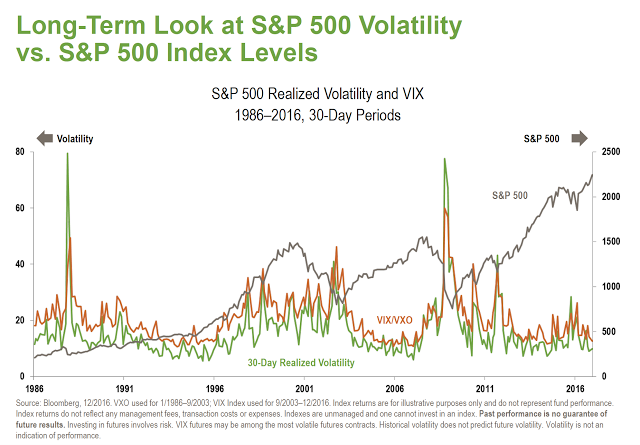

Investors should be concerned about the unintended behavior from low volatility. Low volatility will lead to higher volatility in the future when investors become complacent about risk, the “Volatility Paradox”. This paradox has been discussed by Richard Bookstaber as early as 2011 and recently referred to in a post on his blog, Our low risk (low volatility) world.

Low volatility is a variation on the prosperity argument used by Minksy to start the cycle of speculative excess. Low volatility lulls investors into thinking risk is actually lower than reality just like prosperity or no economic downturn will cause bankers to change lending practices. Because perceived risk is lower, there is a willingness to increase leverage and increase investment in riskier assets. Risky assets are bid higher which are then used as collateral for further leverage. This volatility argument is separate from the reach for yield because of low interest rates. Risk-taking on low volatility makes the financial system more fragile.

The problem of misperception by investors with respect to measured risk and actual risk is real. Investors may be placing too much stock in recent volatility and too much emphasis on standard deviation as the right proxy for risk. Low volatility today does not mean low volatility tomorrow. Low volatility today will create behaviors that will lead to more risk tomorrow. The smart investor should be looking for long vol or divergent strategies that will profit from an increase in volatility.