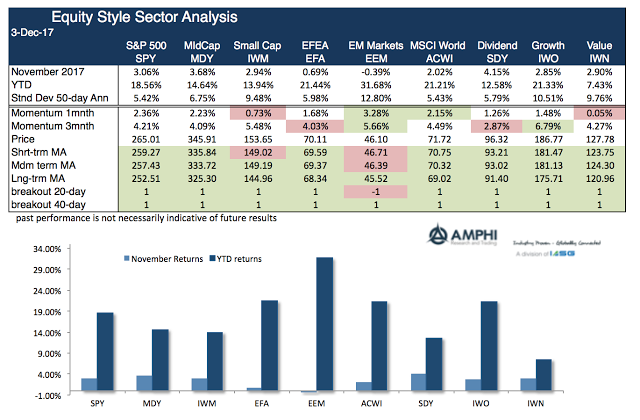

Equity style sectors were strong across the board with only emerging markets posting a negative November return; however, emerging markets have been the best performing sector year to date. The value index showed a strong gain although it still lags the growth index year-to-date. Trend indicators are all positive except for emerging markets and the short-term trend in the small cap index. Price indicators suggest that there is no reason to cut equity exposures.

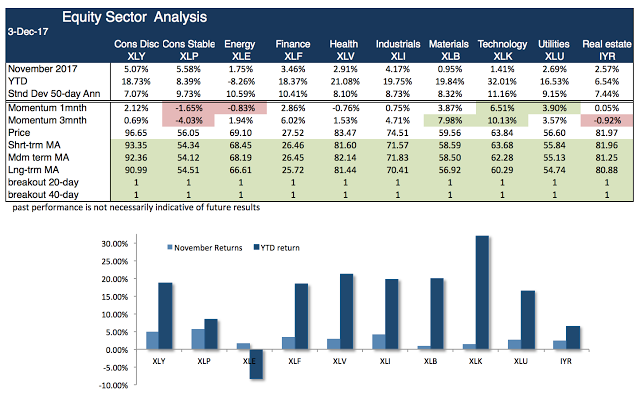

US market sectors all showed positive gains with trend and break-out indicators positive across all time dimensions. Consumer discretionary and consumer stables posted the best gains. The energy sector improved on higher oil prices. Real estate has been the sector laggard for the year.

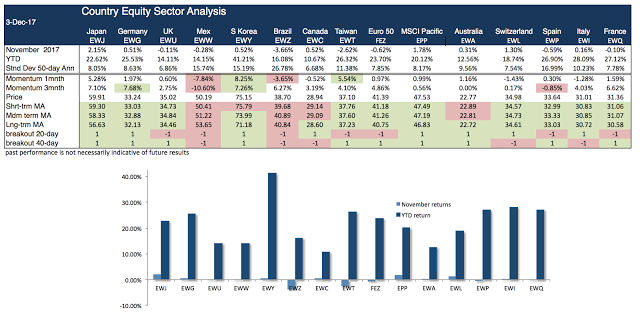

Country equity indices were more muted and diverse in their return performance for November. Some EU country indices turned negative as well as Brazil and Taiwan. Country indices have been more affected by commodity performance and specific trade flows this month. Nevertheless, year to date performance has been very strong; in many cases better than the US benchmark index.

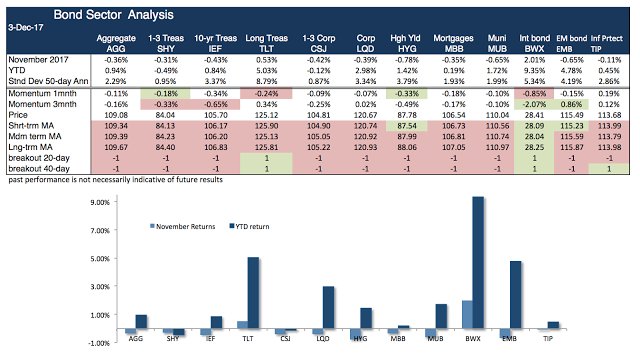

Bond ETFs generally showed negative returns for the month with the only exception the long duration US bond index (TLT) and international bonds (BWX). Trends have generally been headed lower with the exception of international bonds which have had a currency translation tailwind.

Asset allocation based on trend and break-out signals still point to holding risky equity assets across a diverse set of sectors and countries. Indicators show a slowing of momentum for those sectors and countries that have strongly outperformed long-term averages. Bond indicators suggest holding lower exposures versus strategic benchmarks except for exposure to international bonds. A mixed signal is coming from long duration bonds which had positive performance for the month. This conflicting signal should be watched closely in December.