So you see a manager with a good Morningstar rating. It has five-stars. Should an investor care? Past performance is not indicative of future returns, so should it matter if you had highly rated past risk-adjusted performance?

Certainly, a rating is not definitive, but as a heuristic on a fund’s relative performance, there is positive information to be gleaned from ratings.

Some simple important facts across mutual fund research:

- The Morningstar rating is done over a minimum of 3-years so it provides historical perspective.

- The Morningstar rating is based on risk-adjusted returns that account for utility and not just standard deviation. Hence, it offers and alternative view relative to rankings by Sharpe or information ratios.

- The rating is based on a category classification, so it is related to peers.

- The 5-star and 1-star ratings each represent 10% of the sample, so it is hard to maintain over long periods.

- Investors will both punish and reward managers when there is a change in ratings. There are abnormal flows when a rating changes.

- A 1990’s study show that 5-star mutual funds have a fall-off in performance after the ratings is given and there is higher risk.

- Low rated funds do predict future poor performance. Higher rated funds may not outperform the next rating category in the future.

- Mutual fund managers that receive low ratings are likely to be replaced.

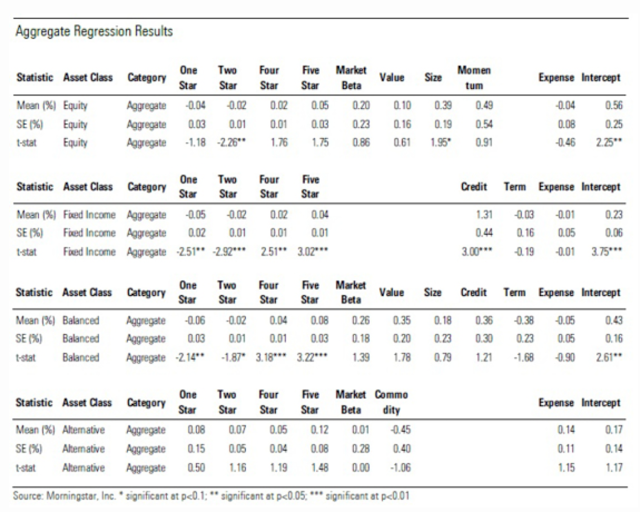

If you expect the 5-star funds to always stay as 5-star funds, you may be disappointed given the 10% star threshold. The signals on performance are mixed, yet the most exhaustive study from Morningstar done last year shows that the rating does make a difference. See the research piece by Jeffery Ptak. There is value in the rating even after accounting for the standard four-factor model in equities. There is also value from a high rating for a fixed income and balanced funds even after account for other risk factors. However, the value associated with alternative investments is not as statistically significant. The author argues that this may be caused by a smaller sample but the general take is that star rating has some marginal meaning.

Research has also found that rankings and performance are tied to costs. Lower cost funds will naturally have an advantage relative to higher cost funds. A closer analysis may show that the more dispersion around any benchmark will reduce the impact of costs as a driver for rankings. Hence, in alternative investment category where there may be more dispersion around a benchmark and there is less agreement on the benchmark, cost impacts will be less. Still, when in doubt look for lower cost alternatives.

Can this be related to choosing managed futures or alternative investment funds? As a heuristic to help identify potentially better funds, the rating system may be a useful first pass. It is a not a substitute for more exhaustive analysis but there should be strong reasons to bet against the best and worst funds regardless of asset class.