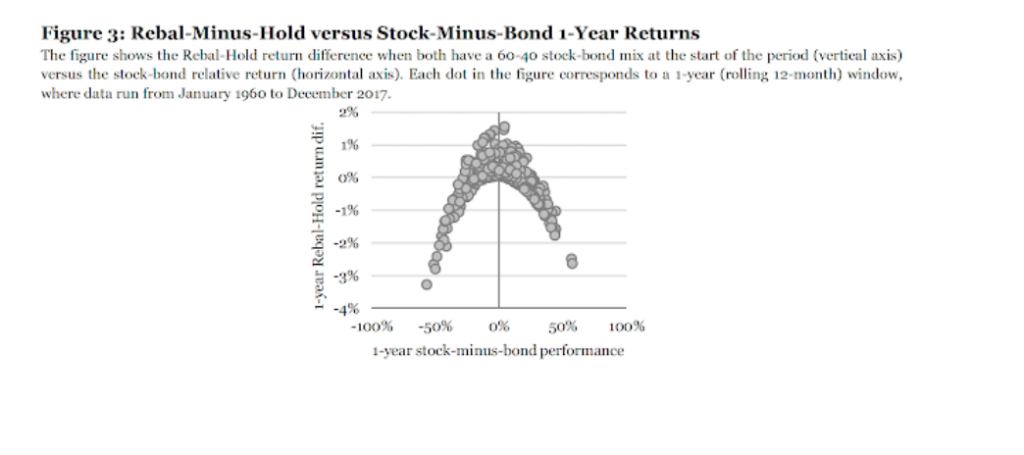

Rebalancing has become an essential tool for portfolio management. Nevertheless, market return patterns will affect the return impact of rebalancing. Regular rebalancing is a mean-reverting strategy. For example, suppose there is a simple 60/40 stock/bond portfolio. In that case, stronger stock performance will cause the allocation to deviate from the strategic allocation and lead to a higher allocation to stocks over bonds. A rebalance will take money away from the better-performing asset and give it to the underperforming asset. It sells winners and buys losers regularly. See “Strategic Rebalancing” by Granger, Harvey, Rattray, and Van Hemert

Rebalancing may seem like an innocent enhancement strategy under regular times, but if there are market trends, rebalanced portfolios will show poorer performance than a buy-and-hold strategy. It will affect drawdowns and volatility. Take the simple market extreme during the Financial Crisis; rebalancing would have continued to add exposure to stocks even during the extended downturn, taking money away from the better-performing bonds. In essence, a rebalancing strategy generates negative convexity for a portfolio.

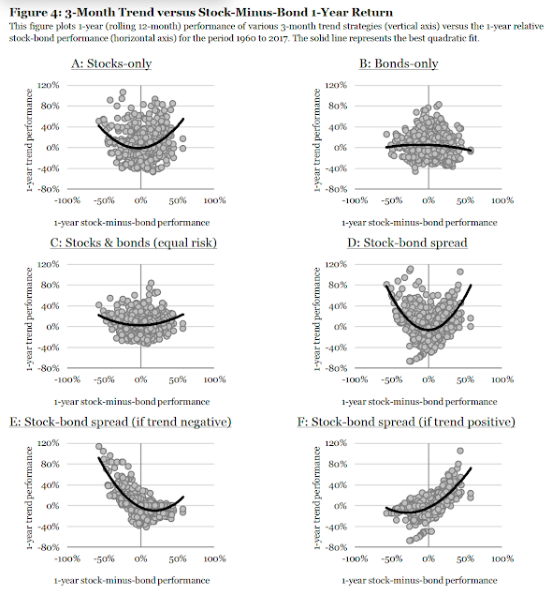

A simple marriage between rebalancing and trend-following is consistent with holding winners and not giving to losers. This will offset the impact of rebalancing drag. While the effects of strategic rebalancing will be minimal during periods of calm, there will be a substantial benefit if we move to extremes. Applying discipline will allow for positive portfolio convexity at the right times.