There is a US/Global equity market disconnect. The higher US growth, optimism, and fiscal stimulus (tax and debt financing) have created a positive economic environment for the US that is not seen in the more lethargic global economy. US growth is expected to surge above 4% for the second quarter (per the Atlanta Fed nowcast) even with slight downward revisions for the first quarter. Global growth is not bad and is expected to exceed 2017, but economic shocks in the EU and EM and tightening China liquidity have all contributed to more fragile global stock markets. China equities, at least measured from the high, are in a bear market.

The “trade war” rhetoric has also not been helpful with world leaders forecasting a slowdown if this talk turns into a greater reality. What is becoming clearer is that global logistics and supply chains make any discussion of trade tariffs more complex than the simple models that were the standard when politicians were students.

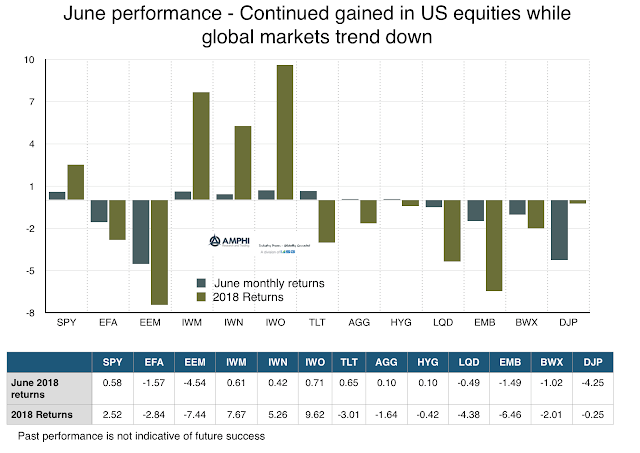

Bond performance for June was surprising. The fall in corporates is consistent with tightening of liquidity, but long duration gains seem out of place. While Treasuries are employing their global safe haven role, the Fed’s inflation index of choice, PCE, has reached 2%. Now all inflation indicators are at the 2% or higher mark. There is no slowing the Fed and bonds do not fully reflect current risks.

What markets are right? US buybacks have been one of the chief uses for corporate tax cut funds. This may artificially push stock to levels out of line with global benchmarks. Additionally, with liquidity slowly leaving the global financial system, the leveraged fueled financial markets look like they are facing growing headwinds. We are more concerned about financial slowdown risks. Our short-term moving average model suggests that there is downside risk set for July.

Here comes the heat of summer and the same can be said for financial markets.