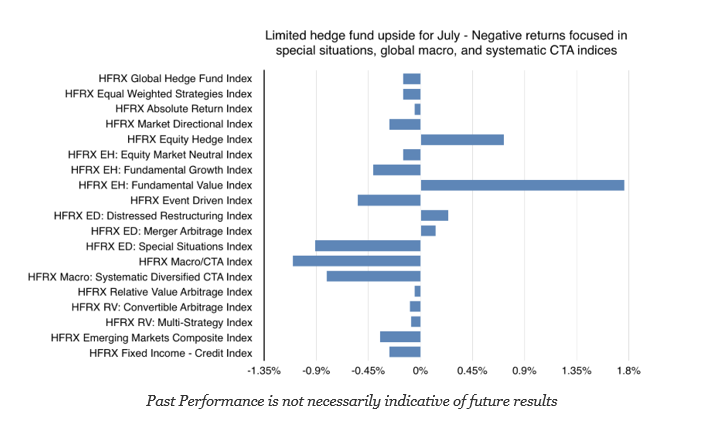

Hedge fund returns for July were generally negative with the only exceptions being equity hedge and fundamental value strategy indices. The class of uncorrelated hedge funds styles, event driven and special situations, under performed. Defensive styles like systematic CTA and global macro also posted negative returns.

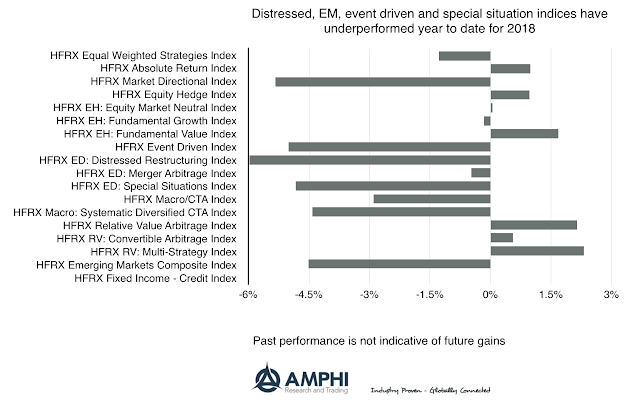

With over half the year done, 10 strategy indices are negative and 7 are positive. The average for the negative strategies is just under 4 while the gaining strategy indices posted an average of 1.25 percent. For the negative strategies to move into positive territory, there will have to be at least a one to two standard deviation positive event over the next five months. This is possible but will require some market dislocations that can be capitalized by hedge fund managers.