There has been a lot of discussion about crisis alpha with some hedge fund strategies like managed futures and the need for investors to build portfolios which will provide some crisis risk offset. There has been less talk about what is the definition of a crisis or how to measure the chance of a crisis.

Most researchers who have investigated crisis alpha have looked at equity market declines as the measure of a crisis. A decline of a certain level or drawdowns is compared with the performance of other strategies. There is nothing wrong with this approach other than the simple fact that any asset uncorrelated with equities could serve as a crisis offset or crisis alpha. The argument just becomes one of diversification and degree of offset. Any non-equity-like strategy will provide some risk offset.

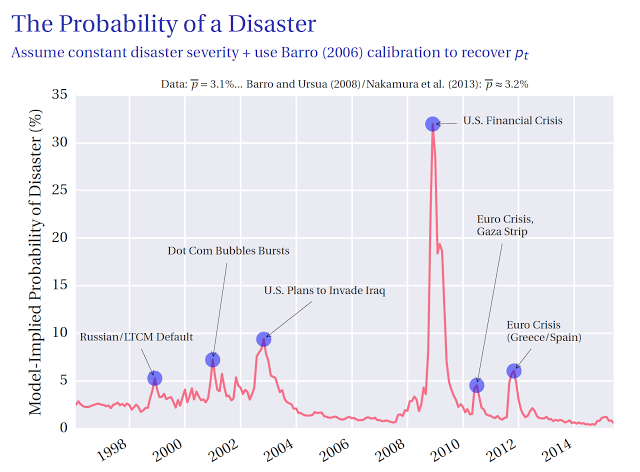

What is really needed is a closer analysis of what causes or drives crises or disasters and a measure of when the chance of a crisis being high. In this more general case, we can classify crisis alpha or risk offset as any asset that will do well during periods when a crisis is more likely. Research by Emil Siriwadane of the Harvard Business School looks at the portability of rare disasters through measuring it in risk reversals. In simple terms, the chance of disaster should be priced in puts but not in the prices of calls, so a risk reversal or the difference in price between puts and calls should capture this risk. His work provides an interesting look at probabilities of disaster and finds that it corresponds with large market moves and times of economic stress. More importantly, the greater likelihood of a disasters match with larger market moves.

This crisis measure is actually associated with real economic risks, so a hedge fund strategy that is supposed to do well during economic as well as financial stress will provide a better crisis alpha. Managed futures may be a good crisis alpha producer because it goes long or short in a wide variety of asset classes which may better protect an investor. While this pricing of disaster risk was not meant to analyze the value of investment strategies, we think this provides more insight in how to construct portfolios and protect against broad risks.