Commentary provided by Todd Delay of Gamma Q

Breckhurst Commodity Fund (onshore) was up a net estimate of 1.29% for January, and Breckhurst Commodity Fund (Cayman) was up a net estimate of 1.25%. The risk loss in trading futures and options can be substantial. Past performance is not necessarily indicative of future results.

A long bias across the soybean complex drove returns for the month, with Russia/Ukraine and South American weather headlines dominating the markets we participate in. We anticipate this will continue for perhaps 3-5 more weeks, but then most attention will turn towards the North American growing season, where our comments today will focus on.

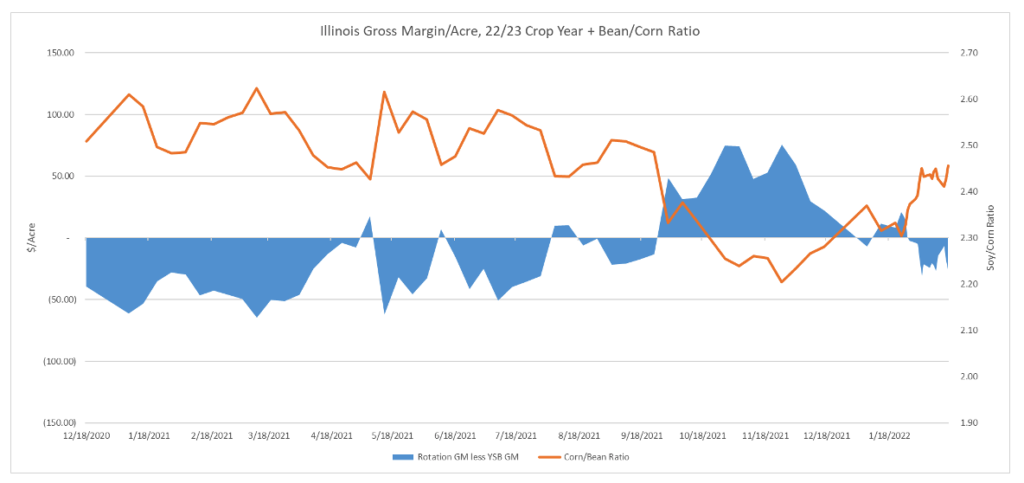

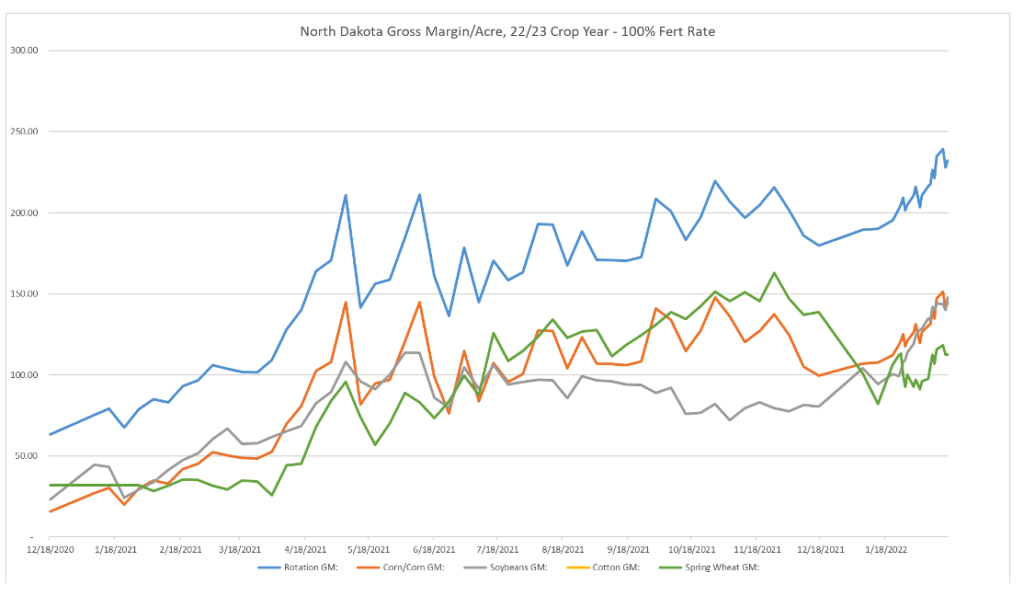

Since early winter, we felt corn acreage could surprise us on the upside even with high fertilizer prices as reduced input options enabled corn to offer superior returns to soybeans and other minor crops. Today, the bean corn ratio has improved to 2.43 from 2.16, and returns for corn no longer offer adequate or superior returns to expect a major shift from soybeans to corn. The uncertainty of receiving chemicals and fertilizer on time could also shift a few acres to soybeans that might otherwise register in the corn column. The graph of Illinois corn revenue vs. soybeans for rotated ground shows consistent gains in beans registered over the past few months. Weather-induced supply losses in S America should keep the domestic and global bean balance tightening further and to a greater degree than corn. Other minor growing areas of the southeast and N Plains also find soybeans looking more attractive vs. corn and cotton in the southeast and spring wheat in the N Plains. To reiterate another previous thought, the slightest challenges in planting crops in the US this spring should lead to larger than normal preventative plant acreage that would likely be the most bullish soybeans. There should be above average relative value trades develop once March 30th planting intentions are released. There will likely be several crops uncomfortable with acreage allocation as we see minor increases in total US acreage pie compared to the previous two years.

Corn’s balance sheet is best described as tight, but rationing has not yet occurred. China canceled some old crop corn purchases recently, but very little pressure resulted from the announcement. Shifting of 2-3 MMT’s of Chinese corn from US old crop to new or to Ukraine does not compete with the 15-20mmt of reduced corn production in S America over the last 60 days. Favorable late-season weather in Brazil and Argentina may stabilize corn yields, but we give higher odds S American corn production is lower than USDA estimates today … even with a slight improvement in the weather. The need for 90 million acres of beans to be planted this spring should keep new crop corn strong and corrections shallow.

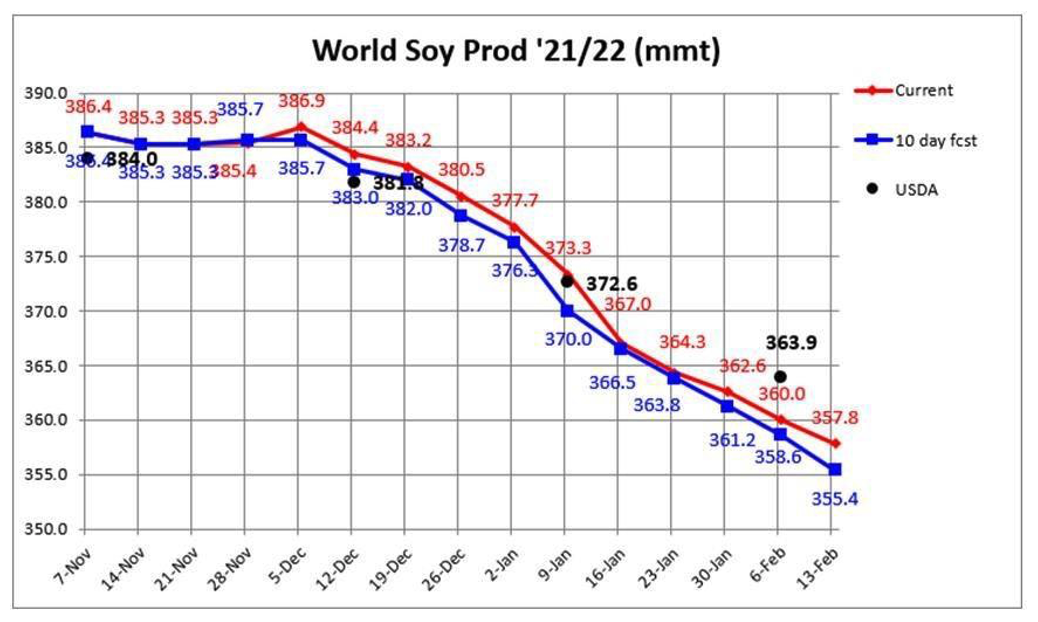

Likewise, the soybean balance sheet continues to tighten, as the USDA has taken aggressive steps reducing S American bean production from 206 MMT to 188 MMT yet we feel production could still be 10 MMT or more too high! The loss of near a billion bushels of beans should add 400-500 million additional bushels of exports split between 21/22 and 22/23. Crush margins continue to be attractive, which is not common in periods past when soybeans are above $15 per bushel. The list of new crush or renewable diesel plants continues to expand while high canola and palm oil leave soybean oil attractively priced outside the bio-fuel arena. The quest to squeeze every ounce of oil by crushing beans and grinding corn for ethanol also reduces the amount of meal or meal by-products, creating less bearish protein markets than one would have anticipated considering the size of crush. Heightened volatility should be with us for several months, if not years. We don’t see the catalyst to become bearish.

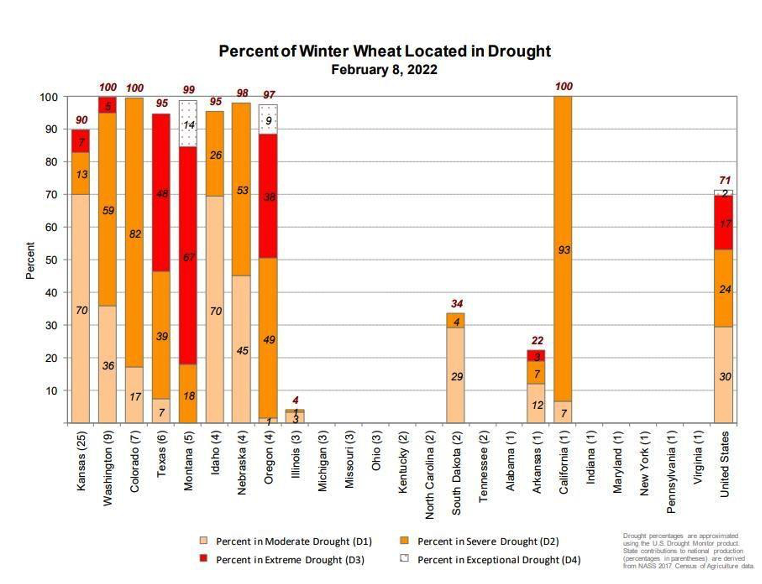

We have a toned-down bullish view on wheat, though we see the downside as limited with spring wheat acreage in the US likely to stay unchanged or drop and 70% of the winter wheat acreage in some form of drought (very high). Relative value trades are still favored, but outright long positions will likely come in vogue without normal to above-normal precipitation in key growing areas within the next 45 -60 days. HRW production appears headed below trend. With 70% of HRW wheat in drought, complacent attitudes could change quickly.

We continue to view live cattle favorably as supply will come down for several years and cow slaughter points to continued liquidation. Drought has placed more feeder cattle in feedlots which could keep supply slightly larger, but the days of reduced supply and lower beef production are close at hand.

Lean Hog prices are near historical highs, but herd liquidation in the US, high feed costs globally, and pork’s relative value versus beef price, we think, bodes well for hogs. Full employment and spiraling wages aren’t the ingredients for real demand destruction.

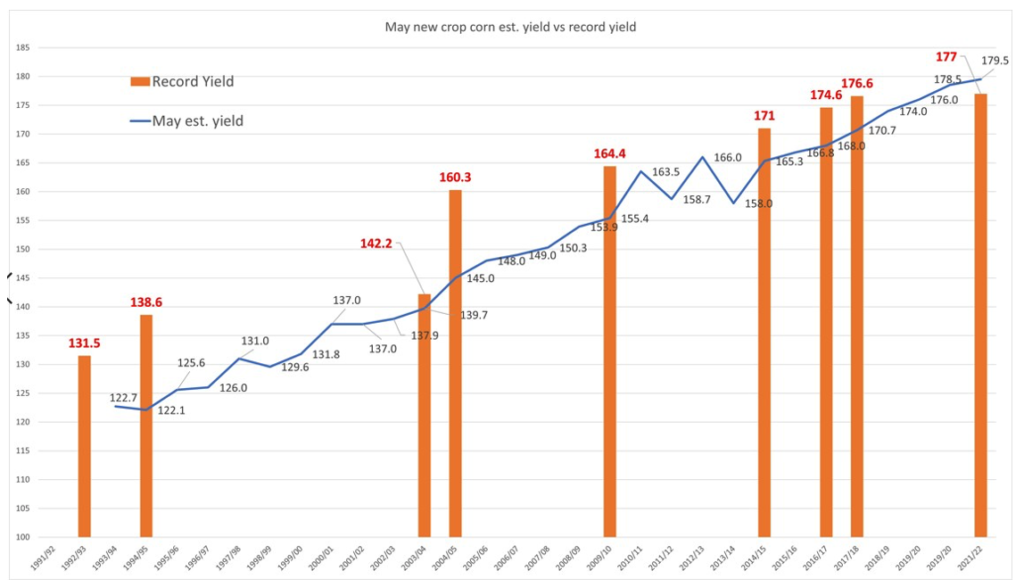

Grain and oilseed prices are high, yet profit margins for end-users are attractive with little rationing taking place. Agriculture stocks, processors, handlers are trading at or near record highs, unlike 2012-13, and the link biofuels appear headed to reduce carbon footprint is a new force in price discovery. Improved genetics, machinery, variable rate seeding, and fertilizer application kept trend yields for corn and soybeans moving higher this century. It may become difficult to see the % increases annually maintained as very few acres are left that haven’t received these yield-enhancing practices as opposed to 10 and 20 years ago. Since 2019 we have also entered the growing season using near or record yields that haven’t been seen before. This wasn’t the case 10, 20, and 30 years ago. The risks of having yields substantially above trend like 92-94-04 are reduced significantly, in our opinion.

The risk loss in trading futures and options can be substantial. Past performance is not necessarily indicative of future results.

References to “we” in this letter refer to Gamma-Q, LLC, the Fund’s General Partner. This letter includes forward-looking statements, and there are risks that actual results could differ materially from the forecasts, projections, or conclusions in those forward-looking statements. The information in this letter should be considered as background information only and should not be construed as investment or financial advice. Further, it should not be construed as an offer or solicitation to buy or sell securities or commodities. This letter includes information from sources believed to be reliable and accurate as of the date of this letter’s publication, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed in this letter are subject to change without notice. The risk loss in trading futures and options can be substantial; therefore, only genuine “risk” funds should be used in such trading. Futures and options may not be a suitable investment for all individuals, and individuals should carefully consider their financial condition in deciding whether to trade. Past performance is not necessarily indicative of future results.

Photo by Waldemar Brandt on Unsplash