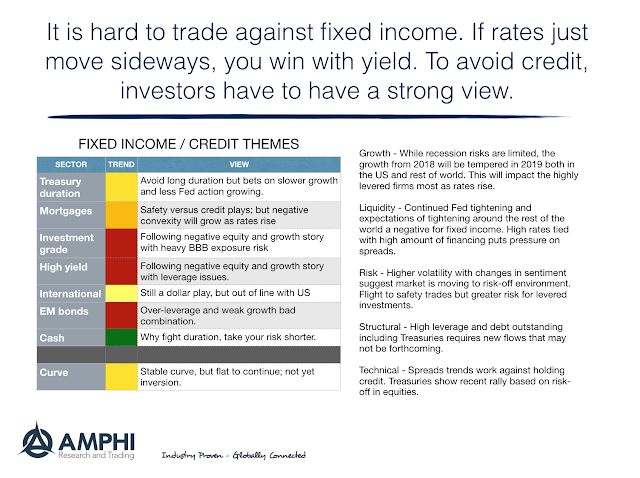

Current views on asset allocation in fixed income and credit are generally negative. The focus should be on holding shorter duration and cash investments.

Credits spreads are widening because of both increased economic and financial risks. International bonds both DM and EM are facing dollar funding risks and slower growth. Long duration Treasury bonds show high risk even with recent rally. Underweight market allocation and risk weighing in fixed income and credit.