Most top-down and global macro managers follow all the macro data announced daily. They compare data across time and countries to understand relative economic performance, but when they go back to basics to understand how data are constructed, they usually feel uneasy. How much noise is in this data?

The construction of economic data is an ugly process. If you don’t believe me, read any report on how data is collected. See Diane Coyle’s GDP as a short read or a recent podcast. This problem becomes especially acute when economists are trying to measure potential GDP and GDP gaps. For that matter, it can be a problem for any cross-country comparisons.

There are delays with data. There are errors with the collection of data. There are data revisions. There are simplifications and seasonal adjustments of data. With surveys, there are limited sample sizes. Yet, traders will often react to any small surprise in the numbers. Traders will react to the actual number. They will respond to the surprise as measured by the difference between actual and expected. They will respond to revisions. It is a challenging game because data from one series today may contradict data from a different series tomorrow.

There is an alternative to using noisy fundamental signals: use price data as the primary or core driver for decision-making. Prices provide core signals of market views and expectations and are updated in real time.

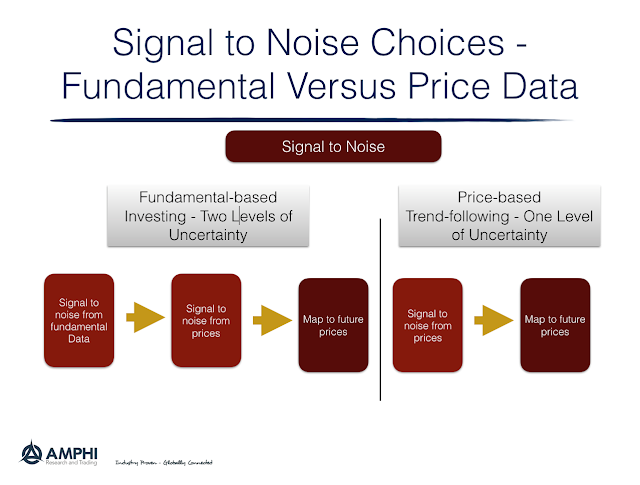

Price data versus fundamental data is a trade-off with signal-to-noise. In the case of macro data, a signal is surrounded by construction noise. This macro data noise can be smoothed through time series techniques or multi-signal aggregation. In the case of prices, a signal is surrounded by the noise of non-information-driven trading. The price noise can be smoothed through time series techniques.

However, there is a key difference. Any signal-to-noise analysis with macro data is a two-step process. There is the smoothing of signal to noise with the macro data, and then there is the signal to noise link between the macro data and prices. In the case of price trend data, there is only a one-step process of linking past price trends with future prices. There is a deeper hurdle to be overcome with macro data. It may be worth it, but it should always be compared against the simpler process of extracting signals from prices.

Neither may be perfect, but prices and their relationship across markets can be viewed as primal.