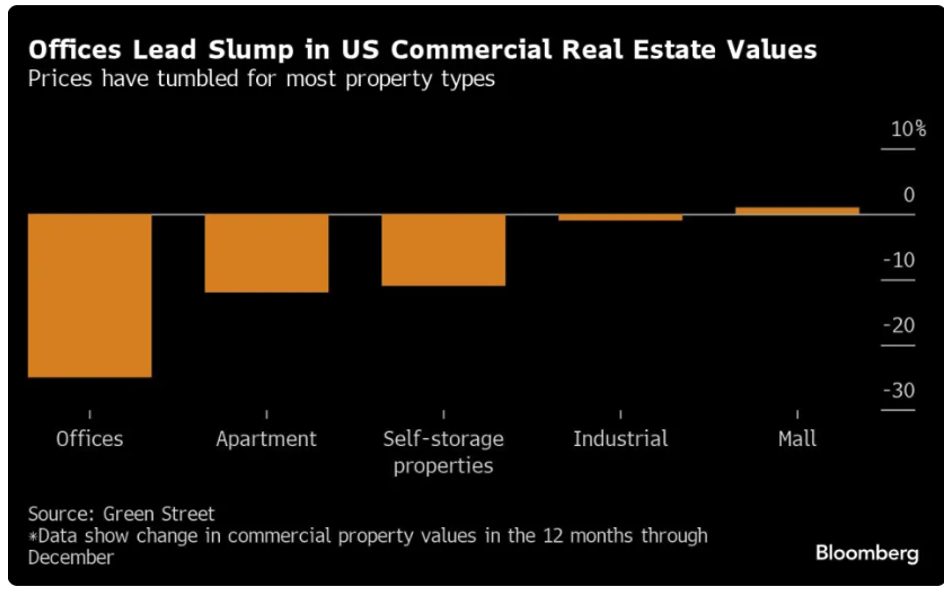

In a July 2023 blog post entitled Real Estate Trends in a Post-Pandemic World, we discussed the potential trajectory of real estate, particularly commercial real estate. As expected, the outlook for office space and other properties is tumbling. While that article mainly focused on supply and demand as work-from-home trends took over and interest rates crept up, it is believed that the future crash might be approaching even faster than expected, possibly due to several new factors that could spiral out of control quickly.

Escalating Vacancy Rates and Rent Reductions

Since that first article, vacancy rates have increased to 18.3% from 13% by the end of December. This compares to a rate of just 3.7% in the period preceding the pandemic. San Francisco asking rents fell 7.8% year over year. The list of companies with leases coming due in the next few years can be observed by building owners in this area, driving this reduction. In the best-case scenario, many companies will reduce their footprint and transition to a co-working space model.

Not surprisingly, banks push employees the most to return to the office five days a week. This action could be interpreted as leading by example so their borrowers follow suit. If ‘too many’ corporations decide against this, their massive real estate portfolios could face crumbling prospects.

Banking Sector Pressures and Market Fallout

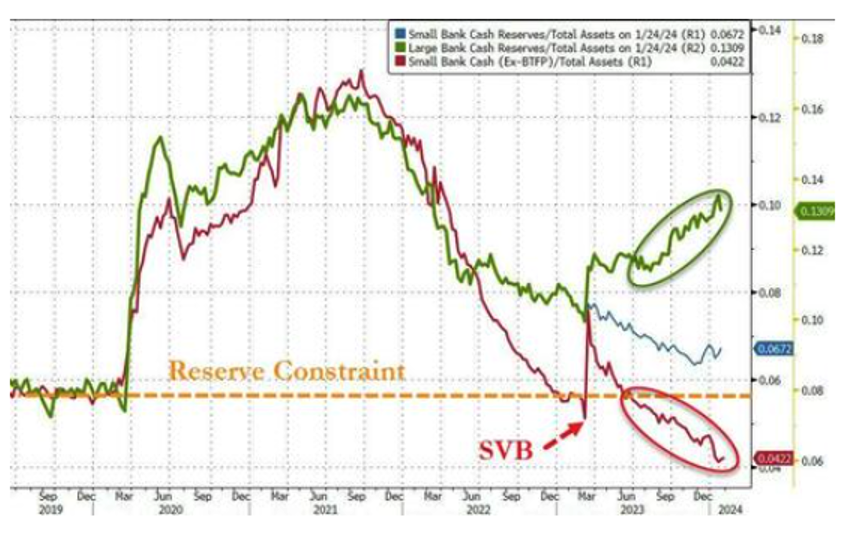

New York Community Bancorp (NYCB) attempted to preempt this risk by slashing its dividend this week to accumulate cash. However, panic ensued, resulting in a staggering 38% reduction in market capitalization in just one day and a further decline of 59.5% throughout five trading sessions. Moody’s is reassessing their bond status, which has already been downgraded to junk (Update: It has). This marks a significant reversal of fortune, considering NYCB’s role as one of the saviors of Signature Bank just last year when they acquired most of their assets. Despite reporting record profits in 2023, the recent events have dramatically altered their trajectory.

Valuation Challenges and Bank Vulnerabilities

A significant question lingers: What is an office building worth? The recent sale of the Aon Center in Los Angeles fetched 45% less than its 2014 price. Many of these loans are held by smaller banks, such as NYCB. While this concentration may prevent a 2008-style meltdown, it could catalyze further consolidation as ‘Too Big to Fail’ banks grow even more significantly by absorbing struggling community lenders. It might be prudent for them to await the settling of dust, despite holding substantial reserves, as a new threat emerges.

Urban Challenges Exacerbate Real Estate Decline

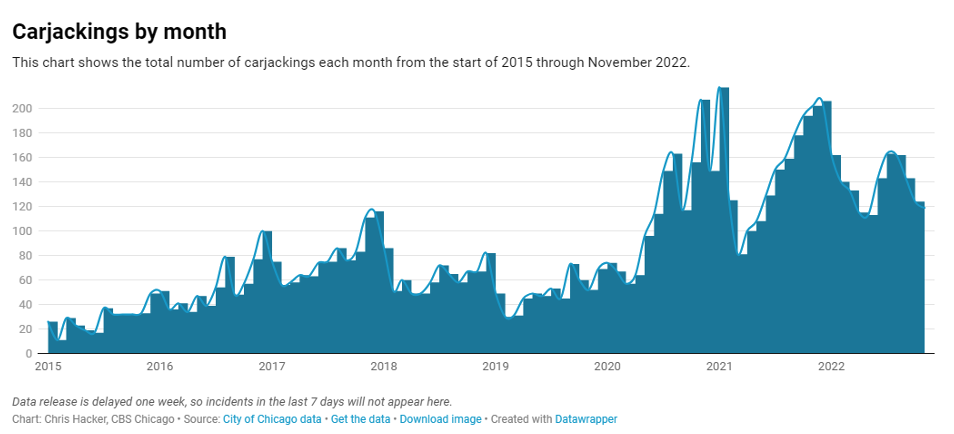

Struggling downtown areas in major cities have grappled with a surge in crime since 2020, coinciding with the George Floyd riots. Companies that typically require employees to work in the office are prioritizing safety amidst local reports of carjackings and theft dominating the news. Even local Chicago news has begun sharing monthly charts depicting these incidents. The timing couldn’t be more challenging for some of the largest cities, which are also contending with an influx of immigrants from impoverished South American countries. So-called “sanctuary cities” limit their cooperation with Federal authorities to enforce immigration law. States like Texas are seeing how committed they are to this stance by bussing thousands of men, women, and children to them from the border. It is not going over well.

By late fall, over 20,000 migrants arrived in Chicago, presenting housing and support needs beyond what the city had prepared for. New York estimates that accommodating 100,000 asylum seekers will cost $12 billion. Both cities intend to limit the duration of shelter stays to discourage new arrivals, yet the toll is mounting. Crime attributed to this group is also on the rise, exemplified by a recent daylight attack on a New York police officer. These challenges exacerbate real estate value declines as tourism wanes and quality of life diminishes for residents.

This strain extends to tax revenues, dwindling as spending needs escalate. Beyond property taxes, the money circulated by city workers is declining, impacting additional taxes. Transfer taxes from property sales are decreasing, and defaults burden banks with partially occupied buildings. This pressure may prompt cities to extract more funds from residents, further prompting migration to friendlier locales—a trend already underway.

It is not all bad news. Technology growth continues to push the need for commercial space for cell phone towers and servers. Multi-family housing is doing well in some areas due to high-interest rates and a tight housing market, and many companies are bringing supply chains closer to home. This “re-shoring” coincides with growth in the transportation sector. Getting goods delivered to a doorstep in less than a day or two means larger fulfillment centers near cities. Sadly, most of these goods are delivered to a person working from home in those cities.

Anticipated Reckoning and Future Prospects

Ultimately, we may see a reckoning that results in new owners of iconic properties. Many of these will be purchased at a discount, and lease rates will come down to a stabilizing level. Cities will need to incentivize spending among residents and visitors while enhancing crime prevention efforts to thrive. Several banks may fail, being absorbed by larger firms. Ideally, migrant populations will become productive contributors or return to their home countries. Higher taxes may do more harm than good, so everyone will need to do more with less. Chances are it won’t be fun. Reckonings seldom are.

Photo by Sean Pollock on Unsplash