Category: Managed Futures Education

The Capital Appreciation Program: Spreads ‐ A Unique Approach to the Energy Sector

Corporate Summary Tyche Capital Advisors, LLC is a New York based registered commodity trading advisor currently offering trading programs to qualified investors. Through its trading programs, TCA will engage in speculative trading of futures and options contracts offered on the United States commodity exchanges and overseas futures exchanges. Tariq Zahir and Steve Marino are the […]

Peering Over the Fiscal Cliff

by Tyler Resch, Portfolio Manager, IASG As we go into the final few months of the year, we are more and more concerned with how we position ourselves going into 2013. A term I am hearing more often from concerned investors is the looming “fiscal cliff.” This “fiscal cliff” they are referring to is the […]

Managed Futures: Portfolio Diversification Opportunities

WHAT ARE MANAGED FUTURES? The term managed futures describes a diverse subset of active hedge fund strategies that trade liquid, transparent, centrally-cleared exchange-traded products, and deep interbank foreign exchange markets. Managers in this sector are called commodity trading advisors (CTAs) and their strategies are largely focused on financial futures markets with additional allocations to energy, […]

10 Reasons to Consider Adding Managed Futures to Your Portfolio

1. Diversify beyond the traditional asset class Managed Futures are an alternative asset class that has achieved strong performance in both up and down markets, exhibiting low correlation to traditional asset classes, such as stocks, bonds, cash, and real estate. 2. Reduce overall portfolio volatility In general, as one asset class goes up, others go […]

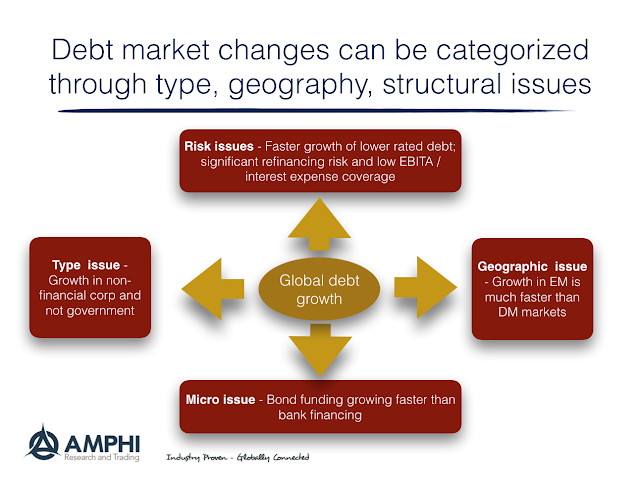

Debt – “If Something Cannot Go on Forever, It Will Stop” – The Problem Is Not If But, Figuring Out When

The McKinsey Global Institute published a new report, Rising Corporate Debt: Peril or Promise?, that is good reading for anyone focused on global debt issues. The charts and tables provide a wealth of data.

Definitions and Formulas

Arbitrage: Several sub-strategies fall under arbitrage. The most prevalent in the managed futures industry is statistical arbitrage. A simple example is simultaneously buying gold on one exchange (for a lower price) and selling gold on another exchange (for a higher price). This strategy looks to profit from the price difference. Average Commission: This represents the […]

Risk Parity and Volatility Targeting as a Danger – Let’s Get Real with Some Numbers

There is growing talk that volatility targeting and risk parity are the dangerous new “portfolio insurance” strategy of the decade. In the post-’87 crash period, the view was that portfolio insurance sowed the seeds of market destruction by creating a market decline feedback loop. As an option replication strategy, portfolio insurance automatically increases risk exposure […]

Scenario Analysis – Because There is More Than One Path to the Future

Investors do not know the impact of different alternatives in history. In fact, history is subject to discovery and this process of historical discovery is subject to biases as we try to sift through facts.

CTAs Set to Thrive at End of QE Era

In the midst of any foggy economic phenomenon, it’s difficult for an industry to really assess how it’s being affected. But with time comes clarity, and it’s now possible to look back on the past eight years of Fed policy and draw broad conclusions about how Quantitative Easing actions created headwinds for investors in the managed futures space. Crucially, these conclusions give us a reason to feel optimistic looking toward 2017 and the return to a world of abundant, varied trading opportunities.

The Failures of Central Banking

We have been meaning to write an in depth report on central bank policies for some time and the market responses to recent BoJ policy decisions as well as the Fed meeting and press conference this week have nudged us to make a start. Below are some initial thoughts on how good central banks are in their forecasts and where they may take us in the future. We don’t mean this to be a rant, but it’s hard to discuss central banking politely when they have been so ineffective, when they refuse to accept they have been incorrect and they refuse to fully acknowledge the full unintended consequences of their hugely experimental policies.

Another European Summer of Discontent

The most obvious and immediate European problem is the UK’s Brexit vote on 23rd June, and momentum has clearly swung away from the remain camp in the last two weeks. What was seen as only a minor risk for financial markets has quickly become a huge potential risk and prices have begun to adjust. In our opinion, this is not just an issue of migration but a problem of the average man on the street simply does not feel that their lives have improved materially since the Global Financial Crisis. There are a huge number of voters who feel completely disaffected and simply want change. This is not an issue unique to the UK. Huge numbers across Europe and the US are in the same boat and the risk of a series of anti-establishment votes in the next year or so is growing.

Life Just Became a Lot More Difficult for the Data Dependent Fed

After a truly disappointing US employment report, the market has priced out any rate hike in coming months, with only slightly more than a 50% probability of one rate rise by year end. In our opinion, Janet Yellen has always been a lot more dovish than a number of her colleagues and will not want to raise rates now. So, either the Fed ignores the poor US employment report (and the continuing weakness in the manufacturing sector and corporate profitability) and raise rates anyway, thereby risking upsetting the financial markets. Or, they shift back to a more dovish narrative, risking their credibility.

When Interest Rates Rise From Zero

The general rule of thumb in equity investing is that you do not Fight the Fed, and there is a lot to be said for that thesis. Naturally, one has to respect the idea that higher rates provide more competition for equities in the traditional equity/bond portfolio, and vice versa when rates are low. I have actually spent, who knows how many, hours trying to model equities vs interest rates and I learned several lessons in the process. Primarily that rates high and rising are indeed not conducive to higher equity prices. However, rates low and rising are not as reliably equity unfriendly. And one can make a case that rates Low and rising are initially actually very good for equities. My studies suggested a high correlation between equities and rates when rates were high, not as much when rates were low.