Category: Alternative Investment Strategy

Commodity Investing – What is it all About?

What is commodity investing all about: 1. The curves and carry – backwardation/contango (inventory). Given the cash market for commodities is often not available for investing, the primary market for investors in commodities is the futures. Consequently, the shape and dynamics of the futures curve is a dominant factor for longer-term investing. Investors cannot think […]

The Real Bias – Stock Optimists versus Bond Pessimists

During a simple discussion on investing, the topic turned to biases. We have learned to talk about many biases from behavioral economics. We now have a catalog of preferences which makes them easier to mitigate. Still, there seems to be one bias that is very hard to address, and that is the overarching theme of […]

Populism and the Market: Assessing Risks for Investors

There has been tremendous talk concerning populism and politics, but for investors, the focus still must be on these movements’ economic and market impact. So discount the news headline and rhetoric and focus on the potential market impact, but a good definition of populism is necessary for building a framework to determine risks. Defining Populism […]

The Role of Factors in Finance: A Focus on Global Macro Investing

What has been at the vanguard of thinking in finance is the breakdown of returns into their constituent parts or risk factors. Finance has moved well beyond market beta. The first breakdown for a portfolio is not returns by asset class but returns by risk factors. Some have criticized the current situation as a factor […]

Using Economic Growth as a Predictor for Managed Futures Returns

Another simple test to determine whether managed futures returns will do better than average is by looking at economic growth. We know that bonds and other defensive assets like managed futures will do better in “bad times,” such as a recession, but there are not many recessions. The cost of being defensive can be very […]

Managed Futures vs. Tight Financial Conditions: Who Wins in the Battle of Investment Strategies?

Financial conditions can inform us about periods when thises and market dislocations will occur. The graph above shows the time series for the Chicago Fed adjusted financial conditions index. The index measures liquidity, risk, leverage in money, debt, and equity markets, and traditional and shadowing banking measures. If the index is positive (negative), financial conditions […]

The Impact of Innovation on Commodity Price Forecasting

Forecasting is difficult for any financial asset but can be especially difficult for commodities. The peculiarities of futures, the potential for large supply shocks, and the higher volatility are associated with the varied interaction of hedgers and speculators. Still, there is also something that makes medium-term forecasts especially difficult – innovation. Innovation and technical change […]

It Is All About the Volatility Management

For many investment strategies, the difference between a good and a bad manager is based on their ability to manage risk. It is as much about how volatility is handled as return generation. A good strategy that does not manage risk well will never be successful. A key conclusion from a recent paper that focuses […]

Speculation – It is Not Supposed to be Glamorous

The history of the bull speculation in cotton of 1903 will never be fully written because, though the men who influenced it are very interesting, their operations are interwoven with bloodless statistics and tiresome technicalities. -Edwin Lefevre Saturday Evening Post, August 29, 1903 from The Cotton Kings: Capitalism and Corruption in Turn-of-the-century New York and New […]

The Art of Money Management: Balancing Skill and Authenticity

Money management has been compared to art. There is a technical skill component to generating returns but there is also an artistic component with how information is weaved together to produce a successful portfolio. Money management can be like art because it may have uniqueness that transcends rules. You can have all of the rules, read all of the books on how to do it, and still not get the results that are expected. Now, we believe that artistic uncertainty can be minimized through good checklists, but we accept that for many, money management as art is real.

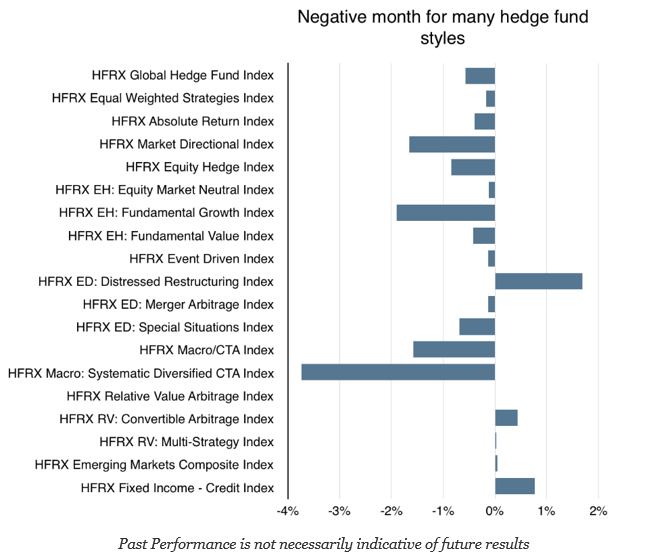

Hedge Funds

Hedge fund returns are a combination of alpha and beta risk exposure. The betas across different hedge fund styles are variable and dynamic. In general, beta will be below one, with most hedge funds showing market betas between .3 and .6. Some hedge fund styles, like managed futures, may be lower. Alpha can also be […]

Equity Hedge Funds Generate Strong Gains in September

DISCLAIMER: While an investment in managed futures can help enhance returns and reduce risk, it can also do the opposite and result in further losses in a portfolio. In addition, studies conducted on managed futures as a whole may not be indicative of the performance of any individual CTA. The results of studies conducted in the […]

Skew Risk, Volatility Risk, and Managed Futures

Some new research on risk parity makes provocative comments on the risk and potential value of managed futures in a portfolio. In one of our previous posts, we cited this recent work suggesting that accounting for skew can be helpful relative to a risk parity approach focused on volatility. See Messy markets, mixed distributions, and skew – […]