Alpha generation will fall when it is measured correctly through an appropriate benchmark. Alpha shrinkage over the last ten years is a measurement problem. Returns for hedge funds are a combination of the underlying risk premia styles employed and the skill of the manager.

This shrinkage seems to suggest that managers generate little extra return through their skill, but there are other forms of alpha associated with forming a portfolio. This has been called “Craftsman Alpha” (See Craftsman Alpha: An Application to Style Investing). The crafting or forming of a hedge fund portfolio is a unique skill and can provide value no different than security selection.

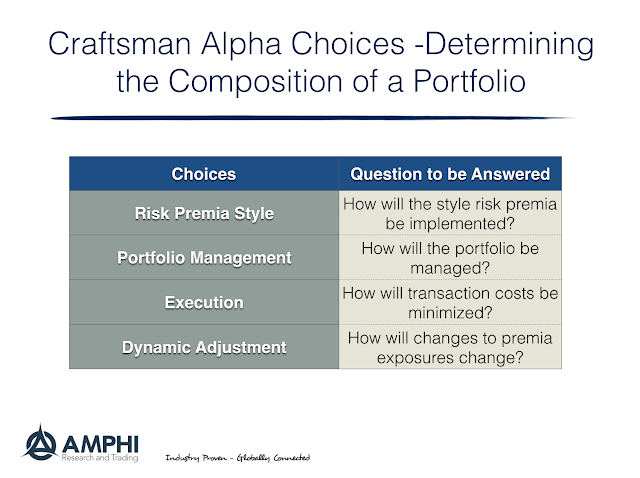

The definition of craftsman alpha is still somewhat vague, but it will include all of the activities associated with portfolio management after a style choice is determined. Craftsman alpha will be the value-added from bundling and managing a portfolio of risk premia.

We break craftsman alpha into four categories or parts:

- Risk premia style choices –

- Implementation of styles: Given any risk premia style, there are a number of implementation choices, asset restrictions, inclusions and exclusions, and definition differences, which determine how a style is generated. For example, a FX carry strategy has to determine the currencies to include, the rate to determine carry, weight constraints, and rebalancing to name a view. These choices, all under the name FX carry, can have appreciable return differs and can be classified as skill.

- Portfolio management choices –

- Volatility targets; determining the overall risk of the portfolio

- Rebalancing timing; determining when to reset the weights of the portfolio.

- Sector and name constraints; determining maximum allowable exposures.

- Weighting scheme; determining the weights of exposure such as equal volatility weights vs equal risk contributions.

- Execution choices –

- Mechanisms for minimizing transaction and trading impact.

- Dynamic Adjustment choices –

- If there are multiple risk premia in the portfolio, the decision process or mechanism for adjusting the portfolio weights.

A craftsman alpha discussion changes the focus from picking securities or risk premia to the process of managing a portfolio of risks; the strategy and tactical decisions of running a portfolio. Given there are no well-defined rules on how to create craftsman alpha, there can be significant variation across managers. These construction choices are the decisions of a craftsman and not scientist.