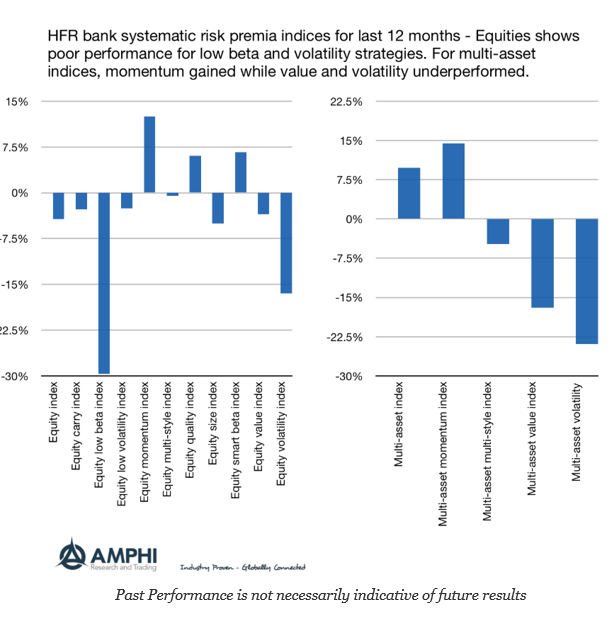

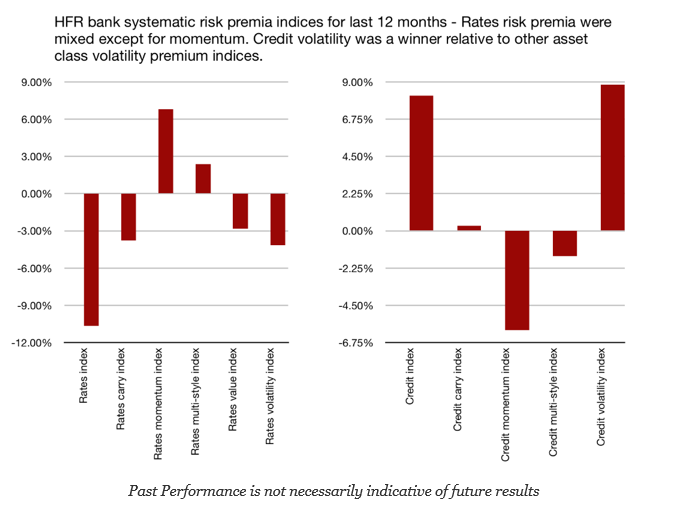

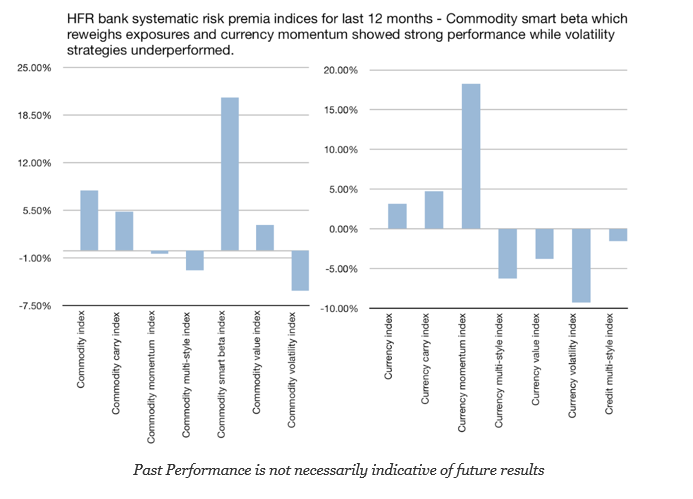

The new HFR bank systematic risk premia indices provide a wealth of information on this growing and important investment area. All alternatives risk premia are not created equal. A review of the return performance over the last year shows that there were clear winners and losers.

Across all asset classes, momentum was a big winner over the last year. This is in contrast to managed futures which showed mixed performance over the last 12 months. Value and volatility strategies were down strongly over the last year.

In the equity sector, the two biggest losers were low beta strategies and volatility indices. The low beta craze created a crowded trade that turned against investors in early 2018. Interestingly, there was big difference between low beta and low volatility strategies. The volatility premia were hit hard by the volatility shocks in February and have not been able to recover.

For rates, momentum risk premia strategies were clear winner while carry and volatility underperformed. Credit strategies gained even in the difficult volatility sector.

Commodity strategies were generally positive for the last 12 months with smart beta strategies that reweigh market exposures doing especially well. Currency momentum gained well over 15 percent on the strong dollar move. Currencies risk premium strategies that focused on volatility and value underperformed.

The HFR index information provided shows that there is significant differentiation across asset classes and strategies within the alternative risk premium universe. It is clear that a diversified risk premium strategy is warranted, but selective allocations that account for past performance and the overall macro environment may prove to also be helpful.