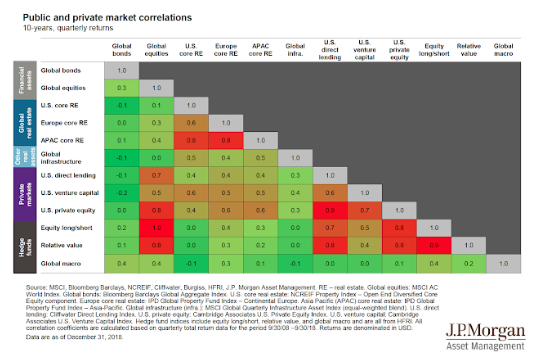

All alternative investments and hedge funds are not created the same. There is significant dispersion in their correlations with global bonds and equities. Some are better at diversification and others are good for adding returns. A recent Guide to Alternatives from JP Morgan Asset Management provides long-term correlations for alternatives and hedge funds for the post Financial Crisis period.

Alternatives have significant value for diversification, but a closer look should give some pause. First, significant diversification gains can be achieved through simple asset allocation with bonds. Second, the diversification gains from equity-like alternatives against global stocks are constrained. The private alternative markets need to generate extra return along with diversification to justify their use. Across all asset classes, the best diversifier is global macro. Albeit it has not performed as well over this period, its broad mandate allows for the greatest diversification benefit. Dynamic allocations across all asset classes can be very helpful.

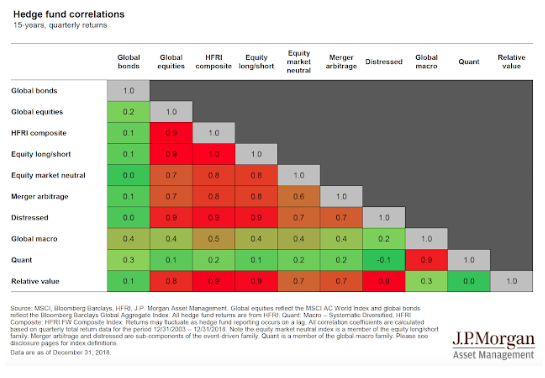

Correlations across hedge funds show a higher degree of clustering than the broader set of alternatives. Global macro and quantitative strategies have the best diversification benefit within the broader set of hedge fund categories. The lower returns over the ten year post Financial crisis period have contributed to this low correlation, but these two styles lend themselves to effective diversification given their unique and broad mandates.

As portfolio diversifiers, alternatives and hedge funds still represent key value for portfolio construction, yet care is still needed for the style and manager selection process. This message is not new but needs to be constantly reinforced.