Category: Alternative Investment Strategy

Economic Data Sausage-Making And Why Prices Are Primal

Most top-down and global macro managers follow all of the macro data announced each day. They will compare data across time and countries to understand relative economic performance, but when they go back to basics to understand how data are constructed, they will usually get a very uneasy feeling. How much noise is in this data?

Understanding the Role of Inflation Beta in Commodity Investing

There is a correlation between commodity investing and inflation. Commodities do well late in the business cycle when bonds usually underperform, and inflation is heightened. Research work by PIMCO measures the inflation beta for some significant asset classes. Stocks have a negative inflation beta even though earnings should rise with inflation. Bonds as nominal assets […]

The Correlation within the Financial Cycle – Not Good for Those Looking for International Diversification

One of the core strategies for portfolio diversification is increasing exposure to international stocks and bonds. This risk reduction strategy is easy to achieve, yet the value of this asset class diversification has diminished over the last few years. The financial cycle has more commonality as measured through times series analysis, and it is harder […]

Focus on the Dislocations – These are the Places of Market Opportunity this Week

There are some recurring themes this week in our highlighted charts, debt and leverage will overhang any global economic discussion; however, we see some interesting dislocations that can offer global macro opportunities:

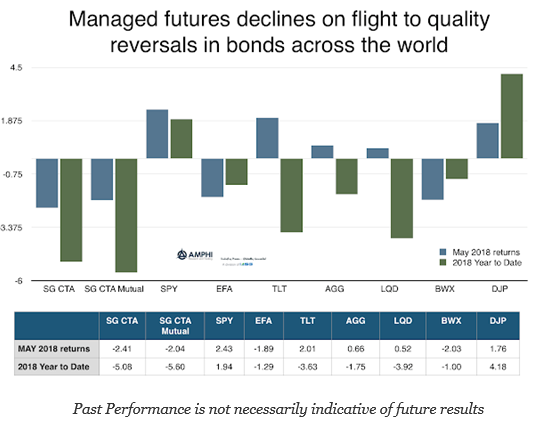

Managed Futures Hurt by Bond Reversals – Surprises Hurt Major Trend-Followers

Managed futures performance for May was driven by one sector, global bonds. The surprise events in Italian politics led to a flight to quality move into safe bonds around the world. This sharp reversal caught most short trend-follower flat-footed. The commitment of traders reports have shown a strong short tilt in managed money. The size of the move over less than 10 trading-days ensured stops would be hit and positions changed. The question was just how much pain managers took in this sector. Notably, the markets sold-off on the good economic employments numbers to further hurt managers who switched to longs earlier in the week. A similar set of events followed the rates markets. Expectations for fewer Fed hikes given the political turmoil only reversed again after the US employment number.

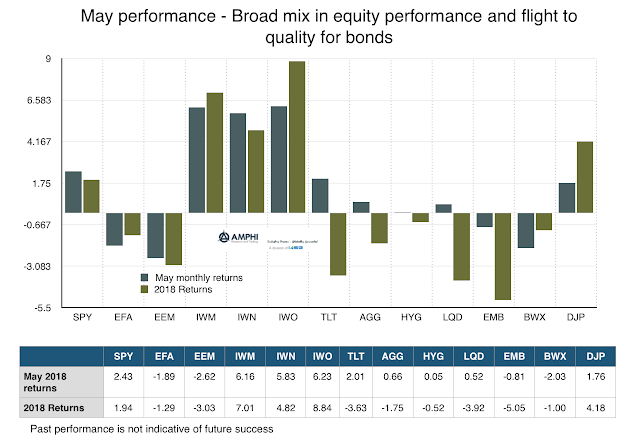

Monthly Performance Does Not Follow an Expected Return Script – Improvisation in Value, Growth, and Small Cap Indices

One way to measure market uncertainty is to run a simple thought experiment. A well-behaved market should match performance with events in a well-defined manner. An uncertain complex market environment would behave in an ill-defined manner. Close your eyes and assume you have knowledge of the news highlights for the month of May. For example:

Political turmoil in Italy and the EU

Off-again/on-again North Korea talks

Good economic data albeit with lower momentum

EM problems in Turkey and Argentina

Trade war discussions

What Keeps Me Up at Night – “The Glaringly Evident that We Have Decided not to See”

“The hardest thing to explain is the glaringly evident which everybody has decided not to see.” Ayn Rand

You May Not Want to be Bound to an Algorithm – So Use a Dashboard as a Decision Support Tool

The benefits from using algorithms are well documented, yet they are still not used for many decision-making situations. The reasons for this lack of use are varied. It could be self-interest. It could be algorithms anxiety. It could be a lack of confidence in the modeling process. If there is a high level of uncertainty concerning the most effective model, there may be fear of being wrong.

Has Bitcoin Futures Saved Bitcoin Trading?

I have been studying the impact of futures on cash markets for decades, so I was very interested in the new short piece of research, “How Futures Trading Changed Bitcoin Prices” FRBSF Economic Letter 2018-12 May 7, 2018 that was published this week.

What We Look for with Trend-Following Beta – A Simple Set of Rules

Trend-following, as applied to managed futures, has been around for decades. Yet, there is no universal agreement on what is or should be a trend-following benchmark that can serve as the strategy beta or as a trend-following strategy factor. A trend-following benchmark can be used to measure the factor-beta of any manager. I can be […]

Managed Futures is not Trend-Following but it is Close – Broadening the Product Spectrum has Added Strategy Complexity

I would not be the first person to engage in the lazy thinking that managed futures are synonymous with trend-following. For many years, there was little wrong with using both terms to mean the same thing. The majority of managed futures are still trend-following.

Factor Risk Premium Differ Across Countries – Make Sure You are Factor Diversified Globally

Equity factor risk premium ranks change through time. The best performing factor premium today may not be the best premium tomorrow even if there are long-term gains across major factors. Most investors would agree with this statement; however, the dispersion of factor performance is more complex.

How Much Machine Learning is Your Quant Using? Not Clear, if you have not Defined Terms

The current buzzword used with quant investing is “machine learning.” Many quants may like to appear more intelligent by peppering their strategy discussions with comments like, “We use machine learning to create new and enhance our existing models.” Yet many investors don’t fully appreciate that machine learning is a term that refers to a broad […]