The concept of investment narratives has been given a bad reputation especially by quants, yet these stories are often the glue that holds together data. Quants say, “Only look at the data”, yet the data may only be useful through words that extend meaning to the data.

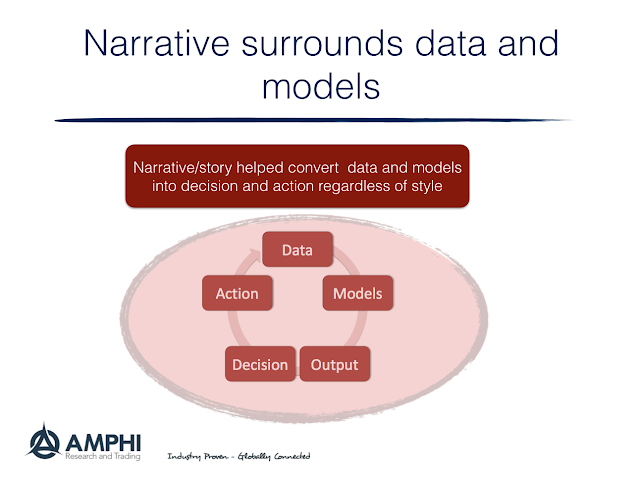

Many investors will not accept facts and output from models, without a good narrative. Models are fundamental to good investment decision-making. Models impose discipline and structure on action, but the action necessitated by a model requires a story for how it fits within the context of the marketplace. Models often leave a lot of variation unexplained. The story fills in the blanks between data, models, and opportunity.

Models are simplifications. They offer a shorthand at explaining the world. Empirical models simplify regularities found within data, but these simplifications need a way to be imprinted in the brain when action is needed. Stories create a memory imprint and excitement that is not present when just looking at data differences. Some may say that the narrative is excessive and adds bias. There is no question that stories can embellish facts, but they more often provide a useful contextual framework, a reference to the past and a comparison across the present.