Index investing is all the rage now, with over a trillion dollars invested in the SPY and VOO ETFs alone. Low fees coupled with broad market exposure are expected to be better for your portfolio than an actively managed strategy with higher fees. One could argue that as the indices’ components attract more capital flow, these names drive the market, and even a “diversified portfolio” often correlates highly to a simple index. I believe that everyone should have some equity exposure, but is there a better way to do it?

Futures managers often design their programs for absolute returns that complement the traditional model portfolio. As an example, trend followers often achieve their highest returns in times of high volatility (equity losses) as many sectors move consistently in one direction over weeks and months. One area we rarely see CTAs engage in is pure competition against the S&P 500 to see if the versatility and margin benefits of futures contracts, along with different timing strategies, can beat the index on an absolute return and risk-adjusted basis after all, if you could have the same investment with lower volatility that would be a no brainer.

Three programs on our site take different approaches to this challenge. Goldman Management typically runs its strategy at a lower level of volatility than the index itself and avoids using leverage entirely (when fully funded). Positions are held for long periods with limited turnover in the portfolio. Sometimes, the trader would go short but often just reduces exposure when the market is falling. This has led to lower drawdowns since inception than the S&P and quicker recoveries. The trader uses deep market research to identify when to be fully allocated or partially allocated.

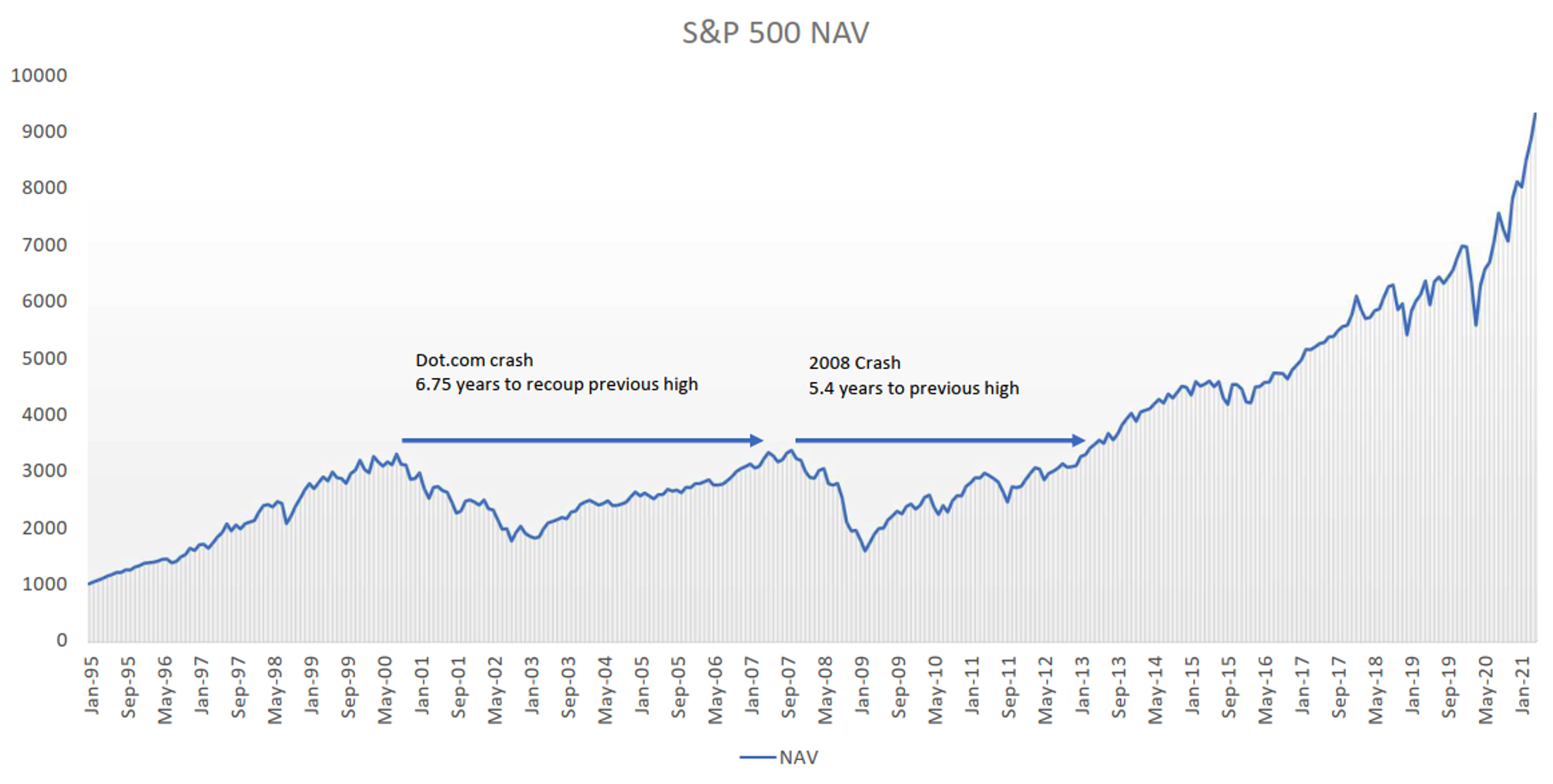

Covenant Capital Management’s Hedged Equity Program takes a different approach. They look at the potential for wealth-destroying drawdowns (greater than 10%) and seek to reduce or eliminate them through a systematic hedging process. We can look at the “Dot.com” crash in the early 2000s or the housing crisis in 2008 as two or the more recent examples of extended down periods for stocks. Each took over five years from peak to valley to recover their high point. A scary prospect for someone planning to retire in the near future as the chart shows these losses occurred back-to-back, equaling 11 years of flat performance. While the program officially launched in 2020, it got its first test almost immediately. It showed its ability to negate a loss and turn it into an opportunity as COVID panic spread through the markets. Unlike Goldman, they trade their program at 1.8x leverage ($100k invested equals $180k exposure). They believe that the ability to play defense gives them the freedom to be more aggressive with their market positions and be more cash efficient than a traditional ETF.

Past Performance is not indicative of future results.

Lastly, Agility Trading created a program with a dedicated long S&P position without leverage and added a shorter-term trading system focusing on negative correlation to the equity markets. The idea matches that of many futures programs, providing the potential for “crisis alpha” that will benefit a traditional portfolio when it needs it the most. Here it occurs all in one investment. This system is always on and has turned some negative periods into winners thus far.

Time will tell if commodity trading advisors can break into the equity market to compete with the largest ETFs in the world. However, these three traders show that it is possible to overcome the fee hurdle and succeed. Moreover, it only takes avoiding one significant loss every few years to pay off.

Photo by Alejandro Benėt on Unsplash