If you spoke to a 25-year-old versus a 65-year-old, you might be shocked at the difference of opinion on where our country’s economic future is headed. While this disparity is common, the degree to which government policy is affecting each may be at its highest point ever. This is sending shockwaves through political circles, as many younger voters that skew towards Democrats might be considering their options. Student debt, housing costs, and high interest rates hit everyone differently. In an inflationary environment, the recent shift in these numbers is dramatic, and with these changes come both welcome and unwelcome side effects. Let’s look at how it impacts three different age groups.

25-year-olds

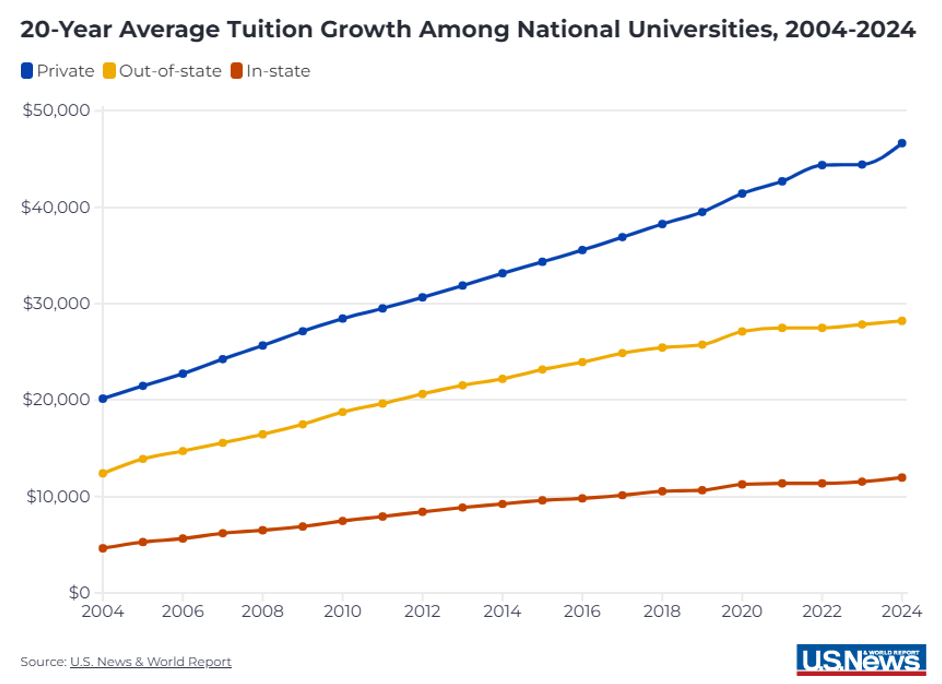

Excited to join “adult society,” recent graduates got hit with an unwelcome shock as they entered the workforce to rising interest rates, inflation of over 20% since 2020, and the beginning of student loan payments. With an average increase of over 50% for every type of university tuition in the past 20 years, these payments were already going to be tough. Now, the interest rates on that borrowing will reach 8% or more for many graduates. At the same time, the cost of home ownership (the monthly payment) doubled in the past four years as interest rates went from 3% or less to almost 7% today. The average home value jumped 40% then, further exacerbating the problem. The future appears bleak for those contemplating marriage, starting a family, or simply enjoying the fruits of their labor for the first time. It is perhaps unsurprising that the birth rates in the United States plummeted by another 3% in 2023, reaching a record low. Without significant changes to affordability measures, this generation finds itself navigating a landscape with limited options.

45-year-olds

This group is doing much better than their younger cohort. Record low interest throughout the pandemic made refinancing mortgages a breeze, and many sit near a 3% mortgage rate. Given the current rates and the decline in the dollar’s purchasing power, they see little reason to relocate. Even those who would like to upgrade remain stuck as the new loan terms would be onerous compared to their current rate. As discussed in our article on real estate trends, this lack of turnover in the housing market further drives up prices.

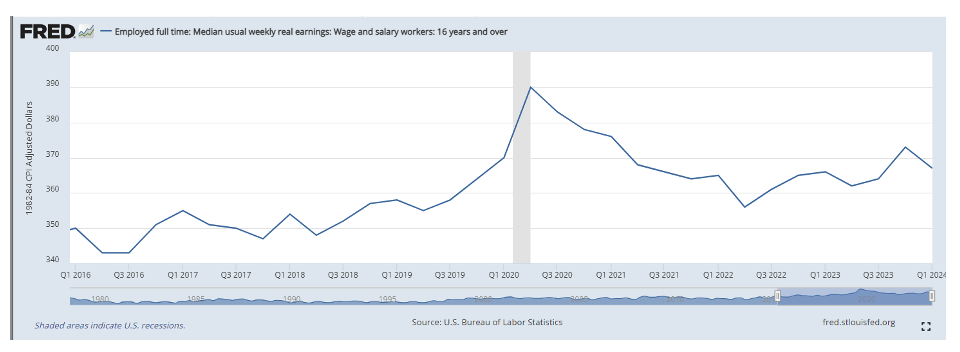

While the cost of raising their family is higher, the increased equity in their real estate and manageable shelter costs allow them some leeway to adjust. Moreover, investments throughout their career provide a tailwind to help them feel more secure. Despite this, the savings from the COVID era have been depleted, and delinquency rates are increasing. Credit card debt rose $143 billion in the fourth quarter of 2023 from the year before, indicating that consumer spending is not keeping up with rising costs. Real wages remain over 5% below their 2020 peak. Skyrocketing college costs loom closely on the horizon for many as their kids enter high school. Given these challenges, many hope to maintain their financial status until conditions improve.

65-year-olds

Several economists contend that higher bond rates provide a stimulative effect on the economy. This contradicts the idea that the Fed can slow inflation with higher rates, which will slow the economy down. Their thesis is that the massive increase in bond issuance due to government spending is now held by investors who previously received a pittance of return. This is particularly true for senior citizens, who were previously compelled to accept higher risks in the equity market or settle for minimal returns. Many individuals own their homes outright, possess growing assets, and live in households with fewer dependents. With major purchases largely behind them and their children having completed their education, borrowing rates hold little relevance. Additionally, the 3.2% increase in inflation-adjusted social security payments in 2024 has further bolstered their financial position. Most of this group never took out a student loan to begin with, as college was affordable throughout their era.

Political Implications

Given these factors, it is understandable that younger people may be reluctant to support Joe Biden in the 2024 election. While student loan forgiveness may appeal to 25-year-olds as a political strategy, it’s unlikely to address the underlying issue of escalating college costs. Campus protests about a myriad of issues add fuel to this politically charged subject. The impact of this critical voting bloc might push the electorate to the right in the United States, resulting in the re-election of Donald Trump. Growing debt will continue to become a larger liability for the country, especially as rates continue at current levels. The risk of stagflation, where inflation remains high as the economy slows, is not easily solved with Federal Reserve policy. The coming years will be pivotal as intergenerational tensions threaten to deepen divisions within the country, with far-reaching policy implications for individuals of all ages.