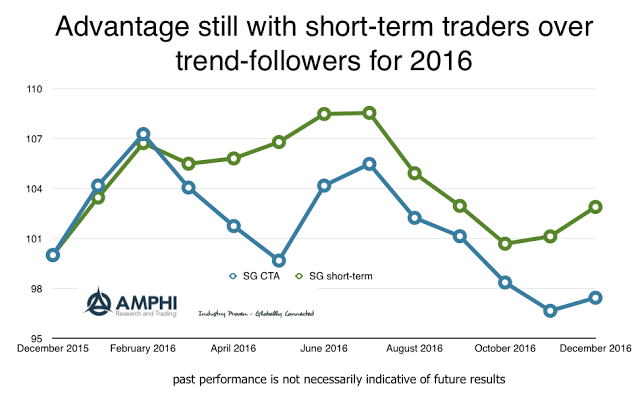

We employ a simple framework for managing portfolio diversification – STM – Style, Timing, and Markets. These are three key dimensions for distinguishing between managers and portfolio building. This framework can highlight the difference between the SocGen CTA index, which is mostly intermediate and long-term trend-following, and the SocGen short-term traders index. Differences between manager time frames lead to differences in return generation.

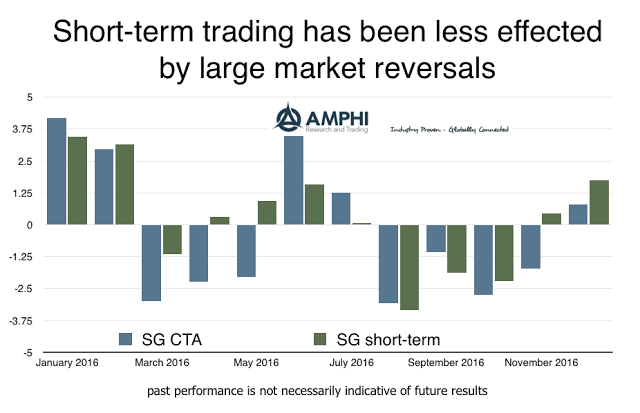

We generally find that short-term traders will have smoother returns because they will be less affected by major trends and reversals. Short-term traders may have average holding periods of a few days at most, so any strong price reversal will lead to a quick exit. Of course, they will not be able to profit from extended trends for the simple reason they will not be looking to exploit them. You cannot profit from what you do not see.

Short-term traders were able to exploit the dislocations in markets during the first two months of the year. They were also able to take advantage of the higher risks prior to the BREXIT vote and some of the post-US election volatility for a significant gain of just over 5% versus the CTA index. The CTA index gained from these events but lost on the reversals that occurred in the spring and fall. A blend between these two approaches would have generated a positive year. Albeit still less than the beta exposures in equities and only matching fixed income, simple manager diversification can appreciably increase the smoothness of returns.