If there is an adverse market move and you want to change portfolio allocations and sell some securities, will you get a fair price? Any downside situations that investors will face will face a liquidity shortage. This is different than thinking about illiquid investments, where the knowledge concerning illiquidity is known.

The IMF Global Financial Stability Report of April 2019

More critical is the vanishing of liquidity for instruments that are usually liquid. Every investor should be prepared for a liquidity surprise. Like entering a theatre, the critical risk manager knows where the exits are. This issue is antiseptically discussed in the Global Financial Stability Report of the IMF for April 2019 as a “Special Report: Liquidity in Capital Markets.” It is a problem, but the report does not sound an alarm bell.

Two issues with market liquidity

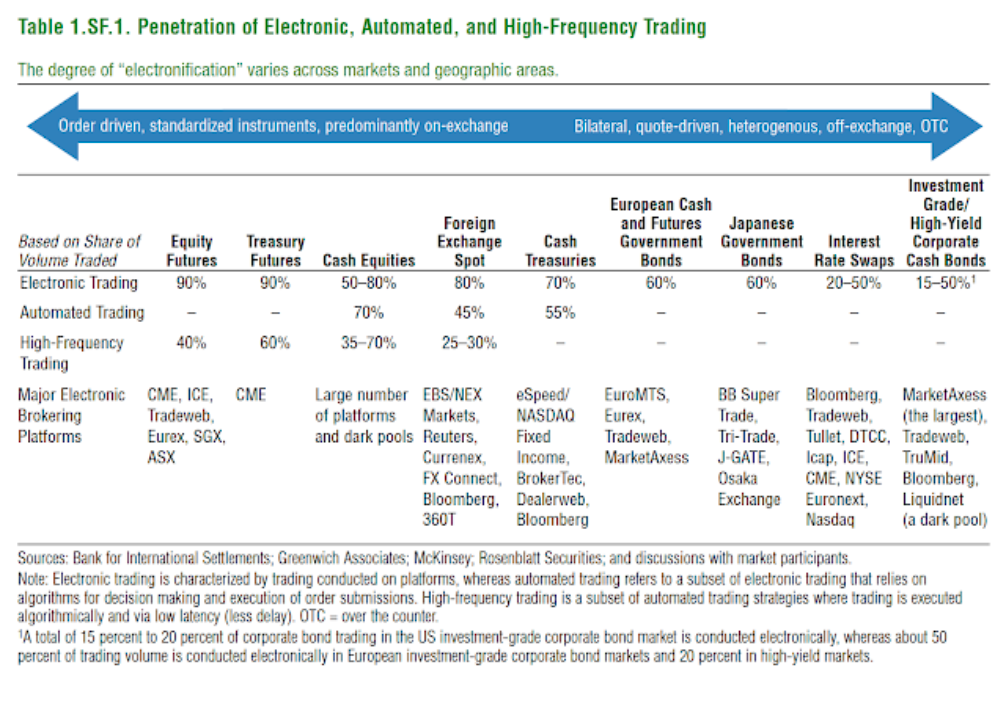

Two issues jump out when thinking about market liquidity. One, the liquidity market structure has changed radically since the Financial Crisis. It cannot serve all investors wanting to sell in a crisis. High frequency and electronic trading make the liquidity in a crisis more fragile, and the spread of technology is unequal. The trading future has come sooner for some. Two, the concept of market liquidity is fluid. Some asset classes are more liquid than others, and market liquidity last year was not the same as this year.

The dynamic nature of market liquidity

Market liquidity is dynamic. By some measures and for some markets, liquidity could be better than a decade ago, but there are some clear hot spots. For example, traders break up orders to reduce the price impact of trades, and high-frequency market-makers can make tight bid-ask spreads, but a shock can cause this liquidity to disappear quickly.