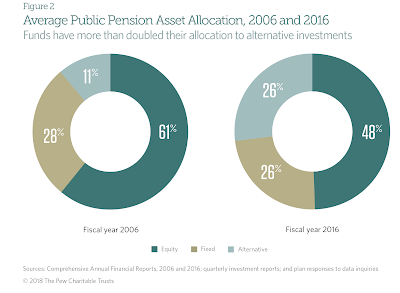

State pensions have changed their portfolio composition during the last ten years to increase their allocations to alternative investments, yet this adjustment has not helped them reach their targeted returns. This gloomy story was presented by the Pew Charitable Trusts State Public Pension Funds’ Practices and Performance Report.

Fixed income allocations have stayed stable, but there has been a switch from equities to alternative investments, yet this has not translated to better absolute returns. The alternative investments were supposed to give higher equity-like returns, but may have behaved more like enhanced fixed income. Perhaps the ideal return profile was never a true possibility. The return gap for many states has been significant. The only way the gap would have been closed would have been to hold large equity beta bets. In hindsight this may seem obvious, but in reality it was a risk states were unwilling to take. The half step was to increase alternative investments.

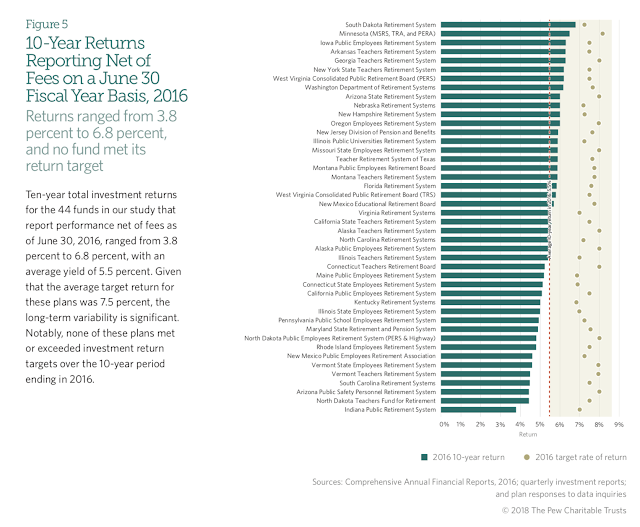

Unrealistic returns expectations could be the reason for the funding gap, but the story is clear. States have a problem. They did not generate the returns actuarially expected and expected returns in a low fixed income and growth environment suggest that the gap will not be closed in the future. As the retirement pool increases, more funds will be needed for pay-outs and not available for future retirees. While some states have done a better job, no state has been able to exceed their return targets for the ten year period analyzed.

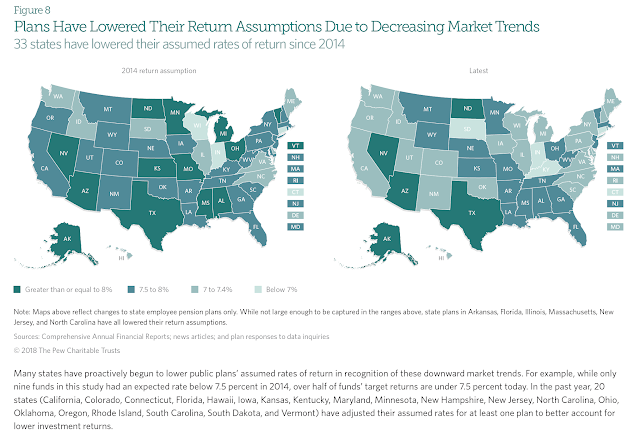

States are aware of the problem and have lowered their funding return expectations, but these numbers are still high when you consider current yields and what may be reasonable equity return assumptions.

The challenge and burden for alternative investing is whether strategies can be employed to close this funding gap and meet some absolute return targets. With over $3+ trillion invested, all state pension funds may not be able to succeed at raising returns without taking greater risks. There just may be too much money chasing limited return opportunities. Everyone cannot have special investments. Nevertheless, each state has to try and find a mix that will lower risk and boost returns.