By Kathryn M. Kaminski, Ph.D. Senior Investment Analyst,

RPM Risk & Portfolio Management

Disclaimer

While an investment in managed futures can help enhance returns and reduce risk, it can also do just the opposite and, in fact, result in further losses in a portfolio. In addition, studies conducted on managed futures as a whole may not be indicative of the performance of any individual CTA. The results of studies conducted in the past may not be indicative of current time periods. Managed futures indices such as the Barclay CTA Index do not represent the entire universe of all CTAs. Individuals cannot invest in the index itself. Actual rates of return may be significantly different and more volatile than those of the index.

Introduction

Most investment strategies are susceptible to suffering devastating losses during equity market crises. Given this, for almost any investor, the key to finding true diversification is in finding an investment that can deliver performance during these turbulent periods. The recent losses of the credit crisis have also reinforced to investors the importance of understanding why a particular investment strategy makes sense. For any new or current investor in Managed Futures, it is well known that these strategies tend to perform well when equity markets take losses, making them an excellent candidate for diversifying a portfolio. By taking a closer look into what happens during equity market crisis events (often called tail risk events), this investment primer will take a new approach to explaining Managed Futures and explain why they can deliver “crisis alpha” opportunities for their investors. Crisis alpha opportunities are profits gained by exploiting the persistent trends that occur across markets during times of crisis. By understanding why Managed Futures can deliver crisis alpha, the commonly cited benefits and characteristics that describe the strategy can be explained in simpler terms helping investors to more effectively use the investment strategy as part of a larger investment portfolio.

What are Managed Futures

Managed Futures, commonly associated with Commodity Trading Advisors (CTAs), is a subclass of alternative investment strategies which take positions and trade primarily in futures markets. Using futures contracts and sometimes options on futures contracts, they follow directional strategies in a wide range of asset classes, including fixed income, currencies, equity indices, soft commodities, energy, and metals. Although there are many types of Managed Futures strategies, the most common type is systematic trend following. Systematic trend following strategies employ technical methods to identify and profit from price trends in financial markets. This approach can vary in discretion in the trading decisions, time horizon, and risk management approaches.

Managed Futures investment in futures markets via professional money managers (CTAs)

| Directional | Systematically exploit directional moves in futures markets prices — upwards or downwards. |

| Globally diversified | Trade both long and short contracts in FX, interest rates, stock indices, energy, metals, and soft commodities in regulated and interbank markets worldwide |

| Regulated | Typically authorized and regulated by financial supervisory authorities such as the Commodity Futures Trading Commission (CFTC) in the U.S. |

What Characteristics of Futures Markets Differentiate Them from Traditional Markets

Futures contracts are standardized, transferable exchange-traded contracts that allow an investor to take a directional (long or short) position in a wide range of underlying assets, including currencies, fixed income, equity indices, commodities, energy, etc. The current futures price is the price today for delivery of the underlying asset at a pre-specified date in the future. Although delivery is possible in most futures contracts, it is quite rare (only roughly 1 percent of the contracts are delivered). To take a position in a futures contract, all investors must post collateral for the positions in the form of margin and maintain their margin account with a clearinghouse broker. The clearinghouse works as the counterparty for all investors and, on a daily basis, marks all contracts to market, settling up the losses and gains between pools of investors using the collateral which each investor has in their margin account. Due to the daily marking-to-market, the margin required usually runs around 5 – 15 percent for both long and short positions, whereas collateral requirements for positions in traditional markets are significantly higher and asymmetrically higher for short positions (for example, Regulation T in the United States requires 150 percent margin for short equity positions as opposed to roughly 50 percent margin for long equity positions).

Since futures contracts depend on the underlying asset’s value at a future date in time, futures prices are highly correlated with their corresponding underlying assets. This correlation makes them excellent vehicles for taking directional positions in various asset classes and hedging. The clearinghouse mechanisms of futures markets, daily pooling and redistribution of funds, lower collateral constraints, and transparency and standardization of contracts create a market that is extremely liquid and relatively void of both the counterparty risk and asymmetries between long and short positions common in traditional markets.

When Should FuturesOnly Strategies Have a Competitive Edge?

In order for an investment strategy to be profitable, there must be an underlying fundamental reason for the existence of a profit opportunity that the strategy can exploit. Given that Managed Futures trade exclusively in the most liquid, efficient, and credit-protected markets, their profitability must rely on those characteristics to obtain a competitive edge. Managed Futures will not profit from credit exposures or illiquidity which are commonly cited risks and opportunities for most Hedge Fund strategies. In fact, since Managed Futures strategies rely on the most efficient type of trading vehicles, they must profit from persistent trends in markets which, given that markets are efficient, should not, under ordinary circumstances, exist. The next logical step is to examine unordinary circumstances where it may be feasible for market efficiency to break down and persistent trends to occur even in the most efficient markets. Given that the vast majority of investors are systematically long-biased to equity markets and that we may be susceptible to behavioral biases especially, or perhaps only, when we lose money, it is clear that equity market crisis is the market scenario where predictable behavior and, as a consequence, persistent trends will be the most likely. By examining what happens during an equity market crisis, Managed Futures, based purely on the design of the strategy, will enable it to deliver crisis alpha.

Characteristics of Futures Markets

| Transparent | Standardized contracts |

| Minimal counterparty/credit risk | Ease of access and use, low requirements for collateral, lack of asymmetry between long and short positions, standardization of contracts, reduced counterparty risk. |

| Highly liquid | Typically authorized and regulated by financial supervisory authorities such as the Commodity Futures Trading Commission (CFTC) in the U.S. |

What Happens during Equity Market Crisis?1

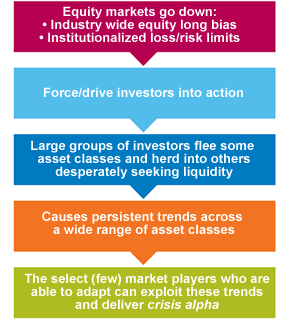

When equity markets go down, the vast majority of investors are long-biased to equity, including Hedge Funds, and they realize losses. Losses represent periods when investors are more likely to be governed by behavioral bias and emotional-based decision-making. When this is coupled with the widespread use of institutionalized drawdown, leverage, and risk limits which are all triggered by losses, increased volatility, and increased correlation, given an investment community that is fundamentally long-biased, equity losses will force or drive large groups of investors into action. When large groups of investors are forced into action, liquidity disappears, credit issues come to the forefront, fundamental valuation becomes less relevant, and persistent trends occur across all markets while investors fervently attempt to change their positions, desperately seeking liquidity.

Why Can Managed Futures Deliver Crisis Alpha?

Managed Futures trade in a wide range of asset classes, primarily in futures, they do not exhibit a long bias to equity, and they generally follow systematic trading strategies. Futures markets are extremely liquid and credit solvent and they remain more liquid and credit solvent than other markets during times of crisis. Although Managed Futures are also subject to institutionalized drawdown, risk, and loss limits, trading primarily in futures guarantees, they will be less affected by the reduced liquidity and credit solvency issues accompanying market crisis events. Given their lack of long bias to equities and systematic trading style, Managed Futures will also be less susceptible to the behavioral effects accompanying a market crisis. Putting all of this together, Managed Futures strategies are adaptable, liquid, systematic, and void of long equity bias, making them less susceptible to the trap which almost all investors fall into during an equity crisis. Following the onset of a market crisis, a Managed Futures strategy will be one of the select (few) strategies that can adapt to take advantage of the persistent trends across the wide range of asset classes they trade in delivering crisis alpha to their investors. It is important also to note that Managed Futures are not timing the onset of an equity markets crisis; they are profiting from a wide range of opportunities across asset classes following the onset of a market crisis (this includes currencies, bonds, short rates, soft commodities, energies, metals, and equity indices and it is explained further in the section Crisis Alpha and Portfolio Management). The characteristics of Managed Futures and their implications during equity market crises are summarized below.

| Characteristics of Managed Futures | Implications during Equity Market Crisis |

|---|---|

| Highly liquid, adaptable strategies based exclusively in futures with minimal credit exposure | Less susceptible to the illiquidity and credit traps that most investors experience during an equity market crisis |

| Dominated by systematic trading strategies No long equity bias | Less susceptible to behavioral biases and emotionally-based decision making triggered by experiencing losses |

| Active across a wide range of asset classes in futures | Poised to profit from trends across a wide range of asset classes |

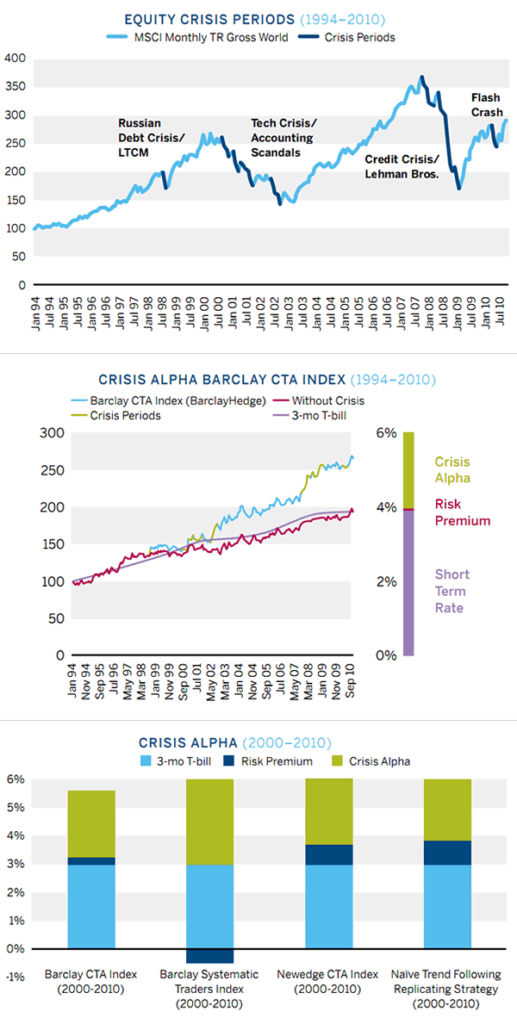

Decomposing Managed Futures Performance by Crisis Alpha

If Managed Futures strategies deliver crisis alpha, their performance can be divided into three parts: crisis alpha, a risk premium, and the risk-free rate. The following figure highlights the largest crisis periods in equity markets from 1994 to 2010 (see Equity Crisis Periods). By comparing the performance of a Managed Futures strategy with a Managed Futures strategy where the performance during crisis events is replaced by an investment in Treasury bills, Managed Futures performance can be divided into those three pieces. In the following figure (see Crisis Alpha Barclay CTA Index), the performance of the Barclay CTA Index is decomposed into crisis alpha, a risk premium, and the 3-month Treasury Bill return from 1994-2010. Over the entire sample period, equity crisis periods make up roughly 15% of the investment horizon, but they are responsible for roughly a third of Managed Futures returns. When the NewEdge CTA Index is added for comparison during the last ten years, equity crisis periods make up roughly 40 to 50% of the return of Managed Futures for the NewEdge CTA Index, Barclay CTA Indices, Barclay Systematic Traders Index, and a Naïve Trend Following Replication Strategy3 (see Crisis Alpha 2000-2010).

A closer look at the performance of commonly used Managed Futures indices shows that outside of these crisis periods, their performance is roughly the same as the rate of return on short-term debt (see Crisis Alpha 2000-2010). Given that capital in margin accounts can earn interest over time, the broader Managed Futures indices do not exhibit extra skill in delivering alpha above the risk-free rate outside crisis periods.

Crisis Alpha and Portfolio Management

By understanding why Managed Futures delivers crisis alpha, the commonly cited benefits and characteristics which describe the strategy can be explained in simple terms.

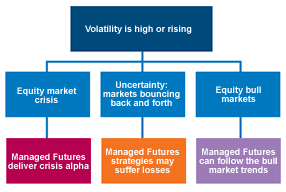

Similar to Long Volatility

It has been widely documented that volatility tends to be high during an equity market crisis. Thus, strategies like Managed Futures which deliver crisis alpha will be highly correlated with a long position in volatility. In addition, Managed Futures strategies are also dominated by systematic trend following. These strategies profit during larger moves in markets. Larger moves in markets cause volatility to be high. On the other hand, when volatility is high, and there is no market direction and, thus, no crisis alpha or trends, Managed Futures will not perform well, whereas classic long volatility strategies might. The following diagram demonstrates three scenarios for high or rising volatility and what can be expected for Managed Futures strategies.

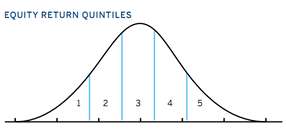

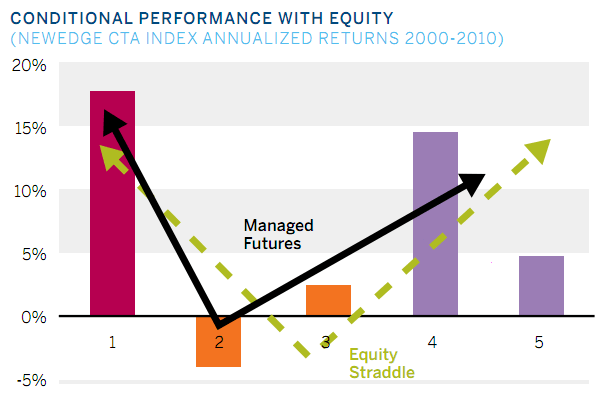

Conditional Correlation with Equity Markets Similar to an Equity Straddle

Since Managed Futures strategies tend to be trend following and deliver crisis alpha, they will make substantial returns when equity markets are down significantly. When equity markets trend strongly upwards, there will be upward trends in which Managed Futures strategies can also participate. This explains why Managed Futures can look similar to an equity straddle without the upfront costs required for investing in options. If the performance of Managed Futures is conditioned on the performance of equity returns, this conditional relationship gives payoffs that, on average, are similar, but not equal, to that of an equity straddle (see Conditional Performance with Equity below).

Lower than Average Sharpe ratios than Most Hedge Funds during Equity Bull Markets

During bull markets, many Hedge Fund strategies realize high Sharpe ratios. Research in Hedge Funds has pointed out that these strategies can contain hidden risks often related to liquidity and credit exposures. If Managed Futures deliver crisis alpha, their performance during bull markets may lag other Hedge Fund strategies, given that they only trade in markets void of these risks. This explains why using Sharpe ratios during bull markets will underestimate the longer-term value of Managed Futures compared to other alternative investment strategies.

Bulls vs. Bears: reasonable Performance during Bull Markets

When equity markets are not in crisis, markets are highly competitive and efficient, especially futures markets. Alpha opportunities outside crisis periods should be less frequent and more difficult to find. Since Managed Futures strategies should earn interest on their margin accounts, the short-term treasury rate is a good benchmark for their performance. Certain skilled managers may also be able to take advantage of short-term dislocations in futures markets, and trend followers may be able to ride the upward trends of strong bull markets. Given that almost all corporate hedging is done through futures markets, Managed Futures strategies may also gain a small premium for providing for hedging demand. Other sources of profits for Managed Futures strategies also include inflation premiums for holding long positions in commodities. A closer analysis of CTA indices and crisis alpha (see Crisis Alpha and CTA Indices) demonstrates that the indices do not perform above the treasury rate outside of crisis periods. This demonstrates how the average CTA strategy can deliver crisis alpha during equity crisis periods and performance similar to the Treasury bill rate outside of these periods.

Manager Skill in Managed Futures Can Come from Two Sources

Within the class of Managed Futures strategies, some strategies are more adaptable during crisis scenarios allowing them to provide more crisis alpha. The other source of manager skill is the ability to find opportunities outside of crisis events. As explained in the previous section, these opportunities should be harder to find, and strategies or managers which have a particular skill at finding these opportunities may be able to provide a risk premium above the short-term treasury rate.

Market Timing: Managed Futures Strategies do Not Predict or

Time Equity Crisis Events, They react Positively in response to Them.

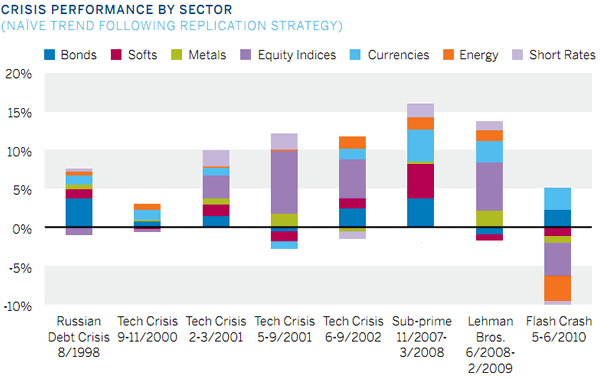

Predicting the exact onset of a market crisis can be next to impossible. Market timing ability for such rare events is highly unlikely. Yet, after seeing the exemplary performance of Managed Futures during the credit crisis, a popular misconception has been that Managed Futures strategies predicted and profited from equity market crisis using short positions in equity indices. During some of the past crisis, periods Managed Futures strategies did profit from short equity positions, but in general, gains in equity indices make up only a portion of the total crisis alpha. Managed Futures strategies react to market crises and position themselves across a wide spectrum of asset classes in highly liquid futures contracts to profit from trends that occur across all asset classes during these periods (see Crisis Performance by Sector). By decomposing crisis performance by sector, it becomes clear that Managed Futures is not market timing equity crisis events but responding positively to the widespread price dislocations and trading opportunities that follow them.4

An Excellent Tool for Hedging Tail risk and

Providing Portfolio diversification

If Managed Futures deliver crisis alpha, it will be an excellent vehicle for hedging and providing diversification during tail risk events, a time when almost all investments tend to suffer losses.

The Future of Managed Futures

Managed Futures strategies trade exclusively in highly liquid and efficient futures markets. The structure and style of these strategies make them more adaptable during situations of market crisis. The adaptability of these strategies allows them to profit from the persistent price trends which accompany these events delivering crisis alpha to their investors. The increased globalization, integration, and synchronization of financial markets, coupled with an industry-wide long bias to equity markets and further push for institutionalized regulation, should keep financial markets susceptible to further equity market crisis events. If this is the case, although it is uncertain when an equity market crisis will hit again, an understanding of why Managed Futures provides crisis alpha can help investors to understand better why the strategy can continue to deliver crisis alpha in future market crisis scenarios.

ABOUT THE AUTHOR

Kathryn M. Kaminski, Ph.d.

Kathryn M. Kaminski is a senior investment analyst at RPM Risk & Portfolio Management. RPM is an investment manager providing customized multi-manager solutions in Managed Futures strategies based on managed account platforms. RPM has been active in the Managed Futures space since 1993, serving clients primarily in Asia and Central Europe, and is located in Stockholm, Sweden. Kathryn earned her Ph.D. at the MIT Sloan School of Management. She was a member of the MIT Laboratory for Financial Engineering, where she researched financial heuristics in collaboration with Professor Andrew W. Lo. Her research interests are portfolio management, asset allocation, financial heuristics, behavioral finance, and alternative investments. She holds and has held academic lecturing positions in derivatives, hedge funds, and financial management at the MIT Sloan School of Management, the Stockholm School of Economics, and the Swedish Royal Institute of Technology (KTH).

Contact information: katy.kaminski@rpm.se, www.rpm.se

For additional related content by this author, visit cmegroup.com/kaminski

1 This explanation is derived using a theoretical framework proposed by Andrew Lo (2004, 2005, and 2006) entitled the Adaptive Markets Hypothesis (AMH). This framework explains how markets evolve and how market players succeed or fail based on the principles of evolutionary biology. For a more in-depth understanding of this theory, please consult Lo (2004, 2005, and 2006). Further analysis of Managed Futures in the context of the AMH is also presented in Kaminski and Lo (2011).

2 For a more detailed explanation of crisis alpha, see Kaminski, K., “Diversify Risk with Crisis Alpha,” Futures Magazine, February edition 2011

3 The Naïve Trend Following Replication Strategy is based on 76 different futures contract prices from 1994-2010. The strategy does not represent an investable strategy or a specific track record that has been invested in; it simply allows for a closer look into strategy decomposition of profit opportunities for systematic trend followers over time (see Crisis Alpha and Portfolio Management).

4 A naïve replicating strategy for systematic trend following can allow us to understand which trends could have been exploitable during crisis periods. From our experience at RPM, the sector performance of actual funds is similar to these replicating strategies, with the exception that equity profits tend to be slightly lower than those posted by replicating strategies, and profits in other sectors such as commodities and energy tend to be higher.

REFERENCES

- Bhansali, V., 2008. “Tail Risk Management,” Journal of Portfolio Management 34(4), 68-75.

- Chong, J., and Miffre, J., 2010. “Conditional correlation and volatility in commodity futures and traditional asset markets.” Journal of Alternative Investments 12, 61-75.

- Fung, W., and Hsieh, D., 2001. “The Risk in Hedge Fund Strategies: Theory and Evidence from Trend Followers,” The Review of Financial Studies 2, 313-341.

- Kaminski, K, “Diversifying Risk with Crisis Alpha,” Futures Magazine, February 2011.

- Kaminski, K., 2011, “Offensive or Defensive?: Crisis Alpha vs. Tail Risk Insurance,” working paper under review, RPM Risk & Portfolio Management.

- Kaminski, K., and Lo, A., 2011, “Managed Futures, Tail Events, and Adaptive Markets,” Working Paper.

- Lo, A., 2004. “The Adaptive Markets Hypothesis: Market Efficiency from an Evolutionary Perspective,” Journal of Portfolio Management 30(2004), 15–29.

- Lo, A., 2006, “Survival of the Richest,” Harvard Business Review, March 2006.

- Lo, A., 2005, “Reconciling Efficient Markets with Behavioral Finance: The Adaptive Markets Hypothesis,” Journal of Investment Consulting 7, 21–44.

- Miffre, J., and Rallis, G., 2007. “Momentum strategies in commodity futures markets.” Journal of Banking and Finance 31, 1863-188

Photo by Paxson Woelber on Unsplash