Category: Advisor Commentary

November 2022 Market Letter

Commentary provided by Chad Burlet of Third Street AG Investments With the arrival of winter in the northern hemisphere, a majority of market observers have turned their attention toward the production prospects in the southern hemisphere, where Brazil, Argentina, and Australia dominate. Australia’s leading crop is wheat, and they are on track to produce their third large […]

October 2022 Opus Futures Ag Commentary

Commentary provided by David Zelinski of Opus Futures. In last month’s commentary, we went through a few reasons why grain and oilseed prices were likely to come under some pressure. We pointed out the low river water levels, which were restricting export capacity and the usual seasonal harvest pressure on prices. The river situation has played […]

October 2022 Market Letter

Commentary provided by Chad Burlet of Third Street AG Investments After months of high volatility and wide daily and weekly trading ranges, the agricultural markets settled down considerably in October. Corn and soybean futures were particularly docile, with corn volatility falling to a two-year low and soybean volatility to a one-year low. The monthly trading range in […]

September 2022 Market Letter

Commentary provided by Chad Burlet of Third Street AG Investments The last business day of September always brings the USDA’s report of September 1st U.S. grain stocks, the end of the previous crop year. This report has often yielded surprises that force a change in the last fall’s crop size and create significant moves in the futures […]

August 2022 Market Letter

Commentary provided by Chad Burlet of Third Street AG Investments We opened the month of August with all eyes on the M/V Razoni, the first vessel to sail out of Ukraine since the Russian invasion in February. The Razoni and at least 64 other vessels traveled safely through the corridors the UN, Turkey, Russia, and Ukraine agreed […]

July 2022 Market Letter

Commentary provided by Chad Burlet of Third Street AG Investments The themes of uncertainty and volatility that have been with us for most of 2022 did not leave us during July. Some root causes, like the war in Ukraine, have been with us for many months, but new risks and unexpected developments have impacted the agricultural markets […]

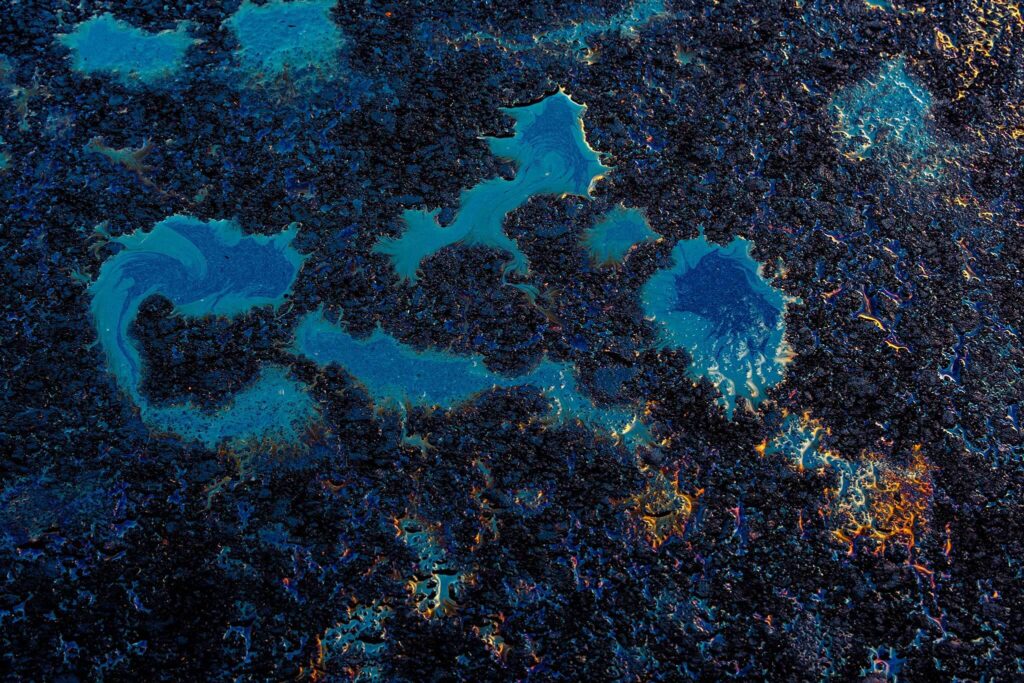

Oil market mid-year S&D outlook: GZC Strategic Commodities Fund May 2022 Report

Commentary by GZC Investment Management Global balances in crude have been tight in 2H21 but since then have been globally neutral to soft. Great disparities between OECD and non-OECD countries have been noticeable. In short, OECD has been drawing oil stocks rapidly until recently while non-OECD countries, particularly China, were constantly building stocks, allowing them […]

June 2022 Market Letter

Commentary provided by Chad Burlet of Third Street AG Investments The last business day of June always brings the USDA’s June 1 Stocks Report and updated estimates of Planted Acres. The combination of those two reports, one for old and one for new crop, make it the most important agricultural report day of the year. This year […]

May 2022 Market Letter

Commentary provided by Chad Burlet of Third Street AG Investments We’re more than three months past the Russian invasion of Ukraine. Yet, developments in the Black Sea and countries’ reactions to these developments continue to dominate our markets daily. The loss of Ukrainian sunseeds and sunoil prompted Indonesia to ban palm exports. The loss of Ukrainian wheat […]

Cayler Capital April 2022 Commentary

Commentary provided by Brent Belote of Cayler Capital Cayler Capital had a slight pullback after our blockbuster performance in March, posting -5.53% for April (Past Performance not indicative of future results). Primary losses were from long oil positions. We have gone back to the sideline for the time being on oil directionally but still believe […]

April 2022 Market Letter

Commentary provided by Chad Burlet of Third Street AG Investments Food security and domestic inflation have quickly become the top concerns of almost every country in the world. The loss of Ukrainian wheat exports caused several smaller countries to restrict their exports and encouraged several importing countries to increase their inventories. The loss of Ukrainian sunseed and […]

Numberline Capital Partners March Performance Report and Market Summary

Commentary by John Knott of Numberline Capital Partners. The NLCP Macro-Economic Model up ticked slightly this month from 8.16 to 8.32. That was a little surprising. We expect it to continue to weaken “slowly” as we move into summer and the Fed tries to slow the economy down. There has been a lot of talk about […]

AG Capital March 2022 Investor Update

Does Powell want an equity market decline? It seems so. Former Fed chair Bernanke spent a decade delivering a policy of actively pursuing a “wealth effect” via quantitative easing (QE), hoping that stock market gains would unleash additional spending in the economy. It didn’t really work, only serving to exacerbate the wealth divide. It took […]