Category: Advisor Commentary

March 2022 Market Letter

Commentary provided by Chad Burlet of Third Street AG Investments From a commodity perspective, March came in like a lion and went out like a lion. At the beginning of the month, the market was trying to grasp the impact of the Russian invasion of Ukraine. At the end of the month, it was attempting to price […]

Numberline Capital Partners February Performance Report and Market Summary

Commentary by John Knott of Numberline Capital Partners. Last month, we left off expecting a re-test of the price lows but firmly believed the “panic selling” was primarily done with. Well, we got the re-test on all three major indices. As expected, the market has stayed volatile, and sentiment has rarely been this bad. In addition, […]

Gamma Q February 2022 Market Update

Commentary provided by Todd Delay of Gamma Q Our long bias to corn and the soybean complex drove returns for February. Deteriorating weather conditions in South America ratcheted down production estimates, providing support to corn and soybeans; then, as the month came to an end, it was marked with the opening of the Russian invasion […]

Russian Sanctions Already Traded: GZC Strategic Commodities Fund January 2022 Report

Commentary by GZC Investment Management In January, global energy demand was on the strong side of expectations, with oil storage in OECD drawing significantly. However, global crude oil balances suggest it is likely to ease for the coming months despite a strong backwardation in oil curves and limitation in US stocks building instrumented by Saudi […]

Gamma Q January 2022 Market Update

Commentary provided by Todd Delay of Gamma Q Breckhurst Commodity Fund (onshore) was up a net estimate of 1.29% for January, and Breckhurst Commodity Fund (Cayman) was up a net estimate of 1.25%. The risk loss in trading futures and options can be substantial. Past performance is not necessarily indicative of future results. A long […]

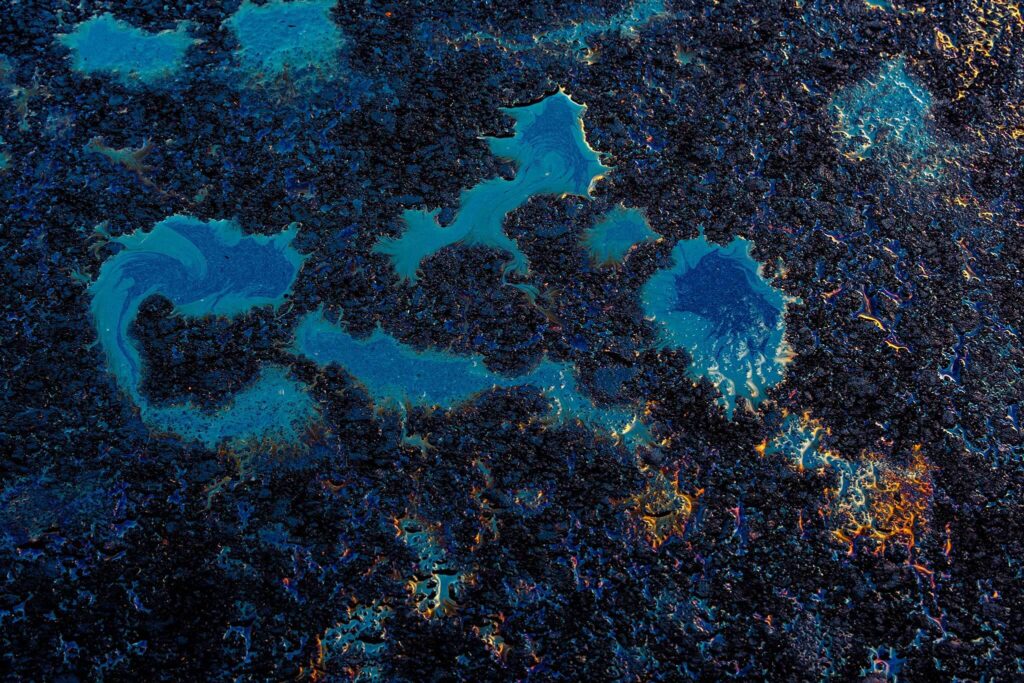

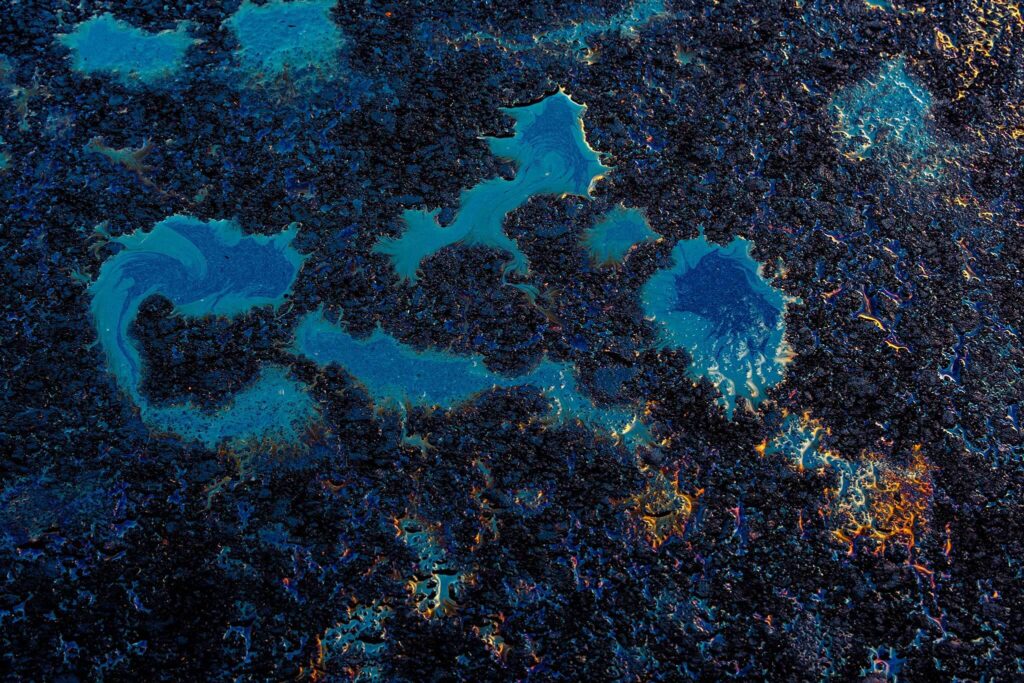

The Rush to Decarbonize

With COP26 underway, the discussion returns to how close each polluting nation can get to net-zero emissions (NZE) by 2050. This, the climate scientists suggest, is the only way to limit the pace of global warming to 1.5°C above pre-industrial levels this century. Not everyone is fully committed, but the general thrust is in this […]

Cayler Capital January 2022 Commentary

Commentary provided by Brent Belote of Cayler Capital We first turned bullish oil in April 2020, and I’m slowly starting to feel like it has run its course. We are still holding long positions, and prices will likely overshoot on the high side, but for the first time since the pandemic, we are starting to […]

AG Capital January 2022 Investor Update

Commentary by AG Capital Management Partners, LP Inflation It helps to go back to 10th-grade calculus class to understand inflation. Inflation is a rate of change (first derivative). For example, the latest headline number of 7% tells us that prices are rising on an annualized basis. What if inflation moves higher from here to 10% over […]

Is this the Season for Managed Futures?

“Winter is Coming” goes the famous line from Game of Thrones. In that context, it portended trouble ahead. Perhaps, it could also refer to the stock market to begin the year with the lowest January returns since 2008. A saying says that “As January goes, so goes the year.” The truth is that few are […]

January 2022 Market Letter

Commentary provided by Chad Burlet of Third Street AG Investments January was a month of extreme volatility for the agricultural markets. The two primary drivers of price were the weather in South America and the Russian military buildup along the Ukrainian border. Southern Brazil, Argentina, and Paraguay experienced several days of record heat on the heels of […]

GZC Strategic Commodities Fund December 2021 Report

Commentary by GZC Investment Management Sell-side analysts and consultants remain extremely constructive, upgrading their oil price targets significantly for mid-year, and investor positioning has resumed in oil futures and options. At the end of Q3, the portfolio was positioned for upside risk as we entered the winter months; however, following further lockdowns due to Omicron […]

The Fed Pickle

I often think of an offhanded comment from the Chicago Fed Chairman Charlie Evans at a networking event shortly after the financial crisis. He said policymakers didn’t know what would happen after their extraordinary measures following the financial crisis. His point that much of what they did had never been tried before was true. I […]

Numberline Capital Partners December Performance Report and Market Summary

Commentary by John Knott of Numberline Capital Partners. As we look back on the year, the program satisfied all the benchmarks we have set for ourselves. Although past performance is not an indication of what is to come, we exceeded our 15% performance target. In addition, we kept our max drawdown under 5%. This year the […]