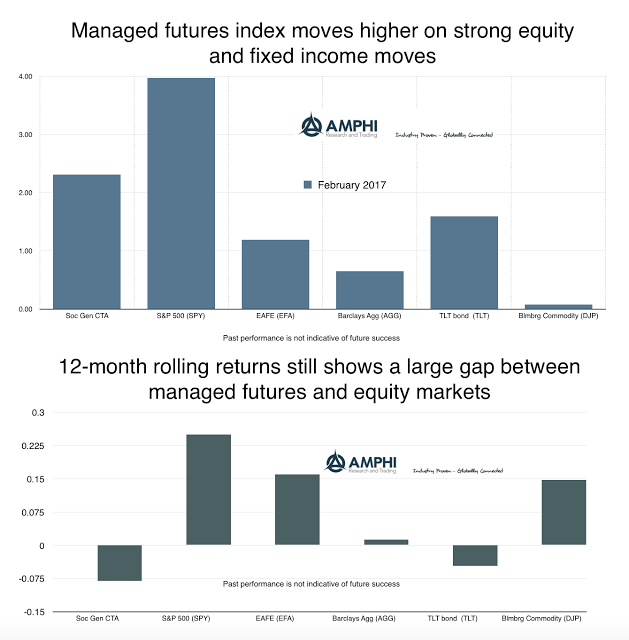

Managed futures strategies generally showed performance gains in February based on strong equity market return trends and the the positive gains in fixed income markets. The dollar also started to again trend up while commodities markets were more mixed. It is notable that there was a strong gap between traditional trend-followers and short-term traders whose index was down almost 2% for the month.

While we don’t want to make generalizations, the largest CTA’s are heavily weighted to financial markets so if both bonds and stocks do well it is likely that CTA’s will do well. This is especially the case if the bonds move to the upside. Generally, CTA’s will do better when there is a bias to lower bond yields. Bond sell-offs are usually quick and choppy which hurts performance. Nevertheless, the end of the month was rocky for bond markets. They started to move lower on more talk of earlier Fed rate rises.

Commodities were not a strong contributor to performance because of some choppy moves in grains and range-bound behavior in oil markets. There were some exceptions like natural gas but the high volatility in this market usually leads to smaller allocations.

The dollar has returned to its up trend. With US shorter-term rates trending higher, the rate differential is very dollar favorable. It is hard to fight carry economics when monetary expectations are in favor of the trend.

While CTA’s did better for February and are positive on the year, the 12-month rolling average favor equities. For many investors, under-weighting of equities in 2016 has led to catch-up behavior with less interest for diversification.