Interest concerning alternative risk premiums has surged over the last few years. With this increased interest there has been questions with how to best access these premiums under real market conditions and not just measure them through existing asset classes. Investors want to know how to operationalize the theory and research.

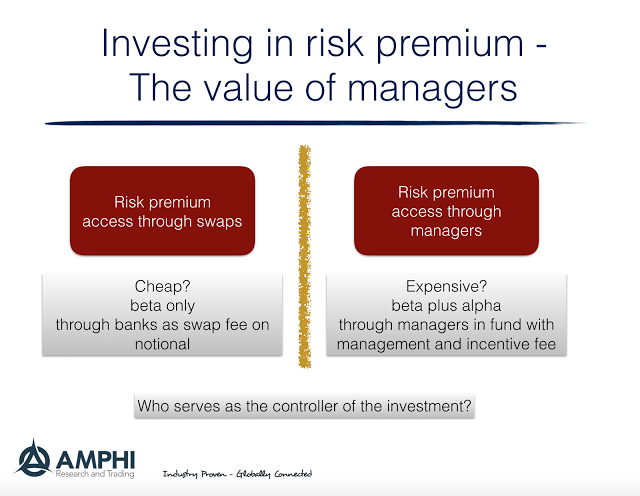

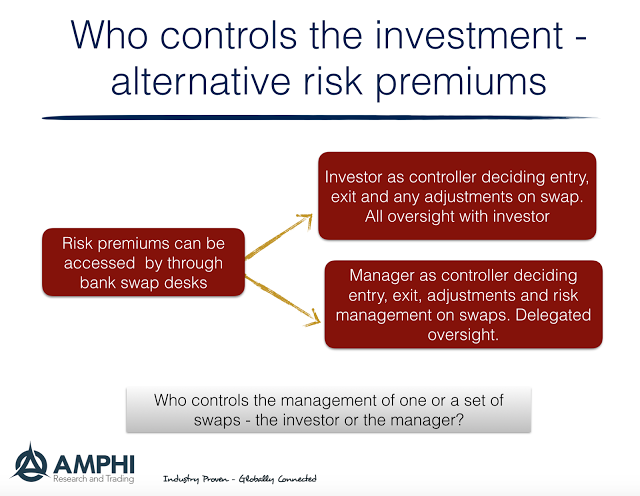

Risk premiums can be obtained directly through two alternatives: access through total return swaps from banks or access through systematic quant managers who construct risk premium strategies. The choice between swaps as pure beta products and risk premiums embedded in quant hedge funds can be broken into a number of value propositions. This decomposition can make it clearer for investors to determine which is the best method for access.

This discussion between a risk premium “beta” swap and the management of risk premium is a variation on the passive and active debate, or variation of the beta and alpha production debate. The swap is completely rules-based and is passive in the sense there is no intervention beyond the rules specified in the term sheet. The swap is also usually viewed as a pure beta expression of the risk premium. The quant manager delivers the risk premium through their model and rules which may include adjustments based on their specific skills as related to the strategy theme. Investors will get some form of the risk premium beta as well as the other activities of the manager.

Using total return swaps has the advantage that they will be the cheapest means of accessing risk premium betas. It is usually priced as just basis points on the notional value with a minimum of margin. What you get is a vanilla rules-based system to access the risk premium beta. An investor can buy a basket of different risk premiums with the exposure weights of their choosing.

The manager who runs an alternative risk premium fund will likely be more expensive than any basket of total return swaps, and the manager chooses the weights on the basket not the investor. The fund product means that the hedge manager controls the mix and sizing of premiums, the entry and exit of any swaps or constructed trades, and the generation of any alpha. The extra expense is associated with the delegated monitoring and management of the set of risk premiums associated with the fund.

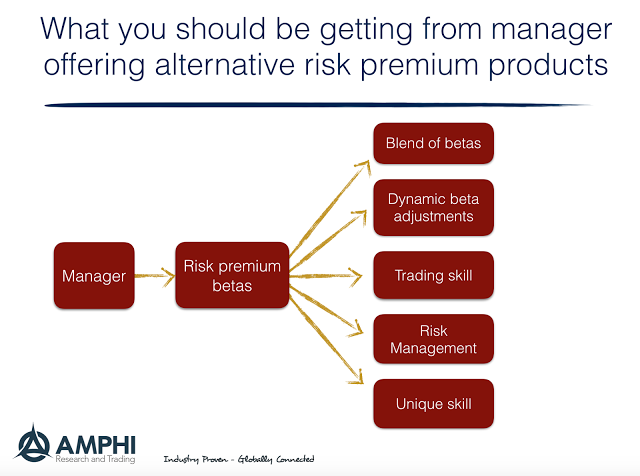

A quant manager provides a number of services through their management of a bundle of alternative risk premium. The investor has to determine the value of the set of manager services and whether the extra cost is worth the benefit of having someone manage the bundle.

The services provided by the manager include:

1. The blend of betas – what are the risk premiums that the manager finds that test well? What is the size of exposures to each of these risk premiums?

2. The adjustment of the betas – How or when should these risk premium betas be adjusted? This could be, at one extreme, just a form of rebalancing versus adjustments based on a dynamic set of factors. For example, carry could be increased or decreased based on whether the market is in a risk-on or risk-off environment.

3. The manager’s trading skill – Once an adjustment decision is made, there is still an issue of trading in or out of the premium. The risk premium could be in the form of a swap or it could be constructed in the futures and options markets where the parts have to be disassembled.

4. The manager’s risk management process – Along with rebalancing and dynamic adjustment, the risk premium portfolio has to be monitored and possibly adjusted based on the risks faced. This risk management could be through volatility adjustments, sizing, or stop-loss.

5. The manager skill – All risk premiums are not constructed the same. Someone may want carry or momentum premiums, but there are literally hundreds of ways to access these premiums based on the markets to be traded, sizing, and environmental triggers. The difference between the investment approach used by the manager and some generic swap version is the manager’s alpha.

The investor has a choice of buying the risk premiums in some generic form, or he can find a manager who can mix the ingredients. It is the difference between cooking your meal at home of paying for a chef to prepare a meal for you. Paying extra for the chef is a function of what the chef can do to better bundle the ingredients. As more investors show interest in alternative risk premium and as banks and managers develop more alternative risk premium products, the decomposition of alpha and beta becomes more important.