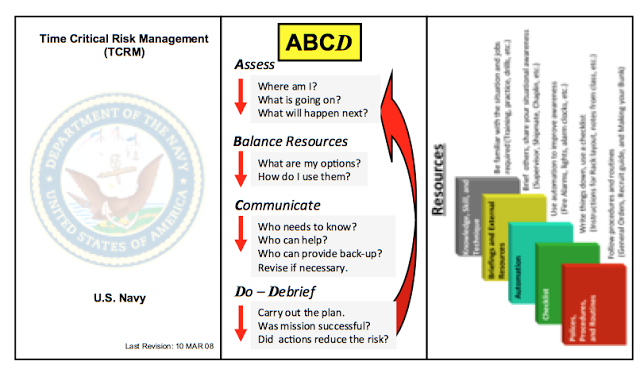

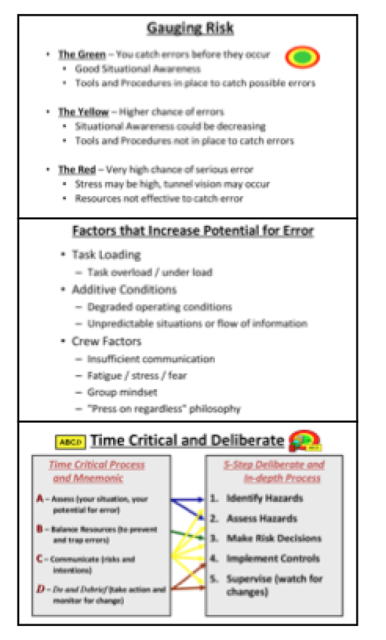

The US Navy has a structured approach to risk management that is slightly different from that of the Marine Corps and the US Army. See our posts on risk management in the US Marine Corps and the US Army. The US Navy also has a trifold brochure on time-critical Risk Management. Would you ever expect to see this from a money manager? Indeed, the ABCD process is a loop for determining any trade or portfolio action.

One of the key problems with risk management is not conceptual. We have theory and knowledge of what is required for sound risk management. The issue is the decision-making process and implementation. This can be achieved through following the Navy trifold.

Money management has not cornered the market on sound risk management processes. There may be a lot to learn from other disciplines facing significant uncertainty.