A key issue with asset allocation and risk parity is the changes in volatility across asset classes. The foundation for risk parity is based on equal weighing of asset classes volatility as opposed to setting dollar weighting. Hence, knowing the relative differences in volatility and how they move through time is critical. We can describe some of the key issues associated with any volatility matching or equalization strategy by taking at a quick look at the CBOE VIX index for equity volatility and the TYVIX for Treasury bond volatility. The simple case of comparing these two major assets classes helps to describe the problem of volatility matching.

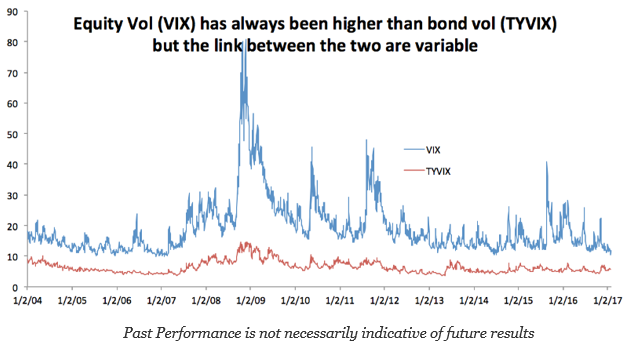

A quick comparison of the two option based volatility indices shows significant differences. Equity volatility has always bean higher than bond volatility, but the changes through time can be dramatic.

The volatility of volatility for equities is significantly higher than bonds. Now there are differences in measurement, (change versus relative change), but by just looking at the absolute changes through time, you can see that equity volatility is more prone to spikes and these spikes do not occur at the same time as bond spikes. If both indices move higher, the equity volatility change will be more pronounced. While there have been two major extended equity volatility spikes since the Great Financial Crisis, even current markets will see more equity volatility spikes. Absolute VIX values may be low and declining, but there are still significant spike deviations from bonds.

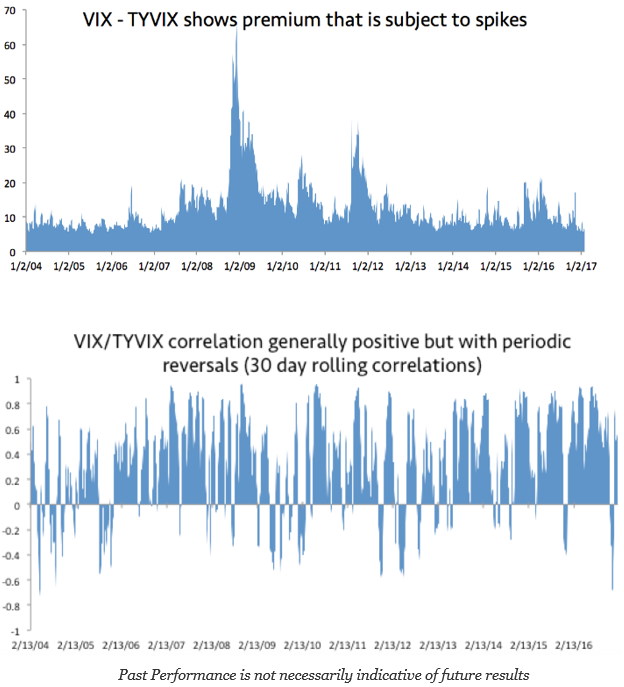

Since there will be periods when equity volatility shocks will be different from bond volatility shocks, the correlation between the two volatility measures will show significant variation. A rolling correlation graph shows that equity and bond VIX will be highly correlated but also subject to significant negative correlation shocks where the market volatilities move in opposite directions.

For asset allocation based on volatility equalization, there will be significant adjustments unless there is a wide tolerance for differences. The difference in volatility can easily change by a factor of two. The link between volatility can move between .8 or higher and below -.4. There is significant room for variation and the factors driving equity volatility may differ from those associated with bonds. Clearly, inflation and central bank shocks will differ from earnings shocks. Volatility equalization can have benefit for controlling risks, but the costs of monitoring and adjusting allocations can be significant.