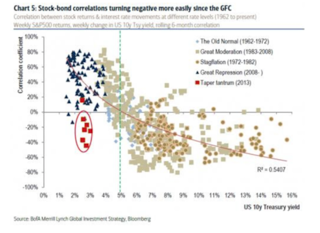

There has been a strong positive relationship between the correlation between stock and bonds and the level of yields. As rates have declined the stock-bond rate correlation has moved from negative to positive. This is a phenomenon which has been found around the world in all major markets. Many analysts have measured this through equity and bond returns (prices) which will show a strong negative correlation. The secular decline in inflation has pushed down bond yields during a time of long-term equity gains. Similarly, the decline in real yields through a fall in bond risk premiums has also been associated with an increase in stocks.

The big question for any asset allocator is what will happen in the future if the level of bond yields increase. The stock-bond correlation will drive portfolio performance in the next year. If the estimate of this correlation is wrong, there will be a significant increase in portfolio risks. There are a number of reasons for the stock/bond relationship to change. The most likely reasons are relative changes in economic growth and inflation. There has been found in the past a positive relationship between the stock/bond return correlation, real rates as a proxy for economic growth, and inflation.

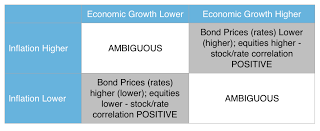

What is the real risk are exceptions to the normal stock/bond correlation relationship such as the Taper Tantrum, or a mix of inflation and growth that are inconsistent with normal expectations or at odds with past relationships. A simple matrix between economic growth and inflation may be a good starting point for discussion. Assuming a simple relationship that economic growth will be good for stocks and bad for bonds returns and the fact that higher inflation is bad for bonds and not as bad for stocks returns since equities are a real asset, we can see why the stock/yield correlation will be positive.

Risky situations are when there may be higher inflation but less growth, or lower inflation and strong growth. In those cases the correlation effect is ambiguous. Additionally, shifts in risk appetite will affect the stock/bond correlation in ways inconsistent with growth and inflation. The Fed can impact the correlation if they push rates higher and stocks are pushed lower because the discount rate increases but there is no change in cash flows. This may be our most significant current concern.