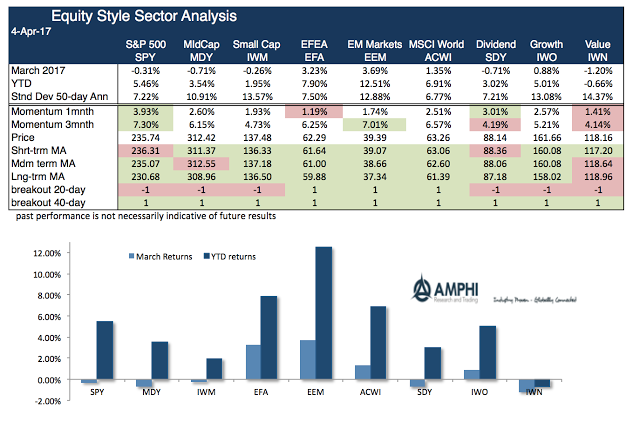

March saw a significant rotation in return performance from US equities to global and emerging markets and from value to growth. Our indicators show prices are starting to break to the downside albeit trends are currently flat. March was a transition month from euphoria to reality concerning US government policies. Future price direction will be determined by the real economy and not policy expectations.

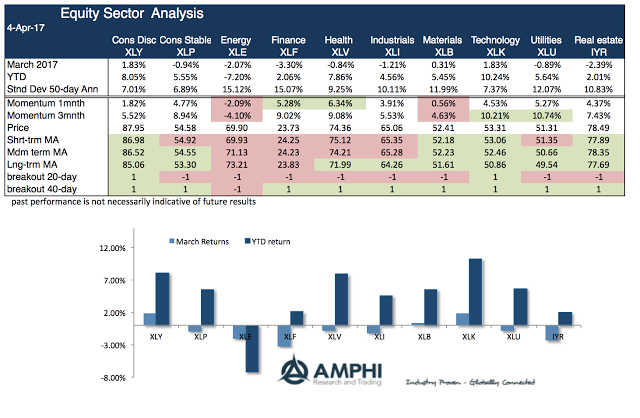

There is a growing dispersion across sectors with energy, finance, and real estate showing strong loses for the month. Technology and consumer discretionary sectors were the only two sectors which showed strong gains and maintained good returns for the quarter. Those sectors expected to be most affected by Trump policies showed the largest reversals.

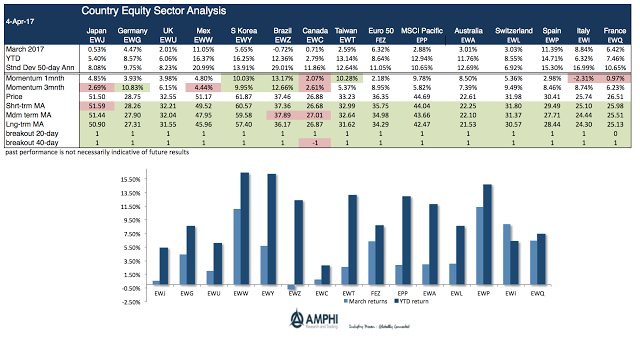

Country equity ETF all showed good returns for the months and quarter except for Canada. Clearly, opportunities outside of the US have been appealing for risk-taking investors. A major turn-around in Mexico suggests that the concerns about trade wars have significantly dissipated.

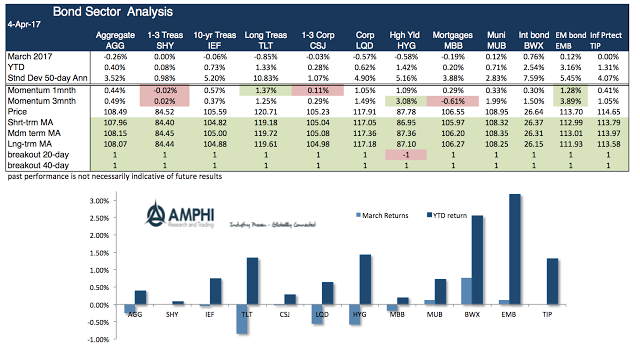

International and EM bond ETF’s have shown positive returns for the quarter even after accounting for the moves in the dollar. Long duration and credit sectors lost money for the month, yet year to date returns are still positive in spite of the change in Fed policy perceptions.

March was a transition month as we started to move through this process of sector rotation. Up trends have flattened and return dispersion has increased. Whether we switch to stronger downtrends or more capital rotation is now a function of economic growth. However, the link between the real economy and asset prices can be highly variable. Bond markets are signaling a weaker economy while equities are suggesting more robust growth outside the US. These divergences in market behavior mark periods of potential dislocation.