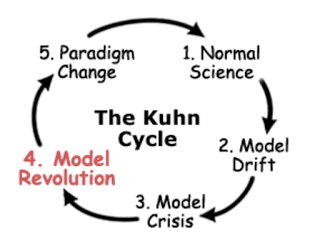

Thomas Kuhn, the science historian, developed big ideas like the paradigm shift in science, but his ideas can also work on the “smaller” ideas of finance research. The Kuhn cycle, which has been applied to the evolution of science, is a durable model for how real world research is conducted. It is an effective way to look at one critical part of the systematic research process. Quantitative research for many firms is broken into two parts:

1. A search for new models and strategies that are either uncorrelated with existing models or a new variation on an existing strategy theme, or

2. Maintenance of existing models through improvement and enhancements of existing parameters and frameworks.

This is a simplification because research can be broken into asset classes, trading, risk management or a number of other topics; nevertheless, the two-part breakdown is an effective generalization. The Kuhn cycle can be employed as a framework for discussion on how research moves from maintenance to a shift to new models. Under normal conditions, a model will be said to work until there is a significant drift in performance. This drift can come in the form of a performance drawdown or forecast degradation. If there is a drift in performance from expected norms, a model may be thought of as in crisis or broken. Parameter adjustments may not be enough to save the model because it is misspecified.

When parameter adjustments are not enough and the specifications for what could be driving performance are wrong, research should lead to a potential model revolution. If the new model proves to be better, the quant strategy will have a paradigm shift in decision-making.

The evolution of model building can be consistent with the evolution of science in finance. On a very micro level, the search for risk factors and risk premium is following a Kuhn cycle one factor at a time. Tests are done, model performance on a go-forward basis drifts, there is a model failure, a new hypothesis is generated, and there is then a shift to a new factor. Academics pursue normal science while practitioners test under live market conditions with profit and loss measuring drift. Poor profits create a model crisis and a search for new alternatives. The speed of new models is dependent on the speed to a P/L crisis. This is an adaptive process.