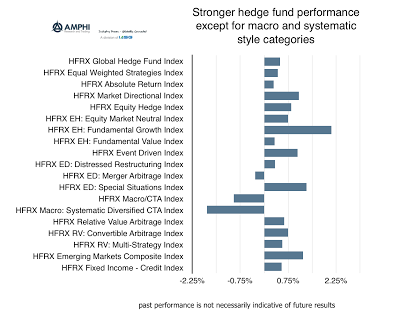

The markets were generally calm for January even with the upheaval and uncertainty from the new Trump Administration. The surprise for many investors is the continued low volatility in the markets which seems inconsistent with the political uncertainty faced. While hedge funds generally did well for the month, there were some negative stand-outs, the macro and CTA strategies.

It is generally accepted that these two strategies will not do as well during calm periods, but that does mean that there should be strong under-performance during low volatility periods. These managers were hit with trade reversals from last month’s trends and new positions that either did not work or stalled under the low volatility environment.

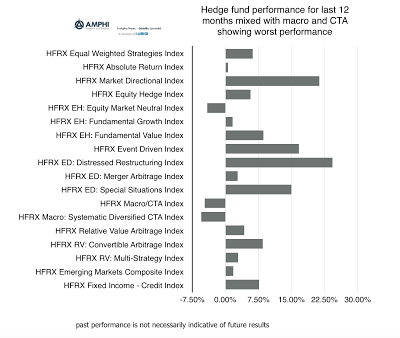

For the last year, there have been some hedge fund style highlights such as market directional, event driven, distressed, and special situations, but many strategies that did not meet expectations. We have highlighted the under-performance in macro and systematic strategies. We believe they should have done better given the rotation away from fixed income during the year. Nevertheless, there has been consistent underperformance by many managers during these bond sell-offs from an inability to profit from short bond opportunities. Fighting against yield and getting timing right for short positions has been difficult for many of these managers.