“When low-income countries get into debt distress, it’s associated with protracted recessions, high inflation, and fewer resources going to essential sectors like health, education, and social safety nets, with a disproportionate impact on the poor” – World Bank.

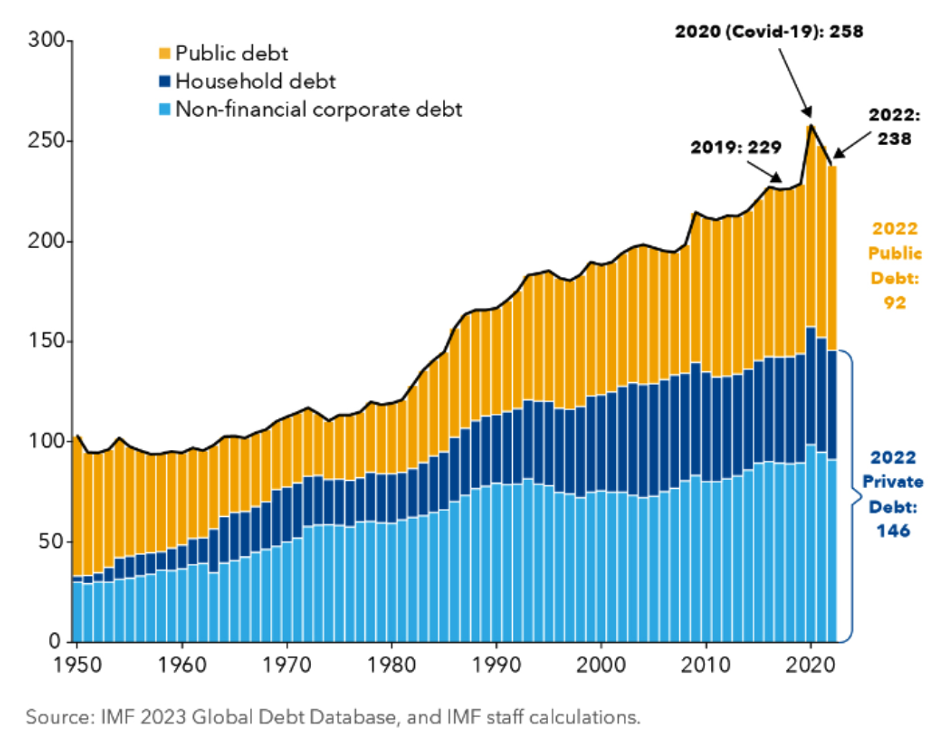

It is no secret that developed countries spent trillions to insulate themselves from the effects of the COVID-19 pandemic. While a noble cause, every decision comes with consequences, and they are coming. The United States did not feel too worried about the effects of borrowing money at 0% any more than European sovereign banks did at similar rates. This worked until government and central bank policies collided, giving us the highest inflation rate in four decades. The reaction to this problem will undoubtedly lead to the next problem unless rates drop soon. Consequently, the national debt is set to swell, necessitating further expansion of the bond market, and this raises the question: Where will the money come from?

The United States is the world’s largest economy and thus able to support the highest level of debt relative to GDP. Naturally, we are attempting to see how much red ink we can bear before a crisis occurs. So far, we are at $33 trillion. Debt servicing accounted for approximately 2% of national GDP in 2022, rising to 4% by 2030. Over the next decade, an estimated $10.6 trillion will be spent on interest costs, a significant chunk considering the current annual GDP of $27.5 trillion. This amounts to roughly a third of a year’s total production. Furthermore, these expenses will increase over time as debt issued at 1% will need to be refinanced at the prevailing rate of approximately 5% (as of today).

As interest rates climb, there is a shift in asset allocation from the stock market to fixed-income securities. This scenario mirrors the 1970s in the United States when bond yields exceeded 10%. Given that the long-term average return of the S&P 500 is roughly similar, it is logical for investors to transition from riskier assets to more stable ones, potentially leading to a bear market. However, this shift may present favorable opportunities for retirees focused on preserving income rather than seeking growth. The aging “Baby Boom” generation will substantially impact this, as they own nearly 50% of the country’s wealth. In the U.S., 36% of the population is 50 or older, and the last Baby Boomers will reach retirement age in 2029. A similar demographic trend can be observed in France. With declining birth rates, immigration may become increasingly crucial for market support and maintaining social safety nets in many developed countries.

With public and private debt increasing again after a short lull following the pandemic, there will be many fixed-income opportunities to soak up this capital. Much of this influx is likely to come from equity market investments. Given that the value of the entire stock market grew by 267% from the end of 2010 to the middle of 2023, primarily driven by the low-rate environment, we might anticipate downward pressure on share prices. However, investor behavior evolved during this period. Low interest rates prompted investors to seek profits beyond traditional fixed-income investments. Notably, the rise of index investing, characterized by low fees and broad diversification, has become prominent. This resulted in the concentration of the total market in the S&P 500 to surge from 68.9% to over 84.7%. So, what might change this behavior?

While the World Bank focuses on low-income countries going into debt distress, the same principles also apply to high-income nations. The key distinction lies in the broader consequences: a prolonged recession in the former primarily affects them, while it impacts the global community in the latter. Governments can get away with reckless spending for a while, but eventually, they must rein in spending as their funding needs crowd out the engine that pays for their largesse. Since there appears to be little appetite to slow spending, it is only a matter of time before they run out of other people’s money. In this case, the silver lining would be a renewed demand for fixed income, subsequently driving down interest rates as capital flows back into this asset class. Perhaps then, we can achieve a more stable equilibrium.

Related

- What is ‘global debt’ – and how high is it now?

- The future of wealth in the United States: Mapping trends in generational wealth

Photo by Susan Q Yin on Unsplash