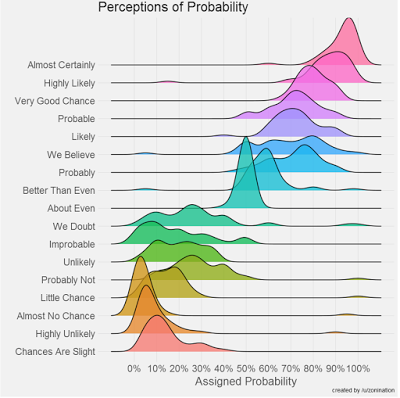

I love this reformulated graph on the old work by Sherman Kent on the potential futility when using language to describe probabilities. There is a lot of ambiguity in the meaning of certain terms. One man’s doubt is not another’s “little chance” and one man’s “likely” is not another’s “probable”. If you use words, back them up with some numbers.

One of the most important features of the move to quantitative investing is the level of precision that can be associated with portfolio decision-making. The precision is not with a point estimate of what will happen but with the ability to generate a distribution around any estimate. When the comment, “this is risky”, is used, it has meaning. Recommendations or ideas have contextual meaning when they are risk-adjusted.

A new year’s resolution for your next investment meeting or when a manager comes into your office and they say “We believe …”, should be to ask them to assign probabilities to what they are recommending. That should be an interesting experiment.