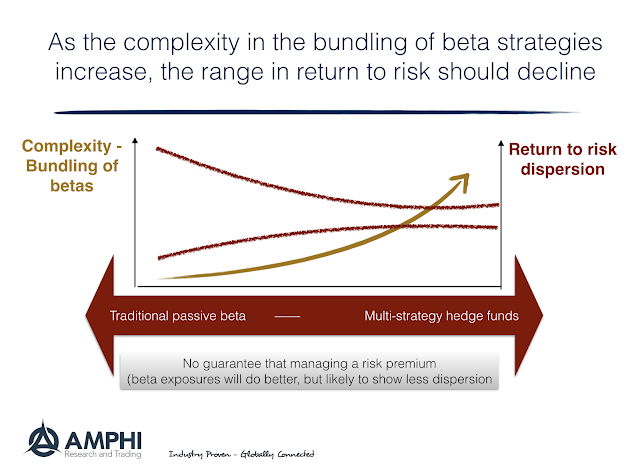

There has been an explosion of alternative measures and methods to access market betas and risk premiums, yet it is not always easy to explain what this added complexity should give investors. We want to simplify the discussion to a simple trade-off – added beta “complexity” through either decomposing, diversifying, or managing the set of betas should reduce the range of return to risk.

The managing of beta risks will not always outperform the return to risk of a passive traditional beta portfolio in, for example, a classic market cap stock index, but a sample of return to risk ratios or the rolling return to risks ratios of a portfolio of risk premiums through time should be more stable. Complexity or the management of the beta risks will buy you stability, diversification, and potential long-term return to risk advantages. Added value will come if the manager has skill at bundling and adjusting beta exposures.

In the simplest case, investors allocate to a traditional asset class benchmark which will return the market risk premium. It will vary with the business cycle and pay investors for the risk of loss during “bad times”. From that simple case investors may buy a diversified portfolio of asset class betas that will have more stable return to risk. Within an asset class, the portfolio can be adjusted based on alternative risk premiums or betas such as size, value, momentum. This portfolio could represent different smart betas.

An added level of complexity beyond asset class or smart betas is gained through alternative risk premium where strategies combine long/short positions. This could be, for example, momentum/trend managers like what is seen in managed futures. It could also be a long/short equity trading based on value. An even more complex case would the bundling of alternative risk premium in a portfolio or through a must-strategy hedge fund.

The decomposition of risk into different factors or risk premium has allowed for more reordering of the risk within a portfolio. The reordering of risk premium should result in smoother return to risk trade-offs.