Commentary provided by David Zelinski of Opus Futures.

Happy New Year to all! I’m excited to get off to a great start in 2023, but before discussing the outlook, I want to spend a quick minute discussing 2022. Our program was off to a strong start in the first half of 2022, but profits were harder to come by during the second half of the year. This is due to several reasons, but the most important, in my opinion, is a general lack of direction in key markets. For example, Dec’22 corn futures closed on June 30th at $6.19 ¾. When those futures expired in mid-December, they were priced at $6.39. That is only a 20-cent move over roughly six months. Obviously, there was *some* volatility during that timeframe, but nothing I felt especially comfortable with getting aggressive. Other markets were similarly directionless. This relatively subdued trading environment was not conducive to strong gains. Still, I’m thankful that we navigated the environment with no major problems…though obviously, the year did not finish as strong as we might normally hope.

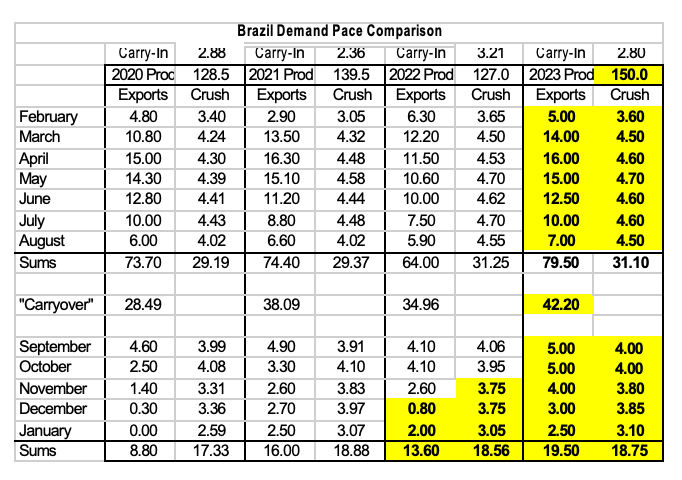

I said in last month’s commentary that it is getting hard to justify historically elevated corn and soybean prices. Since that statement, both corn and soybean prices have staged an impressive rally. This price strength comes on the back of adverse weather conditions, primarily in Argentina. The expected crop losses in Argentina do certainly change some of the math for global balance sheets, but in the case of soybeans, I’m still of the opinion that the strong crop in Brazil is the bigger story. The table above is busy, but I think it might be the best way of detailing how significant the increase in Brazilian production will be this year.

A conservative estimate for Brazil’s crop is 150 mm, which would be up 23 MMT from last year. As shown in the table, we could see Brazil exported 13 MMT more soybeans during the Feb-Aug timeframe this year than it did last year. On top of that, it would still leave “extra” supplies to compete against new crop US supplies next fall. Argentina, meanwhile, has not been a significant exporter of soybeans in the past few years. Again, I don’t want to suggest that Argentine crop losses don’t matter in terms of global soybean trade, but the bottom line is that Brazil’s huge crop is expected to dramatically reduce the call on US soybeans from China and the rest of the world.

US soybean shipments will likely remain strong through the end of January, but beyond that, US exports should grind to minimal levels. This should mean that WASDE’s export projection for the 22/23 marketing year is too large, and it also means that initial 23/24 projections should be conservative.

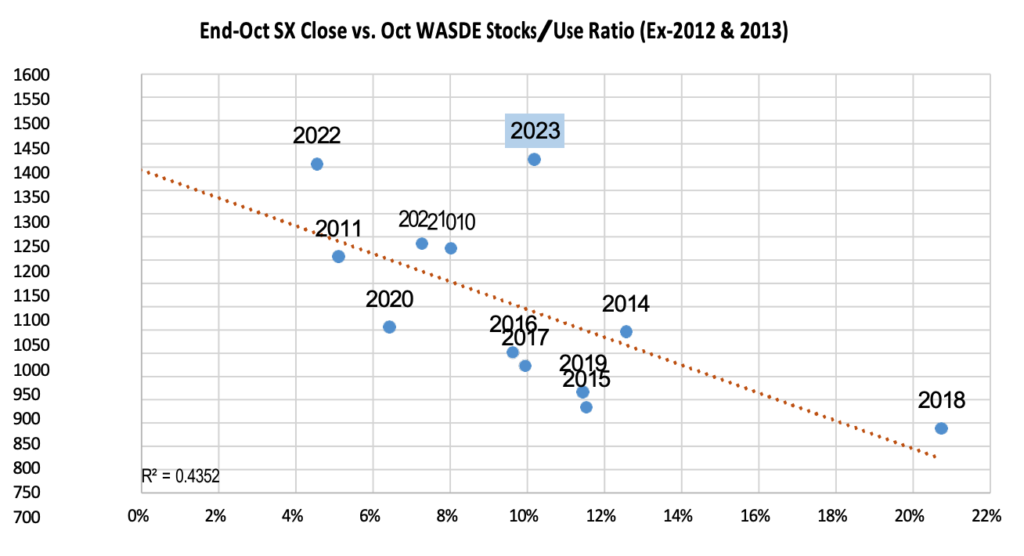

If we assume 22/23 ending stocks prove larger than most expect and that 2023 US production doesn’t run into any problems (admittedly a big IF at this point, but there is no reason to guess otherwise), I see US soybean stocks potentially swelling back to levels we haven’t seen in several years. If that situation is realized, we could see some significant downside in soybean prices in the year ahead. The chart below plots SX prices against stocks/use ratios over the past several years. The highlighted 2023 figure shows the current price of SX’23 against my current supply and demand projections. This clearly shows the case for weaker prices to come.

The situation is not quite as clear-cut for corn. While Argentina hasn’t been a significant exporter of whole soybeans in the past few years, they have remained an impressive exporter of corn. Crop losses will lead to a reduction in Argentine corn exports which will need to be offset by someone…potentially the US. Brazil *might* be able to come to the rescue here, but we won’t know much about Brazil’s corn production potential for another several months. Until that point, corn might be reluctant to drop in value significantly. It should go without saying that the situation in Ukraine could continue to provide on-and-off price support for corn. Corn (and wheat) will continue to see price action being dominated by news coming out of Ukraine. That might make corn a difficult short for the near term. With that in mind, I plan to focus most of my attention on soybeans.

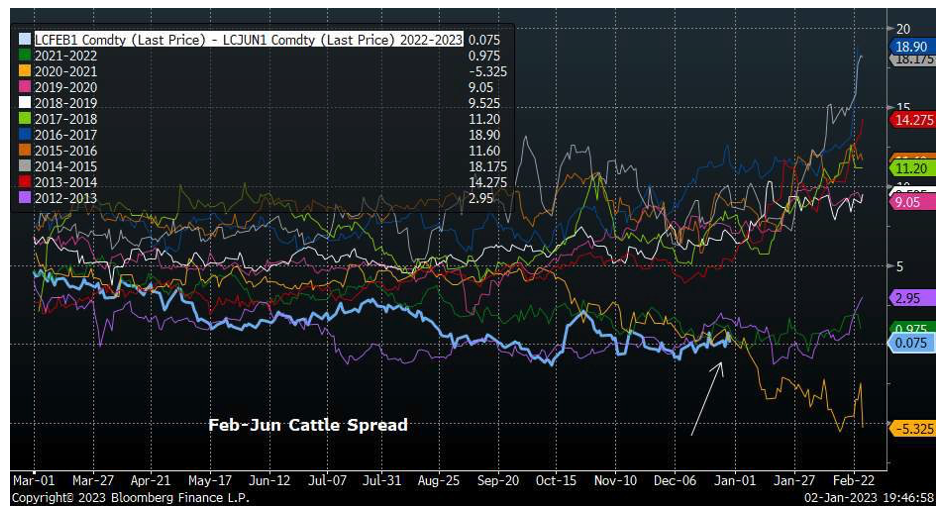

One other market that has my attention is cattle. Cattle supplies have certainly tightened up considerably in the past several months. On top of that, we’ve seen several rounds of adverse weather move through major feedlot areas, impacting feedlot performance. I expect this to lead to a prompt rally on the front end of the cattle curve. I feel bull spreads might be the best way of executing this thought process. The chart above shows the history of the Feb-Jun spread as an example. Notice that the current spread is hovering near the lowest levels of the past ten years. With tighter cattle supplies and poor performance, I would expect that nearby cattle should demand a premium and that this spread should move sharply higher in the weeks ahead.

Photo by Waldemar Brandt on Unsplash