Futures investors often wonder, “If the equity markets are going up, why aren’t we following that trend and making money?” The truth is that many markets can be trending at once or very few at all. Oftentimes, the best trade is in another market completely. One of the best trades recently is long cattle. Yet, nobody asks why they aren’t making money on cattle. Perhaps they should be. So, what is driving the price increase? We explore a few of the possibilities.

Seasonal Demand Drivers

Nobody should be surprised that summer grilling season pushes demand for beef. Despite rising prices, steaks, ground beef, and hot dogs continue to experience huge popularity. The American Farm Bureau Federation assessed that the $6.67 per pound price for ground beef leading into the 4th of July holiday is the highest ever recorded. Despite this headwind, the USDA ranks beef as the second most popular meat in the United States, with 57 pounds consumed per person (chicken retains the number one spot). Southeast Asia and other markets continue to drive exports with $10.5 billion spent in 2024, the second-highest year in history. It is no surprise that robust demand would drive prices, so you would expect supply to increase as well. Sadly, growing a cow takes time, and we are running behind.

Supply-Side Constraints

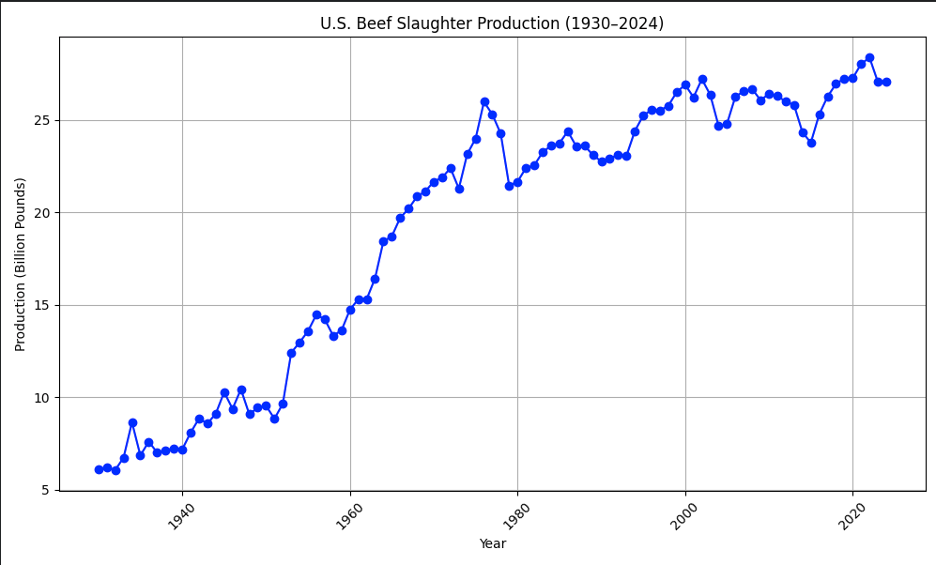

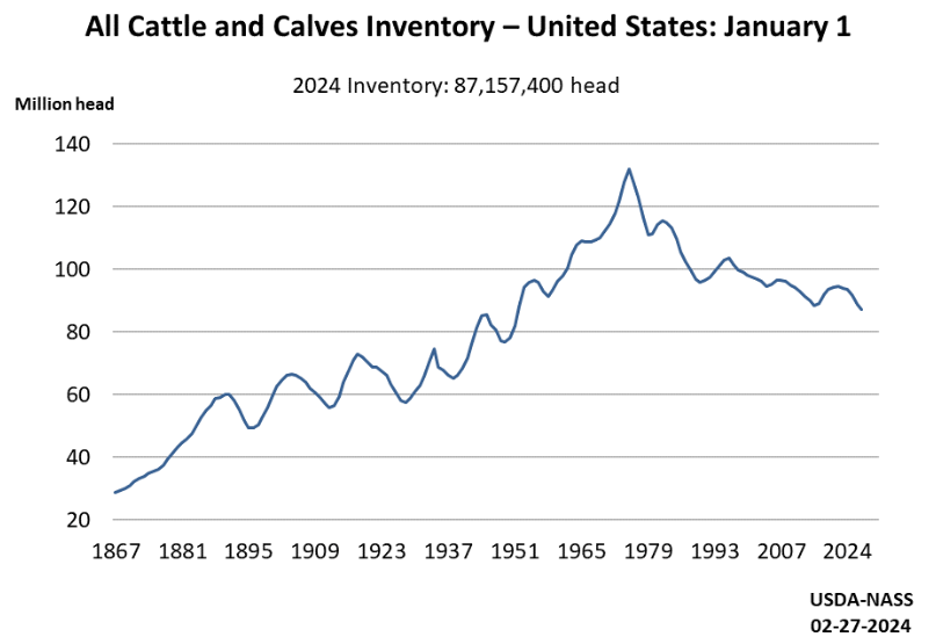

Consistent demand is great for livestock producers. So much so that supply is being pulled forward. With high prices, farmers stop building their herd and immediately send their calves to be processed as soon as possible. On top of this, droughts in meat-producing states negatively affected pastures, forcing the culling of herds over the past few years. The result is a smaller cattle inventory than at any time since 1951, at 86.7 million head. Despite growing the average heifer larger by 26 pounds, slaughter production is similar to 2020 levels.

We would expect imports to make up for these weather-related drops in supply, but a parasitic fly stopped all incoming cattle from Mexico in November 2024. The USDA continues to try to lift this ban, but persistent detection of the screwworm keeps providing evidence that it should remain in place. Most recently, they added a stoppage on July 10th, 2025. Trade rhetoric between the United States and its two neighbors adds further stress to this supply chain. Our primary partners for beef outside the US are Canada and Mexico. Tariffs on both countries put the rules in flux, making contracts and pricing difficult.

Forward-Looking Factors

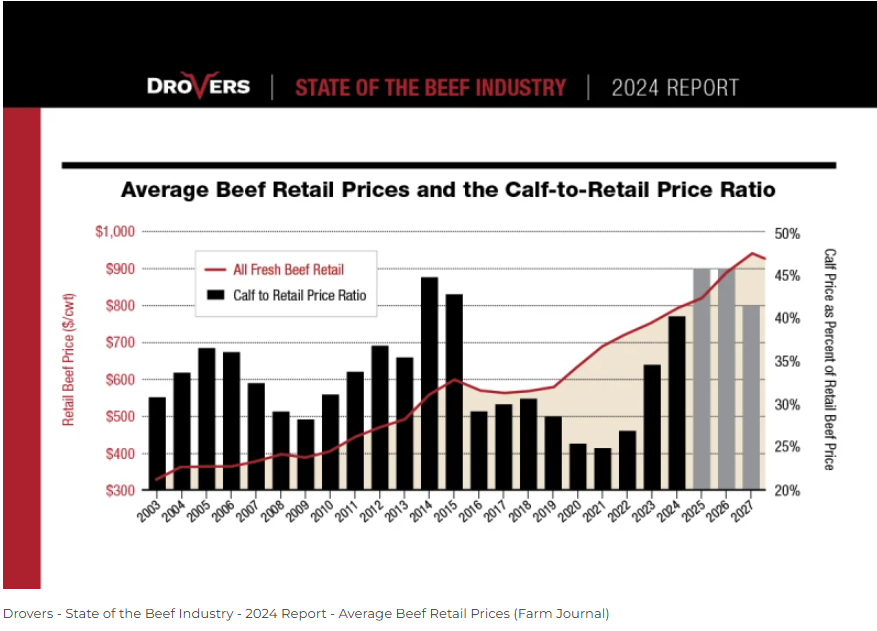

Expectations going forward do not provide confidence that prices will drop anytime soon. Rising costs for fertilizer, fuel, and labor mean that farmers will need solid margins to incentivize herd growth. This seems likely with supply dwindling and demand growing. However, it takes time to rebuild, and it is likely that we will see further pain at the store before we see relief, if that ever occurs. The chart below shows how this might play out.

Investment Implications

Leading into the current spike, low margins pushed farmers to manage their production wisely. Feedlots, slaughterhouses, transportation, and retail pricing consume much of the “extra” value in the supply chain. This will likely lead to cautious planning. Increasing consumption proves the end user’s ability and willingness to pay for their product, though, so their negotiating leverage will improve. Higher interest rates might drive older producers out and limit new entrants’ capacity to expand, putting an additional strain on supply. If rates improve and we see better weather, expectations will improve.

All of this creates the perfect storm for a solid trade. Driven by fundamentals and then pushed by algos, the cattle trade of 2025 is a winner thus far. It is likely we will see a lot of new trends before the year is over. Oftentimes, these occur in markets many would consider obscure. This shows the inherent value of futures investing as the non-correlation, unrelated to traditional markets, shines. This is easy to forget when the equity markets continue their ascent, but nothing goes up forever, and diversification often mitigates risks.

Illustration created by ChatGPT (OpenAI / DALL·E)