Category: Uncategorized

BIS Checklist For Financial Downturn – The Four Things That You Need To Watch

Reading the Bank of International Settlements (BIS) annual reports and the speeches of Jaime Caruana, the BIS General Manager, who finished his term at the end of last year, I formed a simple checklist of the recurring themes he has focused on in his work. For the last few years, he has emphasized four factors which he closely watches to determine whether there will be a financial downturn:

Should Money Managers Think That They Are “Renting Capital”?

There has been a bubbling up of new ideas on fees for money managers. These discussions are focusing on the conceptual framework for fees in order to change the thinking of both managers and investors. A battle to just lower fees between large investors and managers is a lose-lose situation. Managers who do their job well are frustrated with these discussions and investors feel they are disadvantaged when managers underpeform. See the latest piece from my friend Angelo Calvello, Your Fees Are Bull%$&. The capital rental concept should be explored further.

Carry Alternative Risk Premiums Tied To Macro Market Relationships

The returns of alternative risk premium strategies and products developed by banks and investment managers will have close links with the underlying macro relationships that are modeled. In the case of credit carry risk premiums, investors will gain from the difference between high yield and investment grade spreads. In the case of rate carry risk premiums, returns will be tied to the term premium in the yield curve.

Worth Thinking About For The Week – Volatility, Uncertainty, And Contagion

Volatility has fallen since the February vol-shock, but the vol-of-vol shock paints a deeper picture of the calm that has overtaken the equity markets. This same behavior is seen in other asset classes. Given the combination of geopolitical risks, economic uncertainty, and policy changes, should we expect this level of calm? It seems unlikely.

Alternative Risk Premium Versus Bonds – A Choice Of Factor Risks And Diversification

Investors want diversification from their equity exposure. This desire for diversification increases with uncertainty and with expectations of an equity decline. The big question is how or where are you going to get this diversification. The diversification winner for the post Financial Crisis period has been simple, US bonds. Bonds have been an asset that generated a good rate of return with lower volatility and a negative correlation with equities. You could not ask for a better diversifier. Unfortunately, the investment environment is changing and the benefits from bonds may no longer be available, so there is an increased desire to find new diversifiers.

Charts That Give Me Fear and Calm This Week

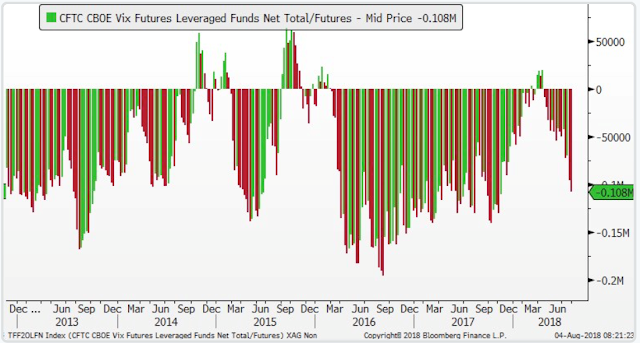

What did we learn from the February volatility shock? Volatility has trended lower and the same trades are being put into play; short volatility. Looks like the market has a short memory.

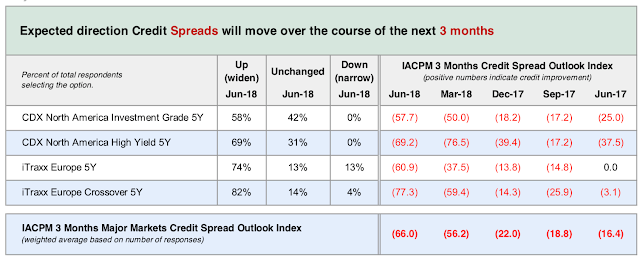

What A Difference A Year Makes – Credit Spread Sentiment Is Moving Negative

The survey from the International Association of Credit Portfolio Managers shows a significant change in the sentiment of credit managers on the direction of credit spreads. The diffusion index which ranges between 100 and -100 shows that the increase in negative sentiment has moved significantly downward. This decline is occurring even with corporate and high yield indices showing some tightening this last month. The survey was conducted in June, but the tilt is strong. This bias should be included in any portfolio adjustments.

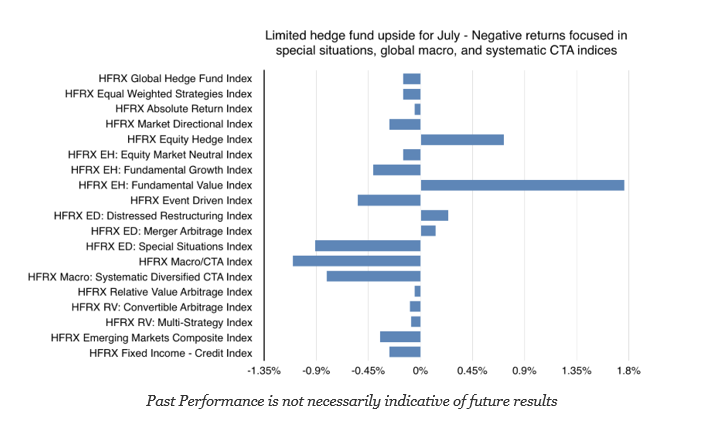

Hedge Fund Performance Mixed for July

Hedge fund returns for July were generally negative with the only exceptions being equity hedge and fundamental value strategy indices. The class of uncorrelated hedge funds styles, event driven and special situations, under performed. Defensive styles like systematic CTA and global macro also posted negative returns.

Switch To Risk-On But Dispersion In Return Shows Mixed Opportunities

All equity style sectors generated gains for July. The EM index ETF is the only major style down for the year. Global markets outperformed more localized US markets as measured by mid and small cap indices. Growth has been the best style index this year with returns exceeding 11 percent. While performing well this month, global equities have still lagged for the year based on growth and earnings differentials versus the US. Nevertheless, there are some concerns about short-term trends in smaller cap indices as well as growth and value indices.

The Overton Window and Finance – Thinking through the Process from Extreme Views to Acceptance

The Overton Window is called the window of discourse for any range of ideas. It has mostly been used to describe differences in political discussions. Extreme views will be unacceptable, but as they are either adjusted or gain traction, there is a window of acceptance or common ground between extremes. The viability of any idea is determined by whether it falls into the window between extremes. Any idea is constrained if it falls out side the window.

Spend Your Time On “What Is”, Not “What If”

Spend your time on “what is”, not “what if”. I picked up the phrase from The 10 Pillars of Wealth by Alex Becker. It seems apt given many recent discussions on the global economic environment. I am a strong believer in scenario analysis and have talked about scenarios as good tools even for trend-followers to assess potential risks, yet there is a hidden or implicit assumption that is more important for any financial discussion – what is the current environment.

Keynes on Money – Do Not Hold Any as a Store of Value

“…for it is a recognized characteristics of money as a store of wealth that it is barren; whereas practically every other form of storing wealth yields some interest or profit. Why should anyone outside a lunatic asylum wish to use money as a store of wealth.

Because, partly on reasonable and partly on instinctive grounds, our desire to hold money as a store of wealth is a barometer of the degree of our distrust of our own calculation and conventions concerning the future.”

-Keynes

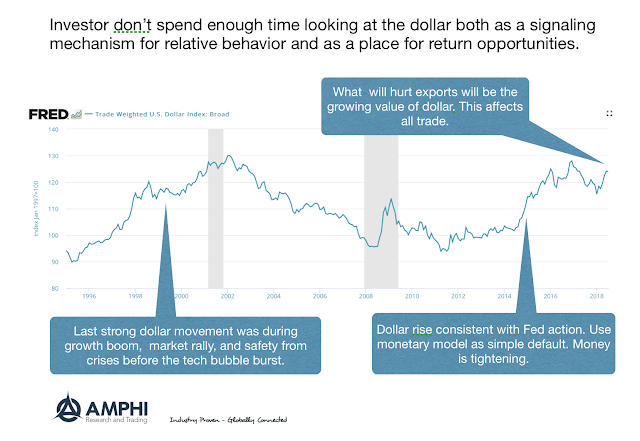

The Dollar is Sending Signals if You Care to Listen

I am concerned about tariffs. They are strong effects on importers and exporters in industries affected by tariffs and we don’t really know how tariffs will impact the supply chain and logistics for many companies. Nevertheless, the strong dollar will have a bigger impact on US exporters across the board.