I was having a discussion with friends for where the SPX will end over the next three and six months as well as what could be the ending value for the year. The predictions were all over the map with a mix of investors saying the market will be either higher or lower. I also had some that said it would be both, first higher then lower, and others suggesting the first leg will be lower only to then go higher again.

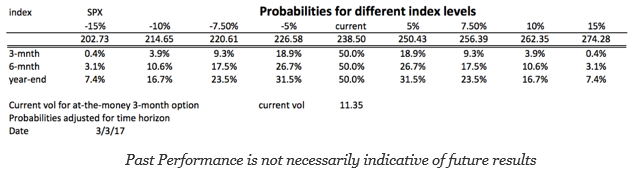

These predictions should be grounded in reality, so looking at the distribution of returns given current volatility and the probabilities of a particular move are important to anchor predictions. The table below is a simple guide of what may be possible over different horizons. The question for someone making a prediction is whether they think the market will be more or less likely to move outside of the range depicted by volatility.

We can take current market volatility for an at-the-money option over the next three months and use it as a base case for finding probabilities for different sized moves. The annualized volatility can be converted into the volatility that will exist over a shorter horizon. Finally, simple benchmarks of up or down 5, 10, and 15% can serve as likely placeholders for some realism on possible gains or loses. Of course, it is simple, but it provides a grounding in current market reality.

In this simple case, if there is no trend, the likelihood that there can be an up or down 10% move over the next 3 months is slim, less than a 5% chance, but there is over a 15% chance of that occurring for year-end. So to say that the market will have a better than 50% change of being up 10% over the next 3-6 months is a very strong bet on a uptrend. Perhaps that is obvious, but there can now be a serious discussion of predictive risk once the distribution is overlaid onto the predictions.