Where did the bankruptcies go? Despite the world locking down, the expected spate of business failures did not materialize as expected. In fact, they barely showed up at all. According to Matt Taunt of Taunt Law Firm, a Michigan-based firm specializing in the area, “Filings fell off a cliff in 2020 to lows not seen since the 1980s.” As the authors of the white paper “Bankruptcy and the COVID-19 Crisis” point out, filings usually climb with the unemployment rate, yet instead, according to the American Bankruptcy Institute, they dropped by 29% from 2019 to 2020 and another 24% through 2021. This might sound like a positive for our world and the economy, but the truth might be that we did not eliminate filings but rather delayed them. Are we headed for a rude awakening?

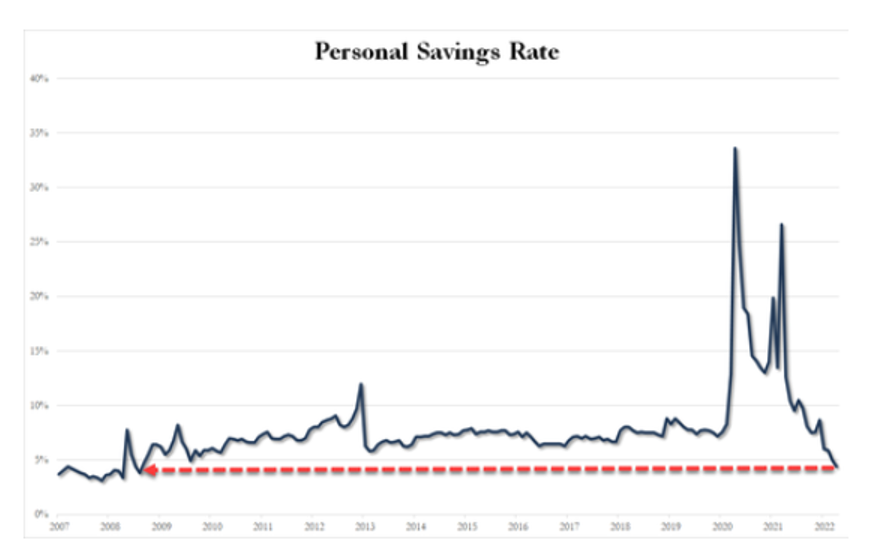

Unlike the recession of 2008, the “plumbing” of the financial markets and credit remained available throughout the pandemic. In fact, with central bank help, economies were flooded with cash. Stimulus checks, business loans, and enhanced unemployment were just a few of the items utilized to support the economy. In the United States, evicting a non-paying tenant or even collecting some debt became prohibited. Not surprisingly, renters stopped paying. With travel at a standstill and everyone not able to leave their houses, savings levels surged. Unfortunately, some companies went in the other direction.

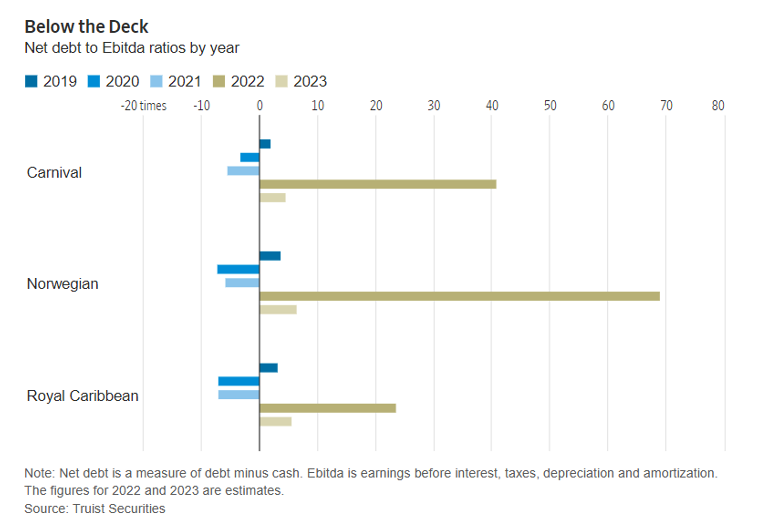

Pandemic-hit industries, including airlines, hotels, and cruise lines, took on massive amounts of debt, increasing their leverage on average from 15-20%. In fact, many businesses received more in credit than they incurred in losses. Early indications of the ability to recover were promising as travel and entertainment spending surged. The ability to service this debt going forward, however will depend on a myriad of factors. Early signs of a negative change in direction are all around us. Inflation and the dismal start to the equity market this year signal challenges ahead. Cruise lines, as one example noted in the chart below, pushed much of their debt servicing into 2022, which they need to refinance soon. This bill might be coming due at the worst time possible.

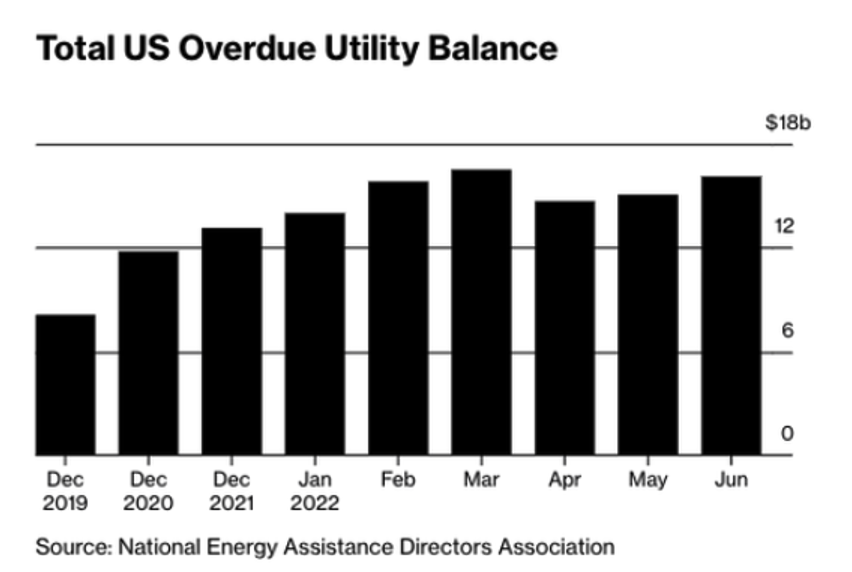

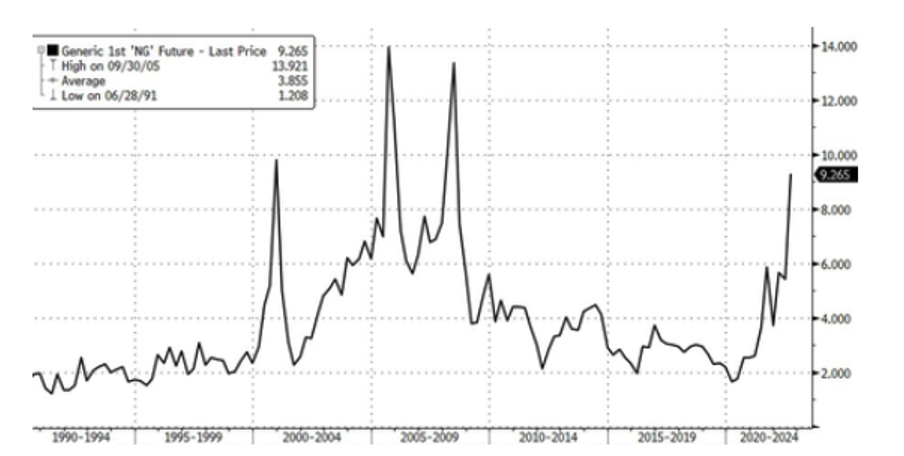

Inflation is driving the Fed to increase interest rates just as consumer credit is running out. Energy costs in Europe and elsewhere, a slowing economy, and the maturity of existing debt creates a perfect storm. According to Bloomberg, 20 million US households are behind on utility bills. This coincides with a spike in natural gas prices to highs not seen since 2008, largely driven by Russia cutting their Nord Stream pipeline output just as winter approaches. 40% of the US power grid is fueled by natural gas, and more is exported to help Europe through liquified terminals daily. So much so that Jennifer Granholm, the US Secretary of Energy, felt a need to send a letter to seven major refiners this week imploring them to reduce exports. She writes, “Given the historic level of US refined product exports, I again urge you to focus in the near term on building inventories In the United States, rather than selling down current stocks and further increasing exports.” The personal savings rate, which was supposed to help us avoid a recession, is at levels last seen in 2008. So where do we go next?

Anecdotal stories of horrific energy bills in Europe and elsewhere continue to pop up before we even hit the critical winter period as US inventories of gasoline hit near decade lows on the East Coast. This is bad news for Europe, which cannot afford to absorb additional shocks. Given the interconnectedness of the world economy, slowdowns in one place will spread to others. We see this already as China shuts down entire cities to enforce their “Zero Covid” policy. If Germany fails to keep their populace warm, expect its GDP to take a hit. This time around, unlike early 2020, when companies were in pretty good shape, might be different. Central bank balance sheets are full, and inflation keeps the pressure on to keep raising rates. Employment is the best indicator of future bankruptcies, and those numbers hold strong for now. As one trader points out, however, risk can be delayed but not eliminated. Perhaps we are about due for our rude awakening.

References:

- https://www.wsj.com/articles/jennifer-granholms-de-facto-fuel-export-ban-energy-secretary-letter-refiners-oil-europe-11661379613

- https://hbswk.hbs.edu/item/covid-was-supposed-to-increase-bankruptcies-instead-theyve-gone-down

- https://www.abi.org/newsroom/bankruptcy-statistics

Image created via Midjourney