The global macro manager is always worried about a few key issues. Where will country and global growth come from? What will be the flow of liquidity and credit to markets? What will be the desire by investors for risk-taking? The answers to these questions will describe the drivers of future asset returns.

As trade flows have gotten bigger over the last two decades, it has become a more important growth component to watch. While capital flows are still more important to financial prices in the short-run, trade is a key link that will allow for spill-over and multiplier growth effects.

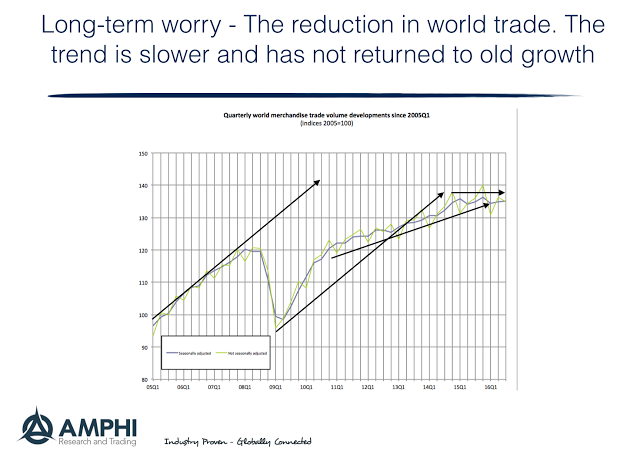

Our review of the WTO trade volume suggests that trade will still be a drag on global growth. The old trade growth rate looked like it was going to return after the Great Financial Crisis, but those rates have not been realized. The slowdown in trade volume has been in the works for years. This lower trend is not a recent phenomenon. The talk of new trade deals and Trump bilateralism is a symptom not a cause of the slowdown. A slower growth rate makes countries fight for trade volume market share. More protectionism is a response to falling trade trends not a solution. Trade slowdown and protectionism coupled with a decline in capital flows and greater controls will continue to place a drag on growth opportunities.