DISCLAIMER:

While an investment in managed futures can help enhance returns and reduce risk, it can also do just the opposite and in fact result in further losses in a portfolio. In addition, studies conducted of managed futures as a whole may not be indicative of the performance of any individual CTA. The results of studies conducted in the past may not be indicative of current time periods. Managed futures indices such as the Barclay CTA Index do not represent the entire universe of all CTAs. Individuals cannot invest in the index itself. Actual rates of return may be significantly different and more volatile than those of the index.

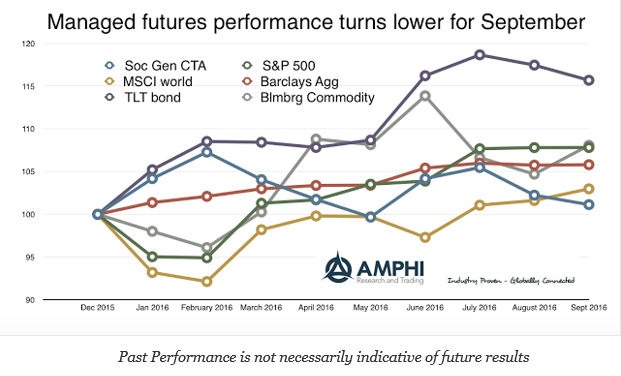

The performance of the SocGen Managed futures index fell short this month relative to major asset classes except for the long bond. Its year to date performance is now below all of the major asset classes. While many traditional long-only traders were able to take advantage of the risk-on environment, managed futures was not able to exploit opportunities surrounding the Fed announcement.

There has been more convergence of performance across major asset classes, but managed futures managers have generally not been able to find new opportunities after the strong first quarter trading.

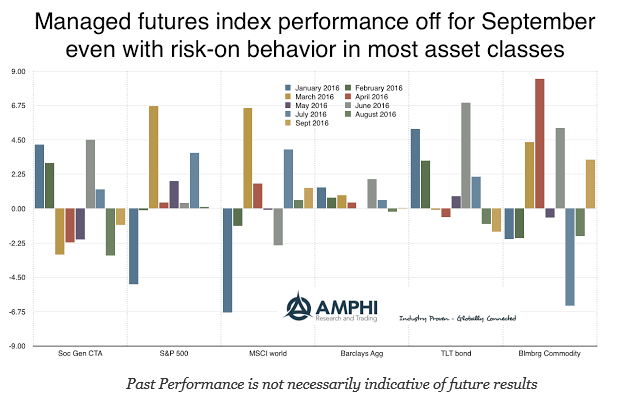

On a monthly basis, the managed futures index has been unable to string together long periods of successful performance. Market moving events have come quickly only to vanish in more market noise or reverse as new information entered the market.

In September, some loses were associated with the reversal around the Fed mid-September FOMC meeting announcements. The positive month for major asset classes does not reveal the intra-month moves that may have hurt active long/short managers. Although there is still another of quarter trading, managed futures have not seen the same strong monthly moves found in major asset classes. This should not be surprising given the diversification of most active managers, but managed futures traders seem as though they have not be able to concentrate bets to exploit the opportunities that have appeared in markets.