What was keeping the dollar moving higher? A simple difference in monetary policy has been a key driver. With the Fed tightening through raising rates and engaging in QT, the reserve currency provider was out of step with the rest of the world. However, recent comments by Fed Chairman Powell and other Fed bank presidents have changed policy expectations. If there is a pause, patience, and caution, it is less likely that rates in the US will move higher. Expectations in forward rates have already declined significantly. A key underpinning for the dollar has been taken away. If the interest rate gap between the US and the rest of the world does not widen, other determinants will drive currency moves.

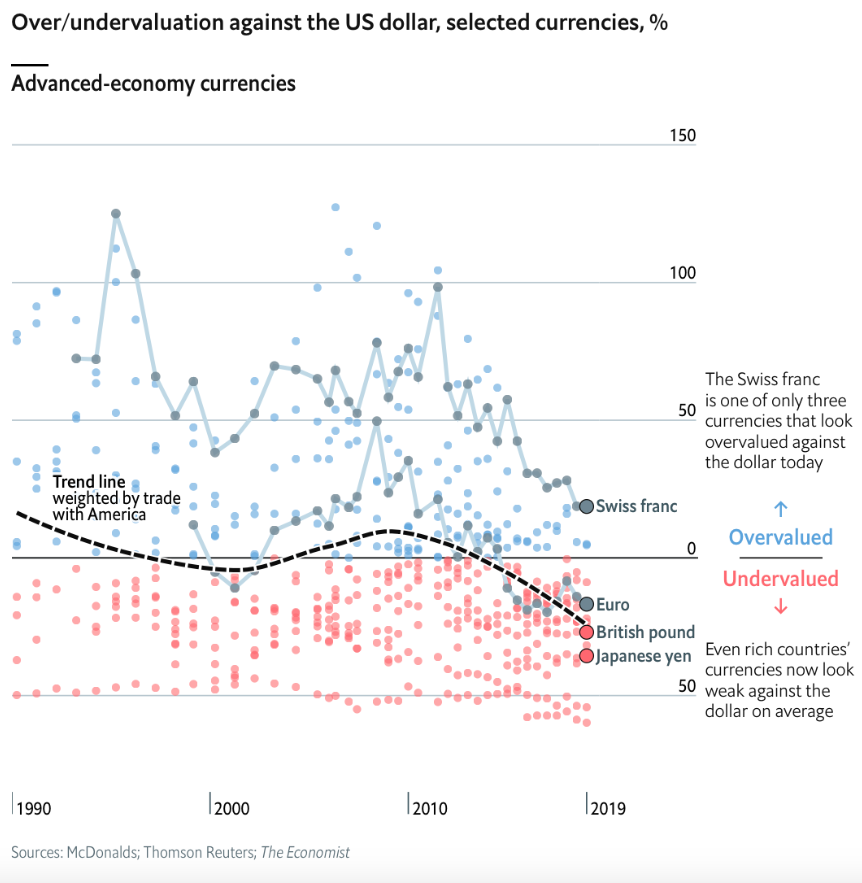

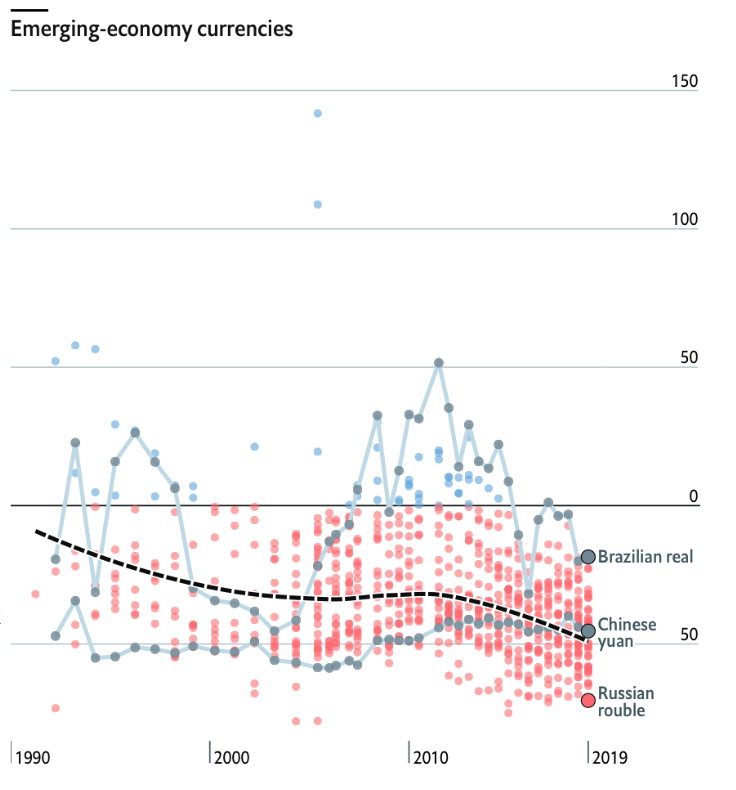

One of the next currency drivers is valuation. In this case, the dollar, as measured by a number of models, is overvalued and the divergence is not trivial. The Big Mac index is just one example. US growth that is more consistent with the rest of the world will support a move to fair value. Now history has shown that the half-life for closing valuation differences can be measured in years, but with monetary policy not as supportive of a strong dollar other factors will serve as drivers. Investors may look to selected equity and fixed income markets to take advantage of these opportunities.