If it keeps on rainin’ levee’s goin’ to break

If it keeps on rainin’ levee’s goin’ to break

When the levee breaks I’ll have no place to stay.

-Led Zeppelin

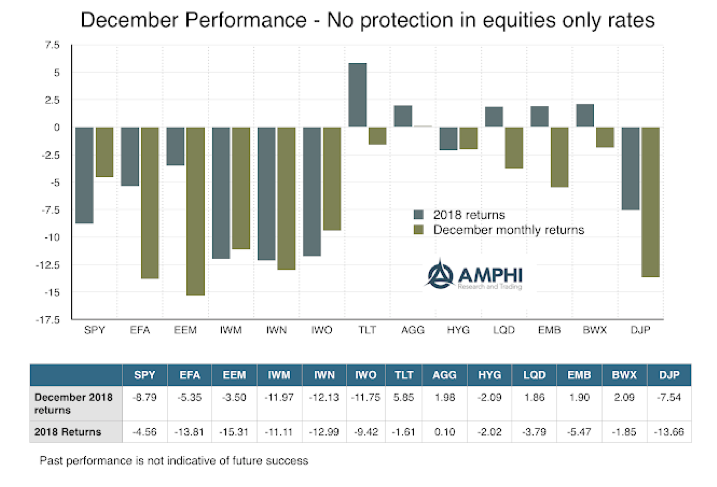

The levee broke in December with heavy selling of equities. Long duration Treasury bonds offered protection through its negative correlation with stock but there was little to make investors happy for the year. In some cases, the entire year’s return was swiped out in one month. Some analysts have suggested that this is the first time where almost all asset sectors and categories generated negative returns. Bad technicals, a change in sentiment, policy uncertainty, weaker growth data, increased expectations of recession, an inverted yield curve, the continued increase in rates by the Fed, lower liquidity across central banks, a US government shutdown, and tariffs wars can all be used as reasons for the fall. Any one reason seems excessive, but the combination has proved to be too much for further market increases.

There are good reasons to argue that markets have overreacted, but a simple asset allocation decision is perhaps best – don’t fight the trends. A trend is the aggregate weight of changing market opinions and there has been a sea change. You may disagree, but the cost of being wrong or fighting the headwind is high. Being defensive and waiting for new information will not provide a first mover advantage, but it also allows for better principal protection. However, making significant changes to exploit the December drop may be late especially if there is no reinforcing information.